- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

@CreditCuriosity wrote:

@DONZI wrote:Thanks for the DP info!

As I understand it, for approvals with >= $10K CL a Visa Signature will be issued, otherwise a classic. The diff. seems to distill down to inclusion of boilerplate Visa Sig. curated benefits of A) hotel / resort and B) dining for the VS card.

Any insight if the other cards have Classic and Signature flavors also?

In regard to the custom categories, do any of the cards offer similar to the BBVA CP with utility, auto, etc type categories? ..any chance a screenshot or list of the categories for any of the synovus cards?

Synovus doesn't offer visa signatures that i am aware of. Card I got started out at 18k and was a non signature, don't believe it is offered as a signature.

Yes the cash version certainly offers categories you choosed and managed through tsys if i recall being rewards they manage for synovus.

Hey CC - not that it matters for me, but I was under the impression that some of their cards came in VS flavor? Like the Travel Rewards, IIRC.

Conversely, since the OP referenced some comparisons between both FI's, I've seen mixed DPs on whether the BBVA ClearPoints comes in VS vs Platinum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

@FinStar wrote:

Hey CC - not that it matters for me, but I was under the impression that some of their cards came in VS flavor? Like the Travel Rewards, IIRC.

I forgot to clarify that I was referring specifically about the travel rewards card when commenting on the Visa Classic Vs Signature benefits in my previous message.

I don't see anything to suggest the signature flavor card is hidden within bank relationship tier structure and/or 'need to know' secrecy like some financial institutions I've investigated do.. but there is a lone PDF document on the synovus website describing a signature variety of the travel rewards card that appears to be reasonably current.

[2020-12-09]=[EQ8|786]-[TU8|746]-[EX8|772] .... gardening until I can't (again).

[2023-10-01]=[EQ8|797]-[TU8|776]-[EX8|775]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

Congrats on your new card!

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

@FinStar wrote:

Conversely, since the OP referenced some comparisons between both FI's, I've seen mixed DPs on whether the BBVA ClearPoints comes in VS vs Platinum.

At one point they were all issued and labeled as Platinums. @UncleB and I both hold a ClearPoints VS that started out life as a Platinum and was later upgraded to a VS without any warning. One day I got a replacement card in the mail labeled "Visa Signature" and that was that. There was a thread here several months ago where I posted a capture I took from a statement confirming mine is a VS.

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

@FinStar wrote:

@CreditCuriosity wrote:

@DONZI wrote:Thanks for the DP info!

As I understand it, for approvals with >= $10K CL a Visa Signature will be issued, otherwise a classic. The diff. seems to distill down to inclusion of boilerplate Visa Sig. curated benefits of A) hotel / resort and B) dining for the VS card.

Any insight if the other cards have Classic and Signature flavors also?

In regard to the custom categories, do any of the cards offer similar to the BBVA CP with utility, auto, etc type categories? ..any chance a screenshot or list of the categories for any of the synovus cards?

Synovus doesn't offer visa signatures that i am aware of. Card I got started out at 18k and was a non signature, don't believe it is offered as a signature.

Yes the cash version certainly offers categories you choosed and managed through tsys if i recall being rewards they manage for synovus.

Hey CC - not that it matters for me, but I was under the impression that some of their cards came in VS flavor? Like the Travel Rewards, IIRC.

Conversely, since the OP referenced some comparisons between both FI's, I've seen mixed DPs on whether the BBVA ClearPoints comes in VS vs Platinum.

Travel card might have a VS card, but not sure. Card I have being Cash version isn't from what i can tell. BBVA as echoed does offer Signature most appear to be upgrades that I have seen vs. initial approval for whatever reason at least for UncleB can't speak for others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

@CreditCuriosity wrote:

@FinStar wrote:

@CreditCuriosity wrote:

@DONZI wrote:Thanks for the DP info!

As I understand it, for approvals with >= $10K CL a Visa Signature will be issued, otherwise a classic. The diff. seems to distill down to inclusion of boilerplate Visa Sig. curated benefits of A) hotel / resort and B) dining for the VS card.

Any insight if the other cards have Classic and Signature flavors also?

In regard to the custom categories, do any of the cards offer similar to the BBVA CP with utility, auto, etc type categories? ..any chance a screenshot or list of the categories for any of the synovus cards?

Synovus doesn't offer visa signatures that i am aware of. Card I got started out at 18k and was a non signature, don't believe it is offered as a signature.

Yes the cash version certainly offers categories you choosed and managed through tsys if i recall being rewards they manage for synovus.

Hey CC - not that it matters for me, but I was under the impression that some of their cards came in VS flavor? Like the Travel Rewards, IIRC.

Conversely, since the OP referenced some comparisons between both FI's, I've seen mixed DPs on whether the BBVA ClearPoints comes in VS vs Platinum.

Travel card might have a VS card, but not sure. Card I have being Cash version isn't from what i can tell. BBVA as echoed does offer Signature most appear to be upgrades that I have seen vs. initial approval for whatever reason at least for UncleB can't speak for others.

I don't know how I missed part of this discussion, but my Travel Rewards card is a VS.

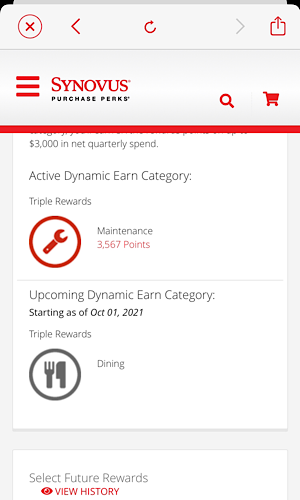

In the months since getting this card, it has became a very solid player in our lineup. With the 1.25X multiplier for redeeming cash back to pay for travel charges, this card is effectively a 3.75% card up to $3K per quarter and 6.25% on travel charges up to $5K. We used it for restaurants for the first quarter we had it, and now I've swapped it over to Maintenance this quarter and I'm running business expenses through it, since Disco is 5% on restaurants through Sept. We used to book our condo for vacation and I've spent around $4K through it in the Dynamic Spend categories. In almost 4 months, we've earned $243 to put towards a travel charge. That's a 4.4% average, and will be higher once we actually go on vacation.

It's been a great card so far!

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

If you never got an answer to this, the rewards structure is very similar to BBVA. In fact, both are handled by TSYS.

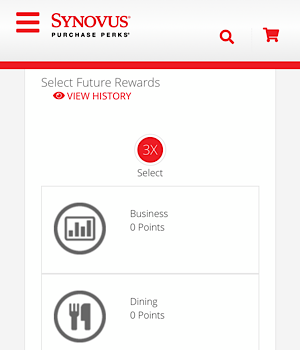

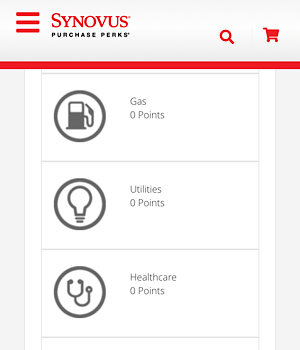

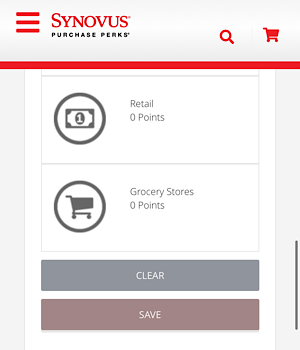

Here are the screenshots of the 3% Dynamic Earn categories, which is 3.75% if redeemed for to pay for travel charges.

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

Thanks for the additional clarifications about the categories.

My understanding is that the chosen category can remain active for all four quarters if desired... ?

Does a category change require doing so within a time window close to first day of January, April, July, October?

[2020-12-09]=[EQ8|786]-[TU8|746]-[EX8|772] .... gardening until I can't (again).

[2023-10-01]=[EQ8|797]-[TU8|776]-[EX8|775]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

@DONZI wrote:Thanks for the additional clarifications about the categories.

My understanding is that the chosen category can remain active for all four quarters if desired... ?

Does a category change require doing so within a time window close to first day of January, April, July, October?

Yes, those chosen categories can stay the same or you can change it each quarter. The good thing is you have all quarter up until the the last day of the quarter to change it.

For instance, I normally use this card for dining, but since Discover is 5% on dining this quarter, I swapped this one to maintenance this quarter and I'm running some of my business spend through it. I already have it set to go back to dining in Oct.

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synovus Impressions and DPs.

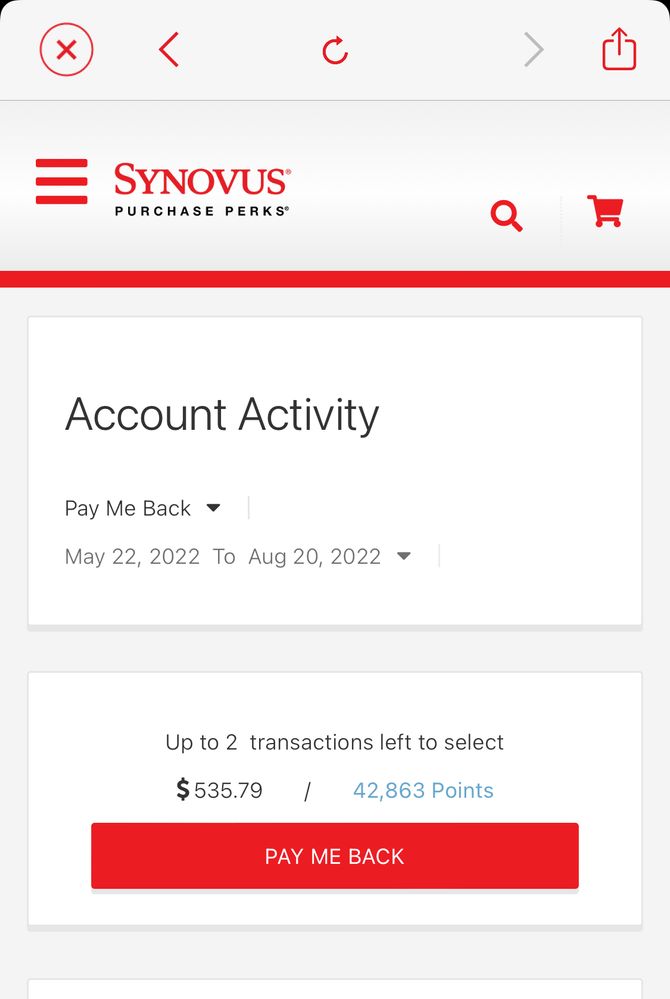

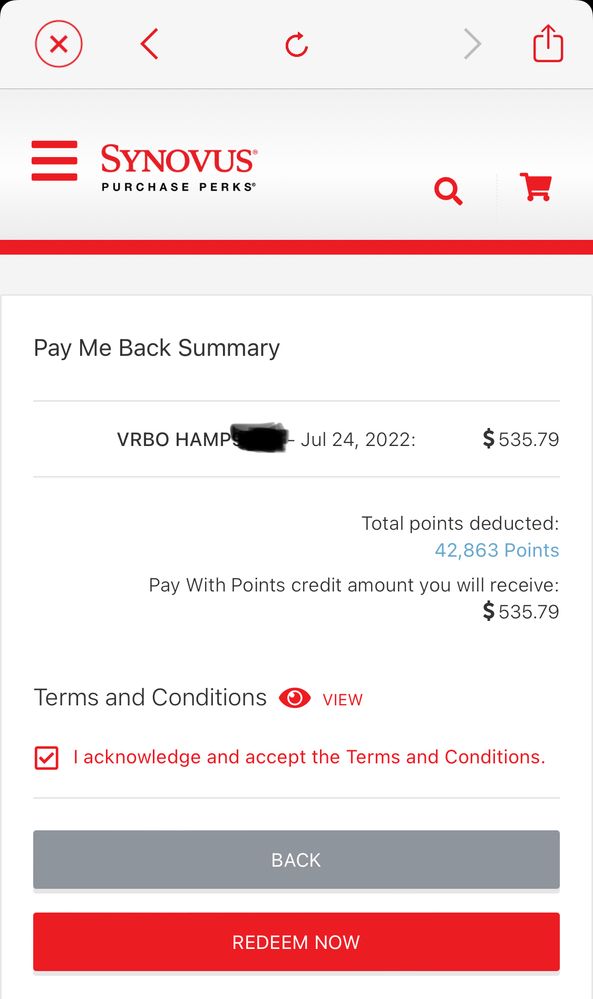

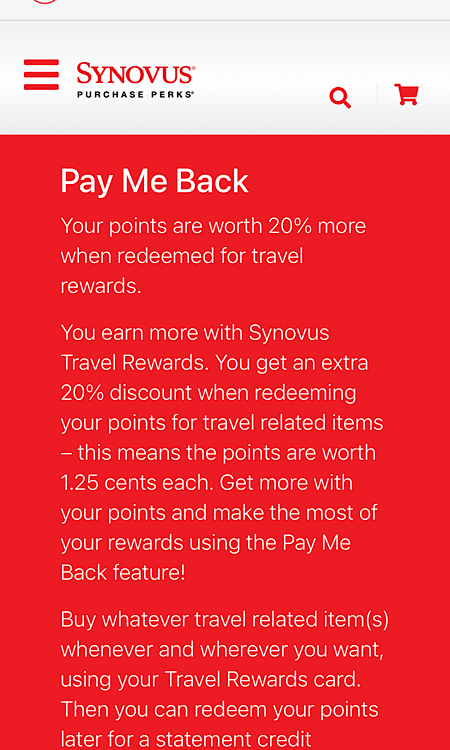

I just wanted to follow up on this great under the radar travel card for people like me who don't fly or stay in chain hotels. I recently redeemed some of my cash back to cover the deposit on our vacation condo. With the 20% extra they give you for redeeming to cover travel expenses, I paid a $535.79 charge on the card for $428.63 in cash back points. I only redeem our points to cover travel expenses, so every dollar we earned the 3% selectable category actually earned 3.75% and every 5% travel purchase earned 6.25%. This requires you to accumulate points for a while - which I know some people hyperventilate about - but as is the case with many travel cards, it is the best to way to maximize cash back.

It a great card for our travel habits, and is a card that typically earns us around $600 worth of cash back. If we spent the full $5000 cap for travel in a year, the card can potentially earn $762 per, minus the $50 AF

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards: