- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Card Management System

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Card Management System

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Card Management System

Hello myFico denizens! I was wondering what you all use to manage which cards to use at which times? Do you have a credit card holder? Do you use a label maker? Do you use an app?

I have 6 cards (4 with rewards) so it's not too hard to manage but I want to hear about everyone's personal systems.

Priority:

- Chase Freedom for 5% on any given category so I would use that for the corresponding category before my other cards

- Amex BCE for 3% on groceries, 2% on drug stores, gas stations and select stores, no where else

- Chase Freedom Unlimited: On all other purchases

- I don't really use my other cards much

So I want to know what you use to manage your rewards. Sometimes I might forget I get certain bonuses at certain stores...sometimes I forget my Freedom rolled into another quarter and I miss opportunities to rack up UR. How do you people with 10,11, 12 and beyond cards manage which cards to use and when?

Thank you!

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

@SecretAzure wrote:Hello myFico denizens! I was wondering what you all use to manage which cards to use at which times? Do you have a credit card holder? Do you use a label maker? Do you use an app?

I have 6 cards (4 with rewards) so it's not too hard to manage but I want to hear about everyone's personal systems.

Priority:

- Chase Freedom for 5% on any given category so I would use that for the corresponding category before my other cards

- Amex BCE for 3% on groceries, 2% on drug stores, gas stations and select stores, no where else

- Chase Freedom Unlimited: On all other purchases

- I don't really use my other cards much

So I want to know what you use to manage your rewards. Sometimes I might forget I get certain bonuses at certain stores...sometimes I forget my Freedom rolled into another quarter and I miss opportunities to rack up UR. How do you people with 10,11, 12 and beyond cards manage which cards to use and when?

Thank you!

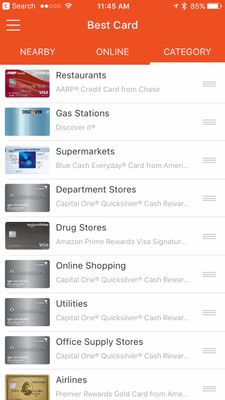

I use an app called Wallaby. It shows you the best card to use based on maximizing rewards. I pull it up and search recommendations on local places all the time to make sure I have the right card before leaving the house. Here are a few screenshots showing the wallet management, features you can manage on the card (if you link your card accounts) and recommendations based on category.

And I'm asking for this wallet for my birthday:

http://www.coach.com/coach-breast-pocket-wallet-in-water-buffalo-leather/55249B.html?dwvar_color=BLK

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

This looks amazing...thank you for taking the time to include screenshots as that really does help understand how it works. I'm definitely getting this app tonight.

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

@SecretAzure wrote:This looks amazing...thank you for taking the time to include screenshots as that really does help understand how it works. I'm definitely getting this app tonight.

Of course, Wallaby means nothing when I'm in sign up bonus mode, like I am now. I'm chasing 4 signup bonuses right now - AARP, BCE, ED, WF Cashwise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

@DeeBee78 wrote:

@SecretAzure wrote:This looks amazing...thank you for taking the time to include screenshots as that really does help understand how it works. I'm definitely getting this app tonight.

Of course, Wallaby means nothing when I'm in sign up bonus mode, like I am now. I'm chasing 4 signup bonuses right now - AARP, BCE, ED, WF Cashwise.

Wow! Good luck! That's a lot of signup bonuses. I am just completing my one...for Freedom Unlimited. So the app would be great since I already met the spend!

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

Keeps track of everything BUT United. MR, SPG, cash, HHonors etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

Good question and interesting answers in the thread![]()

For me it is quite simple:

1.Satisfy sign up bonus requirements (usually this gives 20~30% 'cashback' and you don't want to miss that)

2.For large non-reoccurring purchases that can be paid using a card(your call about how large is large, maybe 1K or more?) I stop and think through my cards, also use a portal if possible.

3.For the rest I look at my year end summary from various cards (you can also use mint) and add up the categories, then re-align the cards with the heavy categories.

The rest usualy don't have a big enough impact and can be safely ignored.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

Bonus categories don't always mean much for me. It's more a matter of asking myself a few questions. If the answer to any one question is a strong "yes", then that is generally what I rely on.

Do I distrust the merchant, or do I need a strong warranty? Use Platinum.

Can I likely buy it cheaper elsewhere? Use Prestige/Costco.

Does any card offer really great rewards or savings? Use that.

Would it be socially awkward if the card was declined as a false alarm for fraud? Probably use Platinum, but definitely avoid Discover.

I once used Wallaby, but gave up on it when GPS told it I was by Costco gas pumps and it told me to use Sallie Mae. Software isn't a substitute for knowing my cards.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Management System

Enjoying the ideas posted here. Good thread.

FWIW...I just use the little round colored stickers.

Green is zero balance for cards not used much.

Orange is balance is over 50% due to BT.

Pink has written the reward % and category. Sometimes 2 stickers on a card. Like Freedom has an orange sticker right now since I'm using a BT offer. But also a pink for 5% at gas...soon to be 5% at grocery stores in April.

My CitiCostco has 4% gas, but Discover and Freedom beat that Jan-Mar with 5%.

It also has 3% for restaurants, which I use too frequently. ![]()

BCE for groceries @ 3% right now. Freedom will beat that next quarter with 5%.

Apping in July for BCP for 6%.

I use Amazon Visa for the 5% there.

Discover will be 5% at home improvement stores and wholesale clubs in April.

For most everything else not listed above, I'm using QS WEMC pretty hard for 6 months @ 1.5% PIF and hoping for CLI after this next statement cut. But...

Prefer Blispay for 2%. and hoping they start passing out some CLIs soon for everyone.