- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

Aprs dont necessarily tell a persons credit worthiness imo because aprs can vary card to card, lender to lender. Ive been in mid 750s when Amex still gave me their highest apr. Discover too. You would think a high fico would land you a low apr. Not necessarily true. Great case is Penfed who love to tout low rates yet most get a high rate on their cc. I wouldnt read too much into what apr you get but some lenders allow decrease over time. . Its ok to want to see a lower number, once you have a card not much else to do but either request cli or lower apr lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

Yeah, don't sweat it @cws-21 .

I've never even bothered to ask for a reduction on any of my Citi CCs.

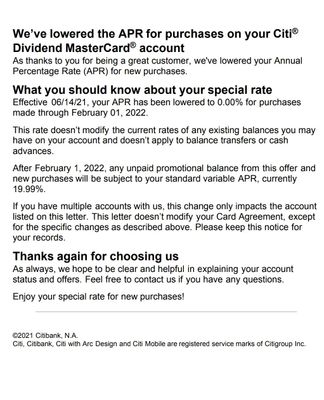

What you may not know is, Citi will sometimes reward you with 0% offers. Right now I believe three of the four I currently hold have 0% purchase offers that are that way until next year.

So why would I care what my normal APR is, if I get basically free credit use 6 months to 8 months out of a year? 😂

They just reduced another one to 0% a few days ago, so it seems.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

Thanks, @AverageJoesCredit and @Gmood1. Much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

APR reductions are pofile specific just as CLI's are, and for whatever reason Citi feels the existing account isn't eligible. Which probably does sound odd to most of us but it's typical of how they operate. I too sometimes get caught up in thinking I need a lower APR since my score is in a much better place than when I applied, or just on principle. lol Yet I also feel why is it necessary to have the lowest APR if I do PIF? I mean it's not like I haev a shortage of available card with a much lower APR such as CU's, or do not haev access to BT's with 0% offers. So if I ever did need to carry a balance I do have options which negate needing to lower APRs on specific cards, because in all honesty 14% isn't that great if i did have to carry a large balance even if it is lower than 24%. Bottom line is that I don't like either rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

@Anonymous wrote:APR reductions are pofile specific just as CLI's are, and for whatever reason Citi feels the existing account isn't eligible. Which probably does sound odd to most of us but it's typical of how they operate. I too sometimes get caught up in thinking I need a lower APR since my score is in a much better place than when I applied, or just on principle. lol Yet I also feel why is it necessary to have the lowest APR if I do PIF? I mean it's not like I haev a shortage of available card with a much lower APR such as CU's, or do not haev access to BT's with 0% offers. So if I ever did need to carry a balance I do have options which negate needing to lower APRs on specific cards, because in all honesty 14% isn't that great if i did have to carry a large balance even if it is lower than 24%. Bottom line is that I don't like either rate.

Yes, the best option to have a low rate emergency card is get a CU Plat card. 7% is pretty reasonable if one needs to carry a balance especially if there are no 0% offers around at the time![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

@cws-21 wrote:I applied and was approved for a Citi Double Cash Card in 2018, but, unfortunately, the APR was 23.49%. I have never carried a balance so the APR is not a huge concern, but, nonetheless, I have wanted it lowered if possible. I have contacted Citi twice in the last several months to have the APR reduced, but, both times, I was told that my account was ineligible for a decrease. However, I was just approved for the Citi Custom Cash Card with a 13.99% APR. Given this, I thought I now must be eligible for an APR reduction for my DC, but, when I called about it, I was told, again, that my account is ineligible. I asked why and the CSR could not provide any reason so I asked to speak with a supervisor who also could not provide a reason other than it is the Bank's decision. I would appreciate it if someone explained to me how there can be such a discrepancy between my APRs for the DC and CC given both are supposedly based on my creditworthiness. As always, thank you.

I feel your frustration. So many people here have posted their success at having Citibank lower their APRs...sometimes several times in the same year. Each time I attempt to have mine lowered, no dice.

For me, I believe it is because I have so little spend on my Citibank accounts. So I am not sure if they are looking for more loyalty or what. Unfortunately, we may never know what algorithm their systems look for to make someone's account eligible. But I do suspect adequate usage has a play in it.

Keep on trying!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help me understand Citi APRs

Thanks to all!

- « Previous

- Next »