- myFICO® Forums

- Types of Credit

- Credit Cards

- First startup charge card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

First startup charge card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Fintech Premium Card Offering

@Ilinferno - please reference the active discussion upthread on this particular card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

Hi OP, welcome to the forums. The card in question comes off as pretentious to me. The annual fee is a major turnoff, as well as the qualifications. Feel free to forward my thoughts to the rest of the marketing team. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

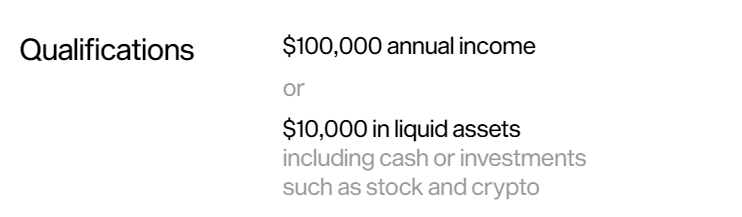

As said, I checked and it comes to this:

So you need either one of these to get approved? Crazy! This is ideal for people who are wealthy.

I'm out ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

I think we may have finally come across a card that makes the BarclayUS Black Card look good.

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

@coldfusion wrote:I think we may have finally come across a card that makes the BarclayUS Black Card look good.

IMO, the X1 card left a lot to be desired, but it blows this PointCard Titan away unless there are details not yet revealed. The earning structure, the high AF, the lack of perks or credit don't make this any sort of serious contender to cards in the $400 AF range. We keep seeing these metal cards pop up that don't deliver premium value, they're all show with tech features aimed at the Gen Z and Millenial market. At least the Apple titanium card paid 2% in cash with Apple Pay and 3% in some cases, with no AF.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$925K

Top Lender TCL - Chase 156.4 - BofA 99.9 - AMEX 95.0 - CITI 95.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

Finally, I found a card that it looks clearly impossible to justify its AF ![]() . How on earth, it would be feasible to cover a hefty 400$ AF without having any e.g. dining/streaming credit? It may work if the 5x subscription category would be very broad including e.g. hefty monthly mortgage subscription of 5k/m and they should them directly a check, since my mortgage does not accept any debit/credit card

. How on earth, it would be feasible to cover a hefty 400$ AF without having any e.g. dining/streaming credit? It may work if the 5x subscription category would be very broad including e.g. hefty monthly mortgage subscription of 5k/m and they should them directly a check, since my mortgage does not accept any debit/credit card ![]()

BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclay View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

$399/yr are they insane?

I saw nothing that would get me to chose this card over premium cards. They're website is doing a poor job of selling this, I can't imagine anyone would willingly pay them to use their card.

DOA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: First startup charge card?

I think the most likely explanation is that they're going for people who are not card-savvy and don't know better. You can make more money from a small number of fools than from a large number of people who shop around. Or for people who just want to have something different (for the sake of being different) than the (in some places common) CSR and Platinum.

Another possibility is that they're trying (not necessarily successfully) to position it as a Veblen good, where demand can rise with price among a small set of consumers. Conspicuous consumption not only excuses but glorifies the lack of value.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select