- myFICO® Forums

- Types of Credit

- Credit Cards

- NFCU Flagship: For those of you who don't travel.....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU Flagship: For those of you who don't travel....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

$500 sub pays my AF for 10 years.

2% on everything is good as 99% of all cards out there.

3% on travel when it does happen.

Cellphone protection.

Tons of benefits.

Decent looking card (wish it was metal)

NFCU!

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

@M_Smart007 wrote:"(PenFed Power Cash is 11.74% and no FTF ... but they also have 3% BT and 5% Cash Advance fees.)"

Snipped from the above post ^^^^^^^^^^^

I have seen very few PenFed Power Cash Rewards Approvals where someone actually gets the 11.74% APR ..

Usually 16.99-17.99%

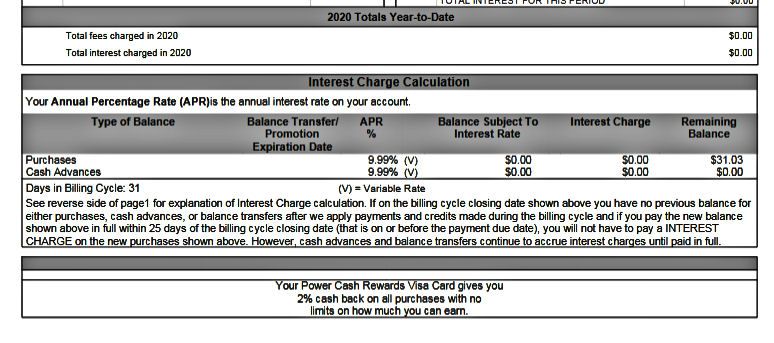

The current APR for purchases on my Penfed PCR is 8.74%.

Right now for new applicants the range they're offering is 14.99-17.99%

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

The APR on my PenFed Power Cash is 8.74% too.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

* The 2% non category spend is nice.

* Starting limit of 5k

* enter Navy's shopping portal for additional category & non category points

* 24 hrs exceptional customer support

* tops out at 80k limit

* no FTF, yearly BT w/o fees, and no ATM fees

* approvals with sub prime credit scores

I understand that the combination of other cards make this card average, but for those that want simple. This card holds its own.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

@Anonymous wrote:It is also the single only card that can have up to an $80,000 limit, vs other cards capped at $50,000 at NFCU.

LOL thats a problem I dont think I'll ever have ![]()

>3/2025 All 3 reports 845 - 850(F8) F9s = 835ish but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

@Heatt99 wrote:* The 2% non category spend is nice.

* Starting limit of 5k

* enter Navy's shopping portal for additional category & non category points

* 24 hrs exceptional customer support

* tops out at 80k limit

* no FTF, yearly BT w/o fees, and no ATM fees

* approvals with sub prime credit scores

I understand that the combination of other cards make this card average, but for those that want simple. This card holds its own.

There are a lot worse cards to have in one's wallet or purse. I have No Regerts about carrying one and it's on my short list of cards to carry for international travel.

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

@coldfusion wrote:

@M_Smart007 wrote:"(PenFed Power Cash is 11.74% and no FTF ... but they also have 3% BT and 5% Cash Advance fees.)"

Snipped from the above post ^^^^^^^^^^^

I have seen very few PenFed Power Cash Rewards Approvals where someone actually gets the 11.74% APR ..

Usually 16.99-17.99%

The current APR for purchases on my Penfed PCR is 8.74%.

Right now for new applicants the range they're offering is 14.99-17.99%

Mine is 15.49% ![]()

>3/2025 All 3 reports 845 - 850(F8) F9s = 835ish but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

@M_Smart007 wrote:"(PenFed Power Cash is 11.74% and no FTF ... but they also have 3% BT and 5% Cash Advance fees.)"

Snipped from the above post ^^^^^^^^^^^

I have seen very few PenFed Power Cash Rewards Approvals where someone actually gets the 11.74% APR ..

Usually 16.99-17.99%

I guess I'm just lucky, @M_Smart007. ![]()

I admit that my PenFed Power Cash APR is not 11.74% however.

It's actually currently at 9.99%! ![]()

*The 11.74% was their lowest advertised rate at that time.

ETA:

DANG @coldfusion and @UpperNwGuy !!

8.74% REALLY rocks!! Congrats!!

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

@Meanmchine wrote:

@coldfusion wrote:

@M_Smart007 wrote:"(PenFed Power Cash is 11.74% and no FTF ... but they also have 3% BT and 5% Cash Advance fees.)"

Snipped from the above post ^^^^^^^^^^^

I have seen very few PenFed Power Cash Rewards Approvals where someone actually gets the 11.74% APR ..

Usually 16.99-17.99%

The current APR for purchases on my Penfed PCR is 8.74%.

Right now for new applicants the range they're offering is 14.99-17.99%

Mine is 15.49%

@Meanmchine .. Mine is 16.74% Purchase APR.

Guess it don't really matter .. I only carry a balance if it is @AllZero ![]()

So when I was refferering to "Usually" .. I realize there are some outliers![]()

And "Usually" was when Interest rates were higher.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Flagship: For those of you who don't travel....

Speaking of this card, am I right in not seeing a current SUB for it? The last one I an find in an article expired April 30th, 2020.