- myFICO® Forums

- Types of Credit

- Credit Cards

- Venmo Credit card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Venmo Credit card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@Anonymous wrote:$10k limit is even worse than BofA $2.5k per quarter. Could someone in theory find some niche use for this card to make $200 a year? Sure but that's not worth the risk of doing business with Synchrony Bank when they can close your account and evaporate all of your rewards points on any whim at any time for any reason.

In theory you could spend all 10k in one month and then they close your account right before the end the month and all you've earned yourself is a credit pull and opportunity loss.

Any issuer can do this exact thing you mentioned and do this exact thing you mention. Just like a consumer can cancel a credit card at anytime for any reason the creditor can do the exact same thing

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@CreditCuriosity wrote:

@Anonymous wrote:$10k limit is even worse than BofA $2.5k per quarter. Could someone in theory find some niche use for this card to make $200 a year? Sure but that's not worth the risk of doing business with Synchrony Bank when they can close your account and evaporate all of your rewards points on any whim at any time for any reason.

In theory you could spend all 10k in one month and then they close your account right before the end the month and all you've earned yourself is a credit pull and opportunity loss.

Any issuer can do this exact thing you mentioned and do this exact thing you mention. Just like a consumer can cancel a credit card at anytime for any reason the creditor can do the exact same thing

Any issuer can, Synchrony bank actively does. Discover miles is 3%, UNLIMITED, for the first year, and they don't have a history of screwing people. No reason to risk doing business with Synchrony bank predators.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@Anonymous wrote:

@CreditCuriosity wrote:

@Anonymous wrote:$10k limit is even worse than BofA $2.5k per quarter. Could someone in theory find some niche use for this card to make $200 a year? Sure but that's not worth the risk of doing business with Synchrony Bank when they can close your account and evaporate all of your rewards points on any whim at any time for any reason.

In theory you could spend all 10k in one month and then they close your account right before the end the month and all you've earned yourself is a credit pull and opportunity loss.

Any issuer can do this exact thing you mentioned and do this exact thing you mention. Just like a consumer can cancel and credit card at anytime for any reason the creditor can do the exact same thing

Any issuer can, Synchrony bank actively does. Discover miles is 3%, UNLIMITED, for the first year, and they don't have a history of screwing people. No reason to risk doing business with Synchrony bank predators.

By the same token, if you've been around the forums long enough, you'd see there's been plenty of Discover 4506-T requests on existing cardholders, as well as other types of adverse actions, namely CLDs or shutdowns. Of course, not in the grand scale to those of Synchrony or Comenity, for instance, but prevalent nonetheless.

The point being, as mentioned upthread, any issuer can and will take their own risk mitigation measures proactively and Discover is not exempt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@Anonymous wrote:$10k limit is even worse than BofA $2.5k per quarter. Could someone in theory find some niche use for this card to make $200 a year? Sure but that's not worth the risk of doing business with Synchrony Bank when they can close your account and evaporate all of your rewards points on any whim at any time for any reason.

In theory you could spend all 10k in one month and then they close your account right before the end the month and all you've earned yourself is a credit pull and opportunity loss.

Oh hey, here are some Chase shutdown threads to go along with the already mentioned Discover.

https://ficoforums.myfico.com/t5/Credit-Cards/Completely-shut-down-by-Chase/m-p/5619706

You're fooling yourself if you think Synchrony is some kind of lone ranger out there. Yes, they take more aggressive action than a more staid bank that's only lending to 750++ scores, but guess what, they lend to a more risky subprime group so when the economy goes belly up, they have to pull in credit lines faster . Combine with a bunch of MyFico'ers who regularly push Synch love buttons and sign up for store cards (a bunch of those cards are for stores that are imploding, BTW, which affects Synchrony too) so they can pad utilization and bring scores up faster, and of course you get a bunch of angry posts about how SYNCHRONY IS THE WORST EVER.

Sure, if you're in the 800s and AOD, or US Bank Cash+ is there for the taking, or you're eligible for BofA Platinum Honors + their juicy cashback cards (with that six digit balance with BofA), sure, you probably don't need Synchrony as a lender. Going subprime is a waste of your time. But not everyone here is sporting that kind of mojo. As such, a subprime lender beats not having options at all, as long as you go in eyes wide open- Synchrony might just be a stepping stone to a better lender (or it might be a forever card if they leave you alone- I think the PPMC and Venmo cards aren't terrible offerings at all, they're arguably better than Capital One and on par with Discover).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@SunriseEarth wrote:I don't have a Venmo CC offer. Yet. And yes, even after my massive Sync purge, I'd consider it.

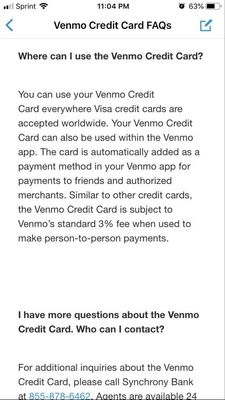

Or maybe not. One bad thing about Venmo is that there is a 3% for using CCs. I thought that the Venmo CC might not be subject to that, but I appear to be wrong:

Start: 619 (TU08, 9/2013) | Current: 806 (TU08, 6/06/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Disney Premier VS $49600 | Discover IT $46000 | Venmo VS $30000 | Cash+ VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 | Synchrony Premier $24,200 | GS Apple Card WEMC $22000 | WF Attune WEMC $22000 | Jared Gold Card $19000 | Citi Custom Cash MC $16600 | Freedom Flex WEMC $16500 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $13500 | Belk MC $10000 | Sephora VS $6900 | Wayfair MC $4500 | ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@notmyrealname23 wrote:

@Anonymous wrote:$10k limit is even worse than BofA $2.5k per quarter. Could someone in theory find some niche use for this card to make $200 a year? Sure but that's not worth the risk of doing business with Synchrony Bank when they can close your account and evaporate all of your rewards points on any whim at any time for any reason.

In theory you could spend all 10k in one month and then they close your account right before the end the month and all you've earned yourself is a credit pull and opportunity loss.

Oh hey, here are some Chase shutdown threads to go along with the already mentioned Discover.

https://ficoforums.myfico.com/t5/Credit-Cards/Completely-shut-down-by-Chase/m-p/5619706

You're fooling yourself if you think Synchrony is some kind of lone ranger out there. Yes, they take more aggressive action than a more staid bank that's only lending to 750++ scores, but guess what, they lend to a more risky subprime group so when the economy goes belly up, they have to pull in credit lines faster .

The OP never implied Sync is a lone ranger. To me he is just cautioning, the same as you, that Sync can be more aggresive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@notmyrealname23 wrote:

@Anonymous wrote:$10k limit is even worse than BofA $2.5k per quarter. Could someone in theory find some niche use for this card to make $200 a year? Sure but that's not worth the risk of doing business with Synchrony Bank when they can close your account and evaporate all of your rewards points on any whim at any time for any reason.

In theory you could spend all 10k in one month and then they close your account right before the end the month and all you've earned yourself is a credit pull and opportunity loss.

Oh hey, here are some Chase shutdown threads to go along with the already mentioned Discover.

https://ficoforums.myfico.com/t5/Credit-Cards/Completely-shut-down-by-Chase/m-p/5619706

You're fooling yourself if you think Synchrony is some kind of lone ranger out there. Yes, they take more aggressive action than a more staid bank that's only lending to 750++ scores, but guess what, they lend to a more risky subprime group so when the economy goes belly up, they have to pull in credit lines faster . Combine with a bunch of MyFico'ers who regularly push Synch love buttons and sign up for store cards (a bunch of those cards are for stores that are imploding, BTW, which affects Synchrony too) so they can pad utilization and bring scores up faster, and of course you get a bunch of angry posts about how SYNCHRONY IS THE WORST EVER.

Sure, if you're in the 800s and AOD, or US Bank Cash+ is there for the taking, or you're eligible for BofA Platinum Honors + their juicy cashback cards (with that six digit balance with BofA), sure, you probably don't need Synchrony as a lender. Going subprime is a waste of your time. But not everyone here is sporting that kind of mojo. As such, a subprime lender beats not having options at all, as long as you go in eyes wide open- Synchrony might just be a stepping stone to a better lender (or it might be a forever card if they leave you alone- I think the PPMC and Venmo cards aren't terrible offerings at all, they're arguably better than Capital One and on par with Discover).

I would have LOVED to provide Synchrony Scam bank with a 4506-T. 1) it would have given me time to reduce my exposure 2) it would have shown that they aren't justified

None of those Chase examples even come close to the experience of having hundreds of dollars of rewards evaporated on the whim of the bank.

I have had one card closed for reasons other than inactivity before and citi went out of their way to make sure I kept all of my rewards.

I expect to be treated unfairly by banks, I don't expect to get completely scammed and ripped off like I was by Syn chrony Bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

I would have LOVED to provide Synchrony Scam bank with a 4506-T. 1) it would have given me time to reduce my exposure 2) it would have shown that they aren't justified

None of those Chase examples even come close to the experience of having hundreds of dollars of rewards evaporated on the whim of the bank.

I have had one card closed for reasons other than inactivity before and citi went out of their way to make sure I kept all of my rewards.

I expect to be treated unfairly by banks, I don't expect to get completely scammed and ripped off like I was by Syn chrony Bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

@Anonymous wrote:I would have LOVED to provide Synchrony Scam bank with a 4506-T. 1) it would have given me time to reduce my exposure 2) it would have shown that they aren't justified

None of those Chase examples even come close to the experience of having hundreds of dollars of rewards evaporated on the whim of the bank.

I have had one card closed for reasons other than inactivity before and citi went out of their way to make sure I kept all of my rewards.

I expect to be treated unfairly by banks, I don't expect to get completely scammed and ripped off like I was by Syn chrony Bank.

With all due respect, I'm not planning on doing 10k of charges in a month if I end up with a Venmo Synch card, which would likely involve me having to cycle the card (I am not getting 10k limits up front right now), and is the kind of thing that screams "bust out fraud" to banks (not that you were trying to bust out, but you may have triggered an algorithm trying to detect that). Especially ones that are lending to subprime profiles more likely to be on the financial edge.

Good luck finding a better lender for your needs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Venmo Credit card

If you suspect bust out fraud you shut down the account immediately not a few hours before the end of the month. It was also actually a much lighter spending month than in the previous months. Have cards with all the other major banks and have 0 issues with them, just was mostly using Synchrony for the straightforward 2%. Would rather get a credit card from Satan himself in the future than Synchrony.

Wouldn't touch their bank accounts either. Money is safer in a casino. At least the casino can be held responsible for inappropriate fees, not even Walmart could make Synchrony take responsibility for their scams.