- myFICO® Forums

- Types of Credit

- Credit Cards

- How do you manage your card statements, reporting,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do you manage your card statements, reporting, and payments?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you manage your card statements, reporting, and payments?

Hi Everyone,

First of all, I've learned so much from this forum, so from the bottom of my heart - Thank You! I've pretty much been a lurker and with a small post here or there.

I am still in the process of rebuilding my credit. Credit card utilization is very important to me right now. With a pocketful of credit cards, different statements dates and different reporting dates, I'm finding myself spending hours and hours strategizing my payments and charges. Is this normal? lol

I guess what I'm really asking is if anyone keeps a spreadsheet to help them out? Maybe this sounds silly to some. I'm probably thinking about this way too hard.

I use my credit cards duriing the month to pay my bills but almost always PIF or leave a very small balance. What is comfusing me is that I'm trying to be careful to make sure that none of these cards report when they are at my highest balance (which is only going to be paid maybe a week later). KWIM?

There has to be an easier way to manage my cards, etc.

Any suggestions or advice? Does anyone use a credit card spreadsheet? If so, what does it look like if you don't mind me asking?

Sorry for rambling!! I type this after spending almost 2 hours updating my balances online for my cards and "plotting" my payments for the month. I'm ready to pull my hair out! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

I have only 3 CCs (2 Capital One & 1 Orchard Bank). I notated the date they report from the first time that they showed up on reports. I know that Capital One reports the day after the statement prints and Orchard bank reports the last day of the month so I usually put the cards on ice the week before they are scheduled to report just to make sure that all goes well. I don't use them until I see that the data has been updated with all 3 CRAs and then I resume charging.

First Guaranty Mortgage Corporation (FGMC)

Starting Score:Equifax: 490 (01/14/2011)Transunion: 498 (01/14/2011)

Current Score: Equifax: 609(07/09/2012) Transunion: 644 (10/14/2011) Experian: 593 Lender Pull (08/22/2011)

Goal Score: 700

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

I hate to show my total lack of computer skills--and my age--but I have a handwritten list on the wall by my computer of my cards and my husbands cards with the name of the card, the due date, and the reporting date. It is in date order: 1st through 31st. Has worked for me. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

I use an account aggregator (Yodlee) to keep on top of my finances. All credit cards that have the feature use autopay as last resort if I don't think of paying beforehand. If I want to make my scores look good, I use a printed list with the closing dates (which are also the reporting dates in my case). This list hangs at the wall next to my desktop computer at home.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

I use a spreadsheet, I'd be lost without it. It lists the name of the card, when I last asked for CLI, the statement cutoff date, the interest rate, the total CL, and what the rotating bonus categories currently are. Then I have columns for the balance, minimum due, how much I last paid, and even confirmation #'s for those payments.

It lets me easily track my total CL, total balances, utilization at any given moment, total minimum payments due, how much I paid on CC's each month, etc... Takes only a few minutes to update, which I do at least once every couple weeks, if not more.

I have the same sort of setup for all my monthly bills on the same sheet. I've actually linked a lot of things together. So for instance, I have my bank accounts listed on there as well now, and it will tell me what my final bank account balance would be once I've paid all the CC's, and taken out mortgage and car payments. Very easy way to tell how much money I have, and how much is coming out every month.

One night I even got bored and created a second sheet which tracks my AAoA, and let's me figure out how adding 1, 2, or 3 cards would affect my AAoA.

I'm assuming programs like quicken can do all the basic stuff for you if you aren't good with spreadsheets. I just see no reason to pay for a program that I can create and customize perfectly for myself.

It originally was just a spreadsheet to track cards, balances, and payment dates. It evolved over time into...well, something much larger. But even the most basic spreadsheet can be very helpful. And if you find you want more details on your accounts in there, you can add them anytime you want.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

I use Bank Of America My Portfolio to keep track all my accounts (CC, Loans, 401k,... ) in real-time.

http://www.bankofamerica.com/onlinebanking/index.cfm?template=my_portfolio

-Not Capital One.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

I have 10 open credit card accounts. All of my statements are received via email. Since many of the cards are not used some months, I don't receive a statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

For the others, arrange for them to automatically debit the current balance or last statement balance from your bank account.

Additionally, have all your banks send their statement to you electronically, open up an email account (e.g., Gmail, Hotmail) specifically for statement notifications and alerts. Install the Google Talk/Notifier app on your PC or Mac so you're routinely reminded of new messages in this account.

----

How do I do it?

I follow the process above. My Yahoo email is largely the one I use for personal email. My Gmail account is for all financial services communications. I use a joint (with my wife) Hotmail accout for receiving and sorting recurring billing statements and notifications from all the companies I do business with. In use the "rules/routing" feature of Hotmail to sort incoming email into folders automatically (e.g., Comcast, AT&T, Verizon, etc.). I rarely have to look in these folders, but everything is there, neat and organized for when I do.

Additionally, I have a checking account specifically dedicated for paying bills. I run my bills through my credit cards (to maintain utilization) and the credit card companines debit this bank account, paying the balance in full each month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

Me??? I have total of 9 ccs, and their closing and Due dates are around middle of the month. I follows o~ld traditional ways to keep it up ... which is write on the calendar ... the due date and amount, the closing date. Then check marks after the payment or transfer schedule is made. So, my calendar has a lot of room to write (got it from 99 Cents Only Store) and has all kind of notes on it include the working schedules.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you manage your card statements, reporting, and payments?

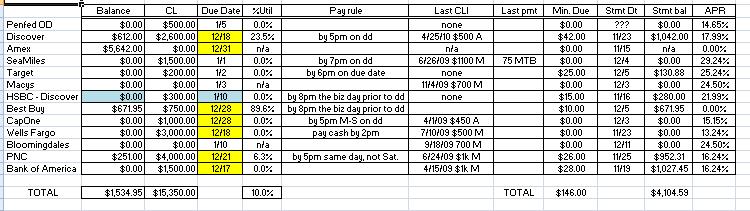

Between DW and I we have 30 CCs that we keep track of. I am the one who pays everything and found it best to use Excel. I keep everything at the office and don't have a handy copy, but I'll do my best to describe it.

I separate DW's CCs from mine and list each CC in the first column.

The second column is for the CC balance as of that moment I check the account.

The third column is the CL for that CC.

The fourth column is the due date as listed on the statement.

The fifth column is the utilization of that CC.

The sixth column I dub the "pay rule" to remind my self the absolute latest time I can pay while cramming in a payment for that day (e.g. some CCs won't let you pay for that day past 8pm, as an example, and any payments beyond that get credited the next day).

The seventh column lists the last CLI we received for that CC and lists the amount, date, and whether it was automatic or manual.

The eighth column is the Last Pmt column and that lists the amount I paid for that CC. I clear this entry each time I confirmed a payment posted in my checking.

The ninth, tenth, and eleventh column track my last statment amount, the minimum payment, and the last statement date. These came in handy pre-mortgage to track DTI and to know when the absolute last day was to push a payment to get it to report a lower balance. I don't use this much anymore, but the statement date comes in handy.

The twelvth column lists that card's APR.

Then the thirteenth column is off to the side a bit and lists the available credit.

Finally, the fourteenth column lists the date I last checked that CC account online w/ another next to it which is used to make a personal mention whether or not my balances and due dates are estimates or not since there is no way of knowing for sure until the statement cuts.

I'll look at all of the CC accounts (takes just over 1 hour) and confirm balances as of that moment, CLs (looking for the AA; knock on wood we've been good), and I'll confirm the due date. I do this about 2x per month. I base all of my payments twice per month (1st for all due dates 1-15th, and again on the 15th for anything 16th through the end). In other words, I'll pay all 1st-15th due dates on the first and pay all 16th to the last day on the 15th and knock it all out. I'll record the payment amounts in the Last Pmt column and will check my checking beginning the next day to confirm that it cleared. I'll also guesstimate the new balance after the payment and the available balance.

After the payment is received, I'll go back in and re-highlight any due dates on any TL that I want to push in a second payment to get the balance reporting like I'd like it. This is my second due date. I'll usually wait until the very last possible second to make a payment and then I'll record the payment like before and confirmed it posted.

While I'll check all of the TLs 2x per month, I'll go in and recheck it a 3rd or more time after the statement cuts to record the new due date, to get rid of the guesstimate balance, and verify the statement date, transaction detail, etc.

I will tally some of the columns. The balance, CL, util, minimum due, statement balance, and avail credit all have totals at the bottom for DW and I. I keep a close eye on the overall util, but will also compare the statement balance and the current balance. If the current balance exceeds the statement balance, then I already spent more than last month which can be a bad thing. I'll then have a grand total for both of our balances for statement and current balances and will keep tabs on them.

I have this in a format that works well, for me anyway. I'll update the spreadsheet once per month by copying and pasting and updating the new copy. This gives me a chance to see a monthly comparison of all of my balances, CLs, or whatever for the past 3-4 yrs.

I've tried other systems like the calendar, and even spent $$$ on the latest and greatest Quicken copy. But I'm not enthusiastic about using it, even though I like to buy stuff like that. This is easy and I can upload the file to my server and access it from anywhere.

Found an older one: