- myFICO® Forums

- Types of Credit

- Credit Cards

- PenFed does not adjust AutoPayment?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PenFed does not adjust AutoPayment?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PenFed does not adjust AutoPayment?

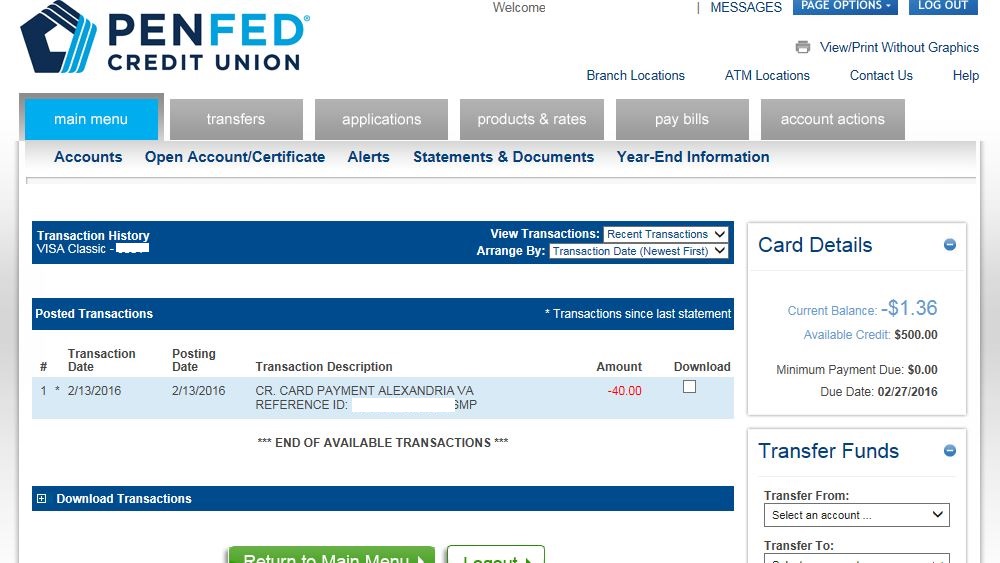

I have my PenFed Secured CC on autopayment of $40 per month, to easily pay down a small BT.

The remaining balance was $38.64, just before this autopayment of $40 was scheduled. The full $40 was pulled. Now the balance is negative $1.36.

Most banks will adjust the autopayment so your balance goes to exactly zero, if the balance on the last statement is less than the autopayment amount..

Will I see another $40 autopayment next month even if I have no new charges?

The interest charge on the last statement was $0.12, so that's not going to sop up the $1.36 credit.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed does not adjust AutoPayment?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed does not adjust AutoPayment?

That's exactly how it is for me. I have auto pay set to $125. It will pull $125 no matter what the balance is. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed does not adjust AutoPayment?

Can't you set the autopayment to the statement balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed does not adjust AutoPayment?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed does not adjust AutoPayment?

@DeeBee78 wrote:Can't you set the autopayment to the statement balance?

Yes, I guess that is an option.

My preference is to just set an amount that will retire a BT offer, then leave that payment amount since going forward it would be more than any expected PIF new charges. Then the payment adjusts to lower of statement balance or autopayment.

It appears with PenFed a little more autopay management will be needed.

Chase is even more annoying since one really has only two options: Pay in full or pay minimum. Only certain cards have the Blueprint option where you can kludge an extra payment amount to be over the minimum without going to full statement payment.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765