- myFICO® Forums

- Types of Credit

- Credit Cards

- I was just informed by Cap1😱😭 ***UPDATE*** Cap1 ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I was just informed by Cap1😱😭 ***UPDATE*** Cap1 "Secured Graduation" possibly on hold for now...??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE***

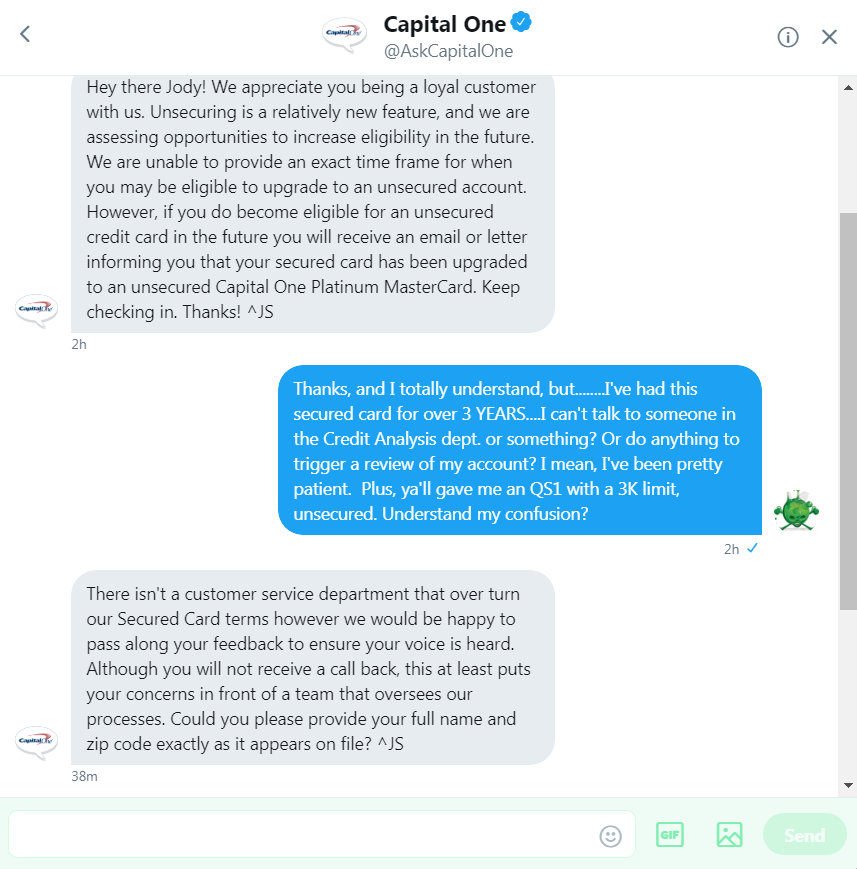

Also, just talked to Cap One via Twitter, basically no new info

Cap1 Sec - $540

Cap1 QS1 - $3000 (new, won't report till probably April?)

Auto Loan

Mortgage

AAoA 7 yr 7 mo

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE***

@jaypmack wrote:Also, just talked to Cap One via Twitter, basically no new info

@jaypmack Has anything come of this convo as of today?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE***

OP- thanks for the alert on this. My card's year anniversary is coming up in April. Guess I'll keep it for the utilization since I already have the QS1 and Discover just unsecured. Very bummed out about this for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE***

For those hating on Capital One, I feel the frustration.

I would urge you to look at your Capital One product for what it is.

When I was rebuilding, I made some mistakes with different products from different issuers.

I had a few of the "Bucketed" Capital One products and they helped immensely.

I no longer have those cards, but I have 49k on 2 cards and my wife has 45k over 3.

Just pay your bills on time and follow the advice you receive here.

It will take a few years to build up limits if that's the route you choose, but you will be extremely happy with the results.

If you simply want a basic 1.5% unbucketed card for minimum daily spend they have that too.

I use my QS simply for money floats if I need it. Most of the time it's a member of the coffee of the quarter club.

I'm not schilling for Cap1, i'm only suggesting that while rebuilding and beyond, use the products. Don't let the product use you.

As your profile improves, your ability to negotiate and earn better terms will as well

Good luck

Woodyman100

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE*** Cap1 "Secured Graduation" possibly on hol

I experienced the same response and closed the card. What I'm really not happy about is that I had a $899 deposit and it will take them 2 more billing cycles before they generate a refund. I'm not happy about that at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE*** Cap1 "Secured Graduation" possibly on hol

Well now I’m confused.

Cap One is not graduating any card issued in 2018-19. Ok got it. They will only do CLI for those cards (according to information posted here from myfico’ers contact with CapOne CSR). Ok got it.

But if you look on their site in the criteria for CLI section, it’s says secured card are ineligible for CLI

https://www.capitalone.com/credit-cards/credit-line-increase/

Anyone tried and received a CLI for a secured card from Cap1? (an increase while it was still secured)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE***

I would agree with woodyman above. Don't let it frustate you. It's an entry level starter/rebuilding card. Don't try to pull teeth and make it something wonderful. As your profile improves you will be eliglible for better products.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE*** Cap1 "Secured Graduation" possibly on hol

Ok I woke up two days ago and checked the Cap1 app because my statement closed. I’m happy to report it’s true. While graduating is not an option you can get a CLI on a secured card without an additional deposit.

My Cap1 secured card received an auto CLI on the 6th month mark. Doubled my limit. While not as good as graduating because my deposit is still tied up for however long, I think it keeps Cap1 secured in the “good for rebuilders” category.

*I was waiting for the actual statement to cut to confirm, lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I was just informed by Cap1😱😭 ***UPDATE*** Cap1 "Secured Graduation" possibly on hol

Well, you can just apply for the unsecured when your credit score allows, then cancel the secured. Up to 10 years history will still show on the card after you close it. It should not have much long term effect on your score. Move on. Credit score improvement is a marathon, not a sprint.

4 years ago, I had 1 card, a CapOne Platinum with 300$ CL. Upper 500s Scores. Time and consistent PIF are your friends.