- myFICO® Forums

- Types of Credit

- Credit Cards

- How was your AMEX return?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How was your AMEX return?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

My spend is so abysmal i dont think there are any calculations to be made. Lets just say my Amex's swipe

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

My statement tells me nothing about how many points I earned, so I'll eyeball it and say somewhere around 57k MRs. None were redeemed last year.

Total spend (all on Platinum) was $17,758, of which just under $10,000 was airfare. The biggest takeaways for me is that:

1. My gym membership apparently codes as entertainment. Who knew?

2. I apparently guessed wrong on a few purchases that should have gone on CSR instead. $96.39 in restaurant spend made its way on the Platinum somehow as did $1,067 in transportation, of which none was gas. That was likely parking fees and other misc. transport services that might have coded as travel for 3x on CSR instead.

If I'm nickling and diming this, I used $200 travel credit, Saks credit, all of my Uber credits, and the SkyClub around a dozen times. I also spent 3 months not traveling due to paternity leave so I should get more visits this year.

The good news is I am finally allowed to put work travel spend on personal cards instead of using a corporate card, so my airfare spend on Platinum should at least double this year. I'm already over $5,000 on airfare spend this year after just 1 month so it's looking better already.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

230k Marriott points

Maybe 150k MR Points

I easily get 2cpp on MR so I value BBP at 4% and Gold at 8%. Those are my DD cards and I use Rakuten as much as I’m able.

BUSINESS; Amex | Citi

F8 Current F8s ~750 Best Ever F8s ~775

TOTAL PERSONAL CL > $350k and TCL > $365k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

I don't want to brag. ![]()

Let's just say the nearly $4,000 in annual fees for Amex pays off in multiples. I ended up with over $14,000 in value just on the Delta side of my Amex relationship, which is a key reason why Delta Reserve will continue to be my non-category card for 2020 (right after I finish this huge spend requirement for Business Platinum).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

I can't brag, I am less than K-in-Boston![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

For 2019 only had the BCE

SUB $200

Cash Back 167.25

Offers $90 (already racked up $130 in 2020)

In 2020 will be more since I only got my bce in may of last year, and I got the amex Amzon Prime Biz card, so that is more rewards and another SUB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

Spend = $4,067

Cash Back = $27

Offers = $258

==============

Total = $285

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

Fun! But not quite as easy for me, as I'm mainly in the MR/Skymiles side of things.

On my Blue Cash Everyday, I had an SUB of 225 on a spend of 2187.14, so a bit over 10%, plus I guess eventually another 21.

On my three MR cards (Gold is closed), I can't get a total of MR earned, My spend was 22,102, so I'm going to conservatively say I got 25,000 MR from that, plus from SUBs and referrals and Rakuten another 108,133, for a total of 133,133

Valued at 1 to 2 cents, that's anywhere from 6-12%.

My primary uses for Amex though, are lounge access and baggage check. Secondary is 0% interest. I'll maximize the rewards I can get, of course, and will always use the platinum on 5% categories, but for normal stuff I use my 2% and 3% cashback cards. I did get both Saks credits. Probably only 4 Uber credits, and the $200 airline credit when gift cards still worked. I'll never get it again.

I didn't have a 2% on everything card last year, so Amex got a lot of my daily spend. This year my spend on Amex will be substantially less. Some airfares later on the platinum, and I charge my phone to the Blue Cash to make sure it's used regularly. I've done my Delta Gold SUB spend already.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

Total Spend:

Platinum: 6k

- $1,250 Offers

Aspire: 16k

- $510 Offers

Everyday: 1k

Green Corporate: Hidden

Makes you stop and think how much you chuck onto those pretty little pieces of metal and plastic. Luckily, think of all we could've lost had that all been spent on debit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How was your AMEX return?

@K-in-Boston wrote:I don't want to brag.

Let's just say the nearly $4,000 in annual fees for Amex pays off in multiples. I ended up with over $14,000 in value just on the Delta side of my Amex relationship, which is a key reason why Delta Reserve will continue to be my non-category card for 2020 (right after I finish this huge spend requirement for Business Platinum).

Yikes, this is definitely going to feel like a brag then.

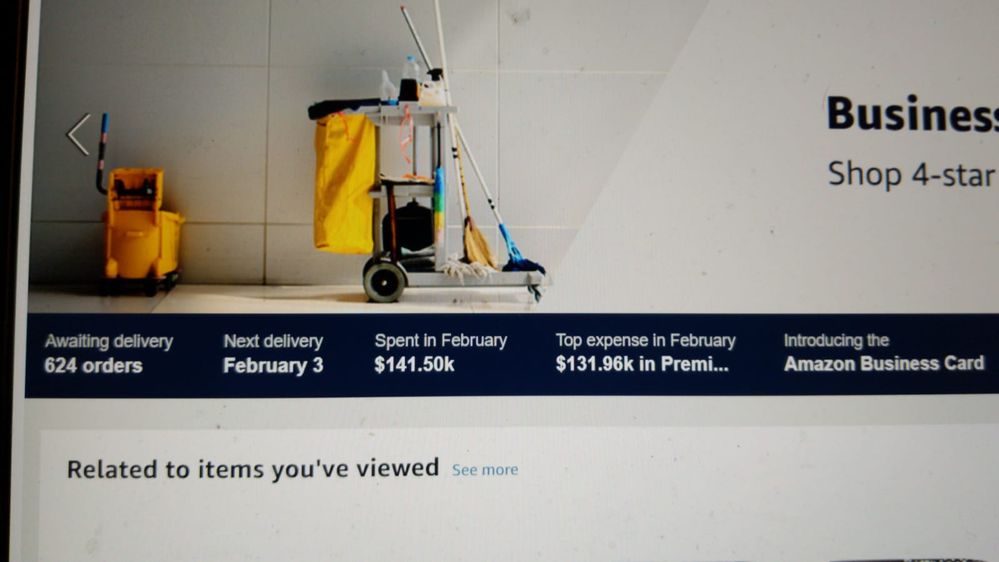

In 2019 between my fiancée's and I's Amex accounts we spent over 700K. I only started my reselling business in July too.

So far in 2020. I've spent over 300K and we aren't even two months in.

This is just amex spend, not accounting for any other banks.

The cards more then pay for themselves, I could have bought a Mercedes with just my amazon 5% cashback.

Total Revolving Limits $254,800