- myFICO® Forums

- Types of Credit

- Credit Cards

- Should I close/ask for a limit increase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I close/ask for a limit increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I close/ask for a limit increase

Morning All,

I'm looking for some advice on what to do with two credit cards.

My FICO scores range from the low 770's to the low 800's depending on the formula you look at. I would like to get my scores to the 800's and I am looking at my report. I have four cards two with limits over 10k, one at 7k and one at 1.5k. The last one is a couple of years old and we have been actively working to improve our scores over the last two years. My credit utilization is right at 12%. I only have balances on two of the cards but I use and pay off the balance on every card monthly.

My question is should I either close the card with the low balance or ask them for a limit increase? I am going to be applying for a mortgatge in 2-3 months and would like to get the prime rate. Because the card is not my oldest card and the balance is so low I don't now if the card helps, hurts or (I suspect) doesn't make much of a difference.

Other data:

No missed payments/late accounts/public records, we have one mortgage for a house we rent out.

Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

@4MER2R0 wrote:Morning All,

I'm looking for some advice on what to do with two credit cards.

My FICO scores range from the low 770's to the low 800's depending on the formula you look at. I would like to get my scores to the 800's and I am looking at my report. I have four cards two with limits over 10k, one at 7k and one at 1.5k. The last one is a couple of years old and we have been actively working to improve our scores over the last two years. My credit utilization is right at 12%. I only have balances on two of the cards but I use and pay off the balance on every card monthly.

My question is should I either close the card with the low balance or ask them for a limit increase? I am going to be applying for a mortgatge in 2-3 months and would like to get the prime rate. Because the card is not my oldest card and the balance is so low I don't now if the card helps, hurts or (I suspect) doesn't make much of a difference.

Other data:

No missed payments/late accounts/public records, we have one mortgage for a house we rent out.

Any suggestions?

Welcome to MyFico. Don't close it and don't apply for a new card if the goal is to get a mortgage in 2-3 months. Ask for a CLI instead. With your scores now at 770, you should be able to get a very good rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

Thank you for the reply and the advice.

Should I whether they are going to add a hard inquiry before proceeding?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

@4MER2R0 wrote:Thank you for the reply and the advice.

Should I whether they are going to add a hard inquiry before proceeding?

What card are you going to be requesting a CLI on? Who issues it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

@Anonymous wrote:

@4MER2R0 wrote:Thank you for the reply and the advice.

Should I whether they are going to add a hard inquiry before proceeding?

What card are you going to be requesting a CLI on? Who issues it?

Good question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

Its a Chase Freedom Card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

@4MER2R0 wrote:Its a Chase Freedom Card.

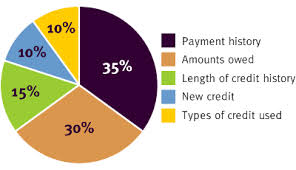

It will be a hard pull. If the goal is to increase your scores from 770 to 800, a CLI will have minimal impact. Here is how your scores are calculated.. So is there something else in credit profile you can improve on to get you to 800? 4 credit cards are enough.

What you can do is reduce utilization from 12% to below 10% on each card. Also, reduce the balances on other loans you have on your credit profile thus if there is any.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I close/ask for a limit increase

Its weird. All of my other cards just increased my limit automatically and I've actually used it more than the others (I try to take advantage of the categories) but I don't think I've ever carried a balance from one month to the next. Then again, maybe that's the reason... They might be losing money if I'm getting 5% back, never paying interest and they are only getting 2-3% on purchases.