- myFICO® Forums

- Types of Credit

- Credit Cards

- Discover "heavy usage"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover "heavy usage"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

Never got a CLI from them until I did a BT to the card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

@Ghoshida wrote:

@Anonymous wrote:

@Ghoshida wrote:

@Anonymous wrote:

@Anonymous wrote:Heavy usage isn't required to get a CLI. Your account is eligible after 90 days for a SP cli. Have some balance and use the card regularly and you SHOULD be ok.

Please note that there are some people who just simply can't get a CLI from Discover to save their lives. I, on the other hand, got a 4400 increase when I asked.

I've been putting a lot of usage on my IT Miles (~ $12k per month for the first year bonus). I'll see if a CLI is available after 90 days.

Did you try their CLI button already? It seemed like Discover has loosened their CLI noose a bit over the past couple of months; probably not as much as AMEX has done with their 60-day rule but still worth a shot.

Or are you referring to auto CLIs?

SP CLI. But I've only had it for two statement cycles so I thought I would wait

I guess waiting is okay if you're not constrained by your current limits !

BTW do you still intend to SD it after a year or do you have plans to PC it into a Discover It (if that's an available choice) ?

Currently intend to SD unless there are some enhancements as someone working for Discover thought there might be. If the double offer is still available, my spouse will apply when mine is about to expire.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

@Anonymous wrote:

@Ghoshida wrote:I guess waiting is okay if you're not constrained by your current limits !

BTW do you still intend to SD it after a year or do you have plans to PC it into a Discover It (if that's an available choice) ?

Currently intend to SD unless there are some enhancements as someone working for Discover thought there might be. If the double offer is still available, my spouse will apply when mine is about to expire.

I might app as well. I won't be a heavy hitter like you but 3% might meet some of my needs. They wanted an EQ pull and I'm saving it for a car loan that I might app for in summer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

It doesn't require heavy usage. In my case I could only get CLI using a HP during my first year with Discover, but I did go from $2000 -> $3000 -> $5000 with those HP's.

The second year, SP increases were available every 3 months. $1000, $1500, $1000, $1000. Since Discover seems to have changes its rules, one month after that last $1000 increase, I was given another $1500 increase. So now my Discover It is at $11,000.

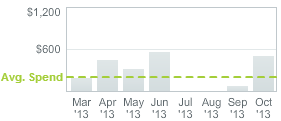

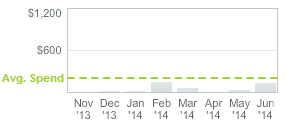

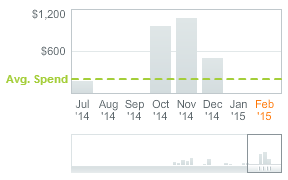

From the charts below, you can see that during the year I was getting regular SP, I was barely using the card (just enough to get the FICO scores). I used it a lot at the end of 2014 because my average monthly spend was very low, now its at $222 (and dropping). Still getting SP CLI's.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

I've never requested a CLI from discover but I've gotten auto-CLIs during quarters when I'm making more use of the card for the bonus spend (usually only happens during the last quarter for online spend).

I always wonder why they do it since even during "heavy" use I rarely come close to maxing out the card and I've never carried a balance with them, it must just be some computer algorithim.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

I've had my Discover It close to a year now. I've practically carried a balance on the card since the day it was approved (did a BT) up until last month when I paid it off in full and never got any CLI. So I dont think carrying balances enhances ur chances of a CLI otherwise my original $1500 limit woulda been peaking at $10k by now. Just saying...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

--------$32,000-------------$30,000-----------$30,000-----------$30,000-----$13,000---------$18,200----------$15,000---------$6,500----

FICO - TU: 780 EX: 784 EQ: 781

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover "heavy usage"

--------$32,000-------------$30,000-----------$30,000-----------$30,000-----$13,000---------$18,200----------$15,000---------$6,500----

FICO - TU: 780 EX: 784 EQ: 781