- myFICO® Forums

- Types of Credit

- Credit Cards

- Updated-Penfed Finally Gave Me Offers!! But.....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Updated-Penfed Finally Gave Me Offers!! But.....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

@RonM21 wrote:I got in with Penfed in May 2016. Opened a Cash Rewards card with a $6K starting limit. Upon approval - 700 Fico with five (30) day lates still reporting due to their errors, from a PAID car loan that Santander took over (they are difficult). Nothing else bad on the report. I put decent spend on the card monthly PIF, or let a little balance carry then PIF. Up until today, I NEVER got offers, even though my scores continued to rise. Frustrating. There is some data to suggest that they may be more income driven, and my income is moderate. Also those lates fell off early last year.

So, I've had them on the chopping block the last few months and no lie, was going to either try a HP for a CLI, or if still unsatisfied, close the card and look at other options. Crazy because I just had this convo with @AverageJoesCredit lol.

Fast forward to late last night, in another post I jokingly mentioned checking to see if they updated so I could verify my Turbo Tax offer was still intact. I log in this AM and see my score updated (793). To my surprise, that Turbo Tax offer was further down with another "Your Offers" section above it?? I click on it and "well what do ya know.'

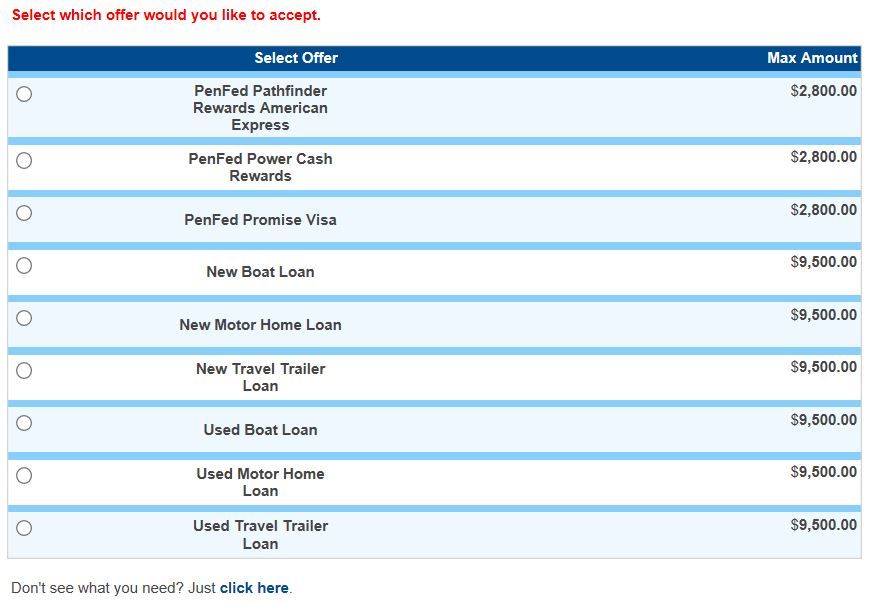

Here's the thing, for my own reasons, I'd like this card to be at least at 10K (not even in the ballpark of my Alliant or NFCU). But if you look at my offers, even if I just added the 2.8K for an increase, I still wouldn't be where I want to be. Yes, I understand it is their business to give me what they want, yada yada

And that is fine. But I can go my own direction as well. So right now, I don't know my next move.

Any thoughts or Suggestions?????

@AverageJoesCredit get at me!!

Thanks for the tip Ron! I never knew about this on PenFed, just checked an I have huge offers. If it has an offer with a "max amount" next to a CC I already have and I accept the offer, is that a CLI or an opening of a 2nd of the same CC?

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

@CreditCuriosity wrote:

@RonM21 wrote:

@CreditCuriosity wrote:Congrats I have had two quarters with 790 EQ 09 scores and no offers yet suppose due to having possibly alot of credit and products with them already? Still be nice to see some as been banking with them 4 years. How you get on their radar i have no idea joined with a dirty file but got approved for some cards now that i am clean still notta. Oh well suppose if I need a new car loan with the again or anything else will jus thave to incur a HP when time comes and get approved that way

Thank you CC!! And your guess is as good as mine, which I am clueless. It would certainly seem as if offers should be on the table for you as well, with your relationship with them. At least you got far enough to have multiple accounts with them!

But I feel like there had been a brick wall between me and Penfed since the day I got the card. One area I did mess up in from the start, was when they gave me the survey after approval, I didn't mention the limit. I was thinking the same as you, that I might have to force the issue by going the HP route, which I DID NOT want to do. I've seen plenty of people getting increases (SP) off of the offers and I wasn't too thrilled about having to do that. I hope you see something soon!

Ya It is strange have a car loan that started out at 68k with them that is down to 44k now, a CC that was 35k with them that I lowered to 27k and a personal loan that started out at 13k and now is at 11k approx with them. So we certainly have a long lending relationship and had a few other cards along the way as well. My main direct deposit goes to them as well so they certainly have my POI

CC, you've had some serious (in a good way) accounts with them, and obviously have never faulted with them. I bet someone would question if you are over extended with them, but if I were a lender I would see you as continuous profit for the company without any issues. So, I would want to keep offers on the table to keep the business relationship going. But, what do I know?? Guess that is why I'm not a lender ![]()

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

@CBartowski wrote:Thanks for the tip Ron! I never knew about this on PenFed, just checked an I have huge offers. If it has an offer with a "max amount" next to a CC I already have and I accept the offer, is that a CLI or an opening of a 2nd of the same CC?

Really?? That's what I'm talking about!!! Congrats!! I am thinking if it's a credit card you already have, that would be an increase. If not me then I am glad to see someone else get the luv! You mind giving more info on what your offers are and maybe some of your stats so that I can be jealous?? ![]()

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

@RonM21 wrote:

@CBartowski wrote:Thanks for the tip Ron! I never knew about this on PenFed, just checked an I have huge offers. If it has an offer with a "max amount" next to a CC I already have and I accept the offer, is that a CLI or an opening of a 2nd of the same CC?Really?? That's what I'm talking about!!! Congrats!! I am thinking if it's a credit card you already have, that would be an increase. If not me then I am glad to see someone else get the luv! You mind giving more info on what your offers are and maybe some of your stats so that I can be jealous??

Yea I had no idea, now there is a "Request Increase" button next to the card on the Products tab as well, looks like they're changing things up.

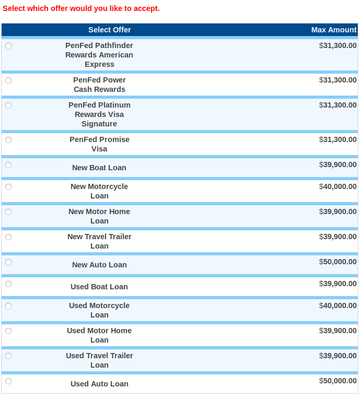

So I haven't pulled a 3 bu report in a hot minute but this is what I'm tracking: range from 750-791 between the 3, no baddies, AAoA is only like 2-3 years and I've only been with them for less than a year. I did recently open one of their high interst online savings accounts though. Maybe that helped? My current CL with the Pathfinder is 10k so 31k is quite an increase. Though it says "max" sooo I don't know if they'd actually give the whole extra 20k.

I also just realized I never got the SUB, if my statement checks are right, I started strong and never finished the min spend...![]() like a rookie!

like a rookie!

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

Congratulations on getting offers from Penfed. Even though they are extremely conservative, I think they are an excellent credit union. I have to admit that credit card and boat offer could entice me.

Guyatthebeach

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

@RonM21 wrote:

@CreditCuriosity wrote:Ya It is strange have a car loan that started out at 68k with them that is down to 44k now, a CC that was 35k with them that I lowered to 27k and a personal loan that started out at 13k and now is at 11k approx with them. So we certainly have a long lending relationship and had a few other cards along the way as well. My main direct deposit goes to them as well so they certainly have my POI

CC, you've had some serious (in a good way) accounts with them, and obviously have never faulted with them. I bet someone would question if you are over extended with them, but if I were a lender I would see you as continuous profit for the company without any issues. So, I would want to keep offers on the table to keep the business relationship going. But, what do I know?? Guess that is why I'm not a lender

Agree it could be i have alot of exposure with them already but my income supports said exposure although they certainly have tightened up recently with max exposure. See how it goes when i pay off the personal loan or the majority of it next March (bonus) and I have 1500 approx left on a BT on the CC that will be paid off within the next few months as well. Exposure is fairly high but my income mention supports it or would never of got that high with them in the first place![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

Well I can't tell you what to do. But I certainly know what I'm about to do with my offers. lol

They just gave me an increase 3 or 4 months ago. I thought I was topped out then. Apparently still a little meat left on the bone.

Congrats on your SP approvals. Never look a gift horse in the mouth. The amount of TCL or income doesn't have much bearing...obviously in my case. I'm already at $45,700 with Penfed. I guess this will make it an even $50k.

Being that I'm also CC's part time doorman and grounds keeper.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What?!? Penfed Finally Gave Me Offers!! But.....

@CBartowski wrote:

@RonM21 wrote:

@CBartowski wrote:Yea I had no idea, now there is a "Request Increase" button next to the card on the Products tab as well, looks like they're changing things up.

So I haven't pulled a 3 bu report in a hot minute but this is what I'm tracking: range from 750-791 between the 3, no baddies, AAoA is only like 2-3 years and I've only been with them for less than a year. I did recently open one of their high interst online savings accounts though. Maybe that helped? My current CL with the Pathfinder is 10k so 31k is quite an increase. Though it says "max" sooo I don't know if they'd actually give the whole extra 20k.

I also just realized I never got the SUB, if my statement checks are right, I started strong and never finished the min spend...

like a rookie!

Lol, it's safe to say you are well ahead of the curve compared to me in your progress with Penfed. I need to check the sight to see if I have the same Request Increase button in the products section.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k