- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi's change to AutoPay

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi's change to AutoPay

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi's change to AutoPay

Got an email from Citi.

"Based on feedback from cardmembers like you, we're updating our AutoPay policy. Currently, if you make an additional payment during your billing cycle, your minimum due AutoPay payment is reduced or canceled. Beginning July 23, 2017, your AutoPay payment for the minimum amount due will still be made even if you make an additional payment during your billing cycle.”

I am wondering. Why would you be interested such a change?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

@vanillabean wrote:Got an email from Citi.

"Based on feedback from cardmembers like you, we're updating our AutoPay policy. Currently, if you make an additional payment during your billing cycle, your minimum due AutoPay payment is reduced or canceled. Beginning July 23, 2017, your AutoPay payment for the minimum amount due will still be made even if you make an additional payment during your billing cycle.”

I am wondering. Why would you be interested such a change?

I dont know but I don't think I like it. Then again citi is like a few that make you manually push payments through via ach when you are trying to micromanage your scores and try to PIF before statement cut date....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

I got the email few days ago as well and God knows I can't figure out how they think or feel that's a good idea! It's a silly update in my opinion. This is just a tactics to cash in on returned payment fees for those who pay early in the billing cycle and forget autopay then not have the funds available when the payment hits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

Before we get too far out on speculation, could someone post the exact text of the new terms? As far as I know mine have not changed, but this is the basic set of circumstances Autopayment is supposed to be able to handle. In all cases, the intent is to not pay the account below zero, and to follow the cardholder instructions as to Pay In Full or some lesser amount of monthly payment, while avoiding paying too much to go negative on the current balance.

I am guessing the new language just clarifies that a minimum payment won't be reduced.... unless it would put the card account in a negative balance.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

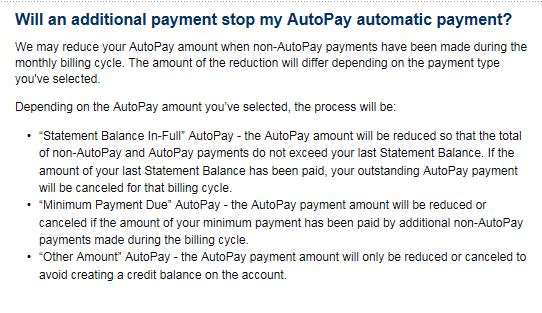

Here's the exact text:

"

|

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

The wording puzzles me. An autopay applies to the grace period ending with the due date and has nothing to do with the billing cycle ending with the statement date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

You are always in "a billing cycle". There is a minimum payment due by the end of this current billing cycle you are in, a payment that is due by the Due Date as they start the process of generating a Statement on the Statement Date.

The clarification of this policy is only that they will not pull the entire Minimum Payment from your last statement, in this Current Billing Cycle, if it will make the account negative.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

Let's not make this any more complicated than it really is. Bottom line is beginning July 23rd, even if you make a prior payment in the billing cycle, Citi will still draft the autopay regardless. In the event the autopay will create a credit balance then it'll be cancelled. Rest assured I hate the new policy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

@pip3man wrote:Let's not make this any more complicated than it really is. Bottom line is beginning July 23rd, even if you make a prior payment in the billing cycle, Citi will still draft the autopay regardless. In the event the autopay will create a credit balance then it'll be cancelled. Rest assured I hate the new policy!

How does this even make any sense? From my understanding with my current bank if I make the mimimum payment or pay more they won't even try to make a payment and will see that I have already paid. That makes more sense to me.

Though, now I want to double check with my current bank on how they do this just to make sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi's change to AutoPay

@Anonymous wrote:

@pip3man wrote:Let's not make this any more complicated than it really is. Bottom line is beginning July 23rd, even if you make a prior payment in the billing cycle, Citi will still draft the autopay regardless. In the event the autopay will create a credit balance then it'll be cancelled. Rest assured I hate the new policy!

How does this even make any sense? From my understanding with my current bank if I make the mimimum payment or pay more they won't even try to make a payment and will see that I have already paid. That makes more sense to me.

Though, now I want to double check with my current bank on how they do this just to make sure.

You are overthinking it. I'll explain it one more time. Currently, with Citi if u have autopay and u make a payment at any time in the billing cycle that at least covers ur minimum amount due, it effectively cancels out your autopay for that period. That means, say for instance ur due date is the 22nd and u paid earlier on the 15th, when the 22nd comes around, autopay will not be scheduled so no additional money will be drafted from your account. But now it's changing so even if u paid before, the autopay will still be processed unless you pay off the entire balance before it kicks in. My point is I do not like the new changes, they should stick to the status quo. Hopefully this makes more sense to you now!