- myFICO® Forums

- Types of Credit

- Credit Cards

- How to reverse Capital One overpayment?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to reverse Capital One overpayment?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to reverse Capital One overpayment?

I accidentally pushed two PIF payments to Capital One. I overpaid by a few thousand dollars and don't expect to spend that much more on the card.

What's the best way to get the excess back? Would they be like Amex and just write a check after a month? Should I call or use chat? Is there some website feature I can use?

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

I don't recall if Capital One would have the capability as some other lenders to deposit the excess funds via your checking/savings account in lieu of the refund check.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

If you have a credit of more than $1, the lender has to refund you the owed amount within 7 days following a written request. Probably just calling the customer service can have it reversed in no time.

Alternatively, you might also check whether withdrawing as cash would incur any charges -- since they owe you money, it should not cost you any interest charges. You're out of luck if you have withdrawal fees though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

I did call and was impressed with an alert and helpful customer service rep, given the bad things I had heard from other about Capital One. The CSR said an ACH payment would arrive in 5 calendar days.

That said, there was a tremendous amount of background noise at the call center, which is pretty nerve-wracking when giving someone routing and account numbers. I do wish there was a way to handle it over the website.

Hopefully it will all get settled smoothly in a few days. In retrospect, with the noise maybe I should have just asked them to mail me a check.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

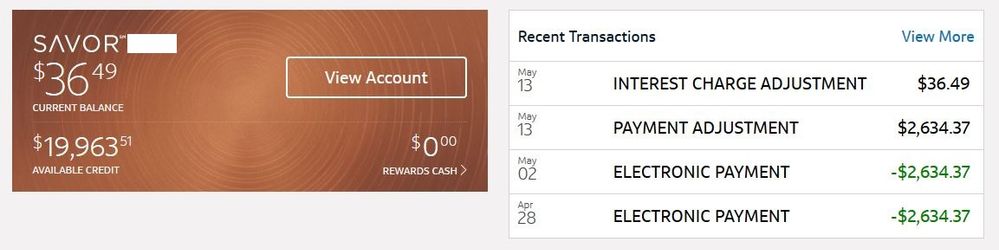

WTH?

My due date was May 5, and I paid twice by that date. I only asked them to refund one payment.

How can I possibly owe them interest? My payment still hasn't even arrived back at Schwab.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

Looks like a phone call is in order.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

FWIW I found it comical when they mailed us a $0.11 check (on a BoA checking account no less, assuming this is a regulatory thing?) a while back due to a PIF and cashback overpayment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to reverse Capital One overpayment?

@CreditInspired wrote:

It looks like they're crediting the interest, not charging interest, or am I looking at it wrong?

It's a $20k CL, and only $19,963.51 is available.

I called and the rep offered a credit of $36.49 towards interest and reset my grace period (to avoid residual interest). The rep said the credit would appear in 3-5 business days. No word on when the money would actually appear back at Schwab checking.

So it sounds good...but I'm still concerned I'll be calling back next week.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select