- myFICO® Forums

- Types of Credit

- Credit Cards

- NFCU cards APR lowered automatically!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU cards APR lowered automatically!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU cards APR lowered automatically!

@MrZero wrote:Yeah, mine went down 1.5% to 12.99%, also noticed they've updated at least the CashRewards SUB, the spend requirement for $150 bonus is now $2,000 instead of the $3,000 it was when I signed up at the start of April and it's now 0% interest for the first six months instead of 1.99% on purchases.

Do you know if the SUB and the 0% interest applies when the secured card graduates to cash rewards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU cards APR lower automatically!

@pt91978 wrote:

@Anonymous wrote:

@pt91978 wrote:Hmm interesting.. I try not to carry balance anymore, but I'll take it. Which means I don't have to wait a year to ask for APR reduction. Good news, indeed.

Variable rates cards will see automatic rate changes when the prime rate changes. You should still be able to request APR reductions on any usual schedule, as that is a request to change the margin.

So, how often does the prime rate changes? Like once a year, every 6 months, 3 months? Depending on the economy? And the APR could go back up, etc..?

Thanks.

Depending a) on what the decision makers think of the economy and b) sometimes political considerations. For the rate changes see

https://about.jpmorganchase.com/about/our-business/historical-prime-rate

Note that the rate stayed constant from Dec 2008 till Dec 2015, and quite a few changes since then

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU cards APR lowered automatically!

@pt91978 wrote:

@MrZero wrote:Yeah, mine went down 1.5% to 12.99%, also noticed they've updated at least the CashRewards SUB, the spend requirement for $150 bonus is now $2,000 instead of the $3,000 it was when I signed up at the start of April and it's now 0% interest for the first six months instead of 1.99% on purchases.

Do you know if the SUB and the 0% interest applies when the secured card graduates to cash rewards?

No idea, that would be a question for NFCU or a member who has graduated.

Updated 8/12/22.

Total Inquiries: EX: 1|TU: 1|EQ: 1

Derogs: 0

AAoA: 2Y1M

AoOA: 2Y6M.

AoYA: 1Y1M.

Total CL: 57,600

Utilization: ~1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU cards APR lowered automatically!

@pt91978 wrote:

@MrZero wrote:Yeah, mine went down 1.5% to 12.99%, also noticed they've updated at least the CashRewards SUB, the spend requirement for $150 bonus is now $2,000 instead of the $3,000 it was when I signed up at the start of April and it's now 0% interest for the first six months instead of 1.99% on purchases.

Do you know if the SUB and the 0% interest applies when the secured card graduates to cash rewards?

You would need to actually open a new cashRewards to be able to get a SUB or intro APR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU cards APR lowered automatically!

You're right! Reduced from 18.00 to 17.49!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU lower CC APRs!

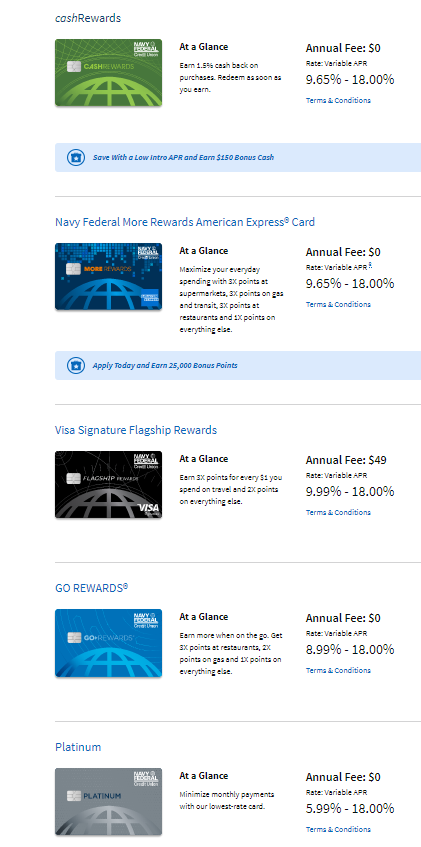

I'm sure you guys are probably already aware but NFCU credit card APRs have gone down! I wish I could snag a 5.99% platinum but I've already reached my internal limit with them. ![]()

EXP/TU - 727

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU lower CC APRs!

Pretty sure the rates are just down overall because of the Fed. When I check the details on my cards at login the interest rates are all lower than what I was initially approved for and I've only been with them a short time/have not requested any changes.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU lower CC APRs!

@recoveringfrombk7 wrote:Pretty sure the rates are just down overall because of the Fed. When I check the details on my cards at login the interest rates are all lower than what I was initially approved for and I've only been with them a short time/have not requested any changes.

+1

All of your aprs should have automatically adjusted per the fedrate decrease by now, so...check your accounts...

I already have the NFCU plat and was approved at their lowest 7.49%. As of last week, my apt has dropped to 5.99%. It likely won't last - whenever the economy recovers, rates will go back up.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU lower CC APRs!

I was wondering if that'd be the case. Thanks so much for letting me know!

EXP/TU - 727

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU lower CC APRs!

I believe we will be benefiting from the low APRs for a few years at least. The economic outlook isn't great.