- myFICO® Forums

- Types of Credit

- Credit Cards

- Verizon Visa - Revisited

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Verizon Visa - Revisited

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Verizon Visa - Revisited

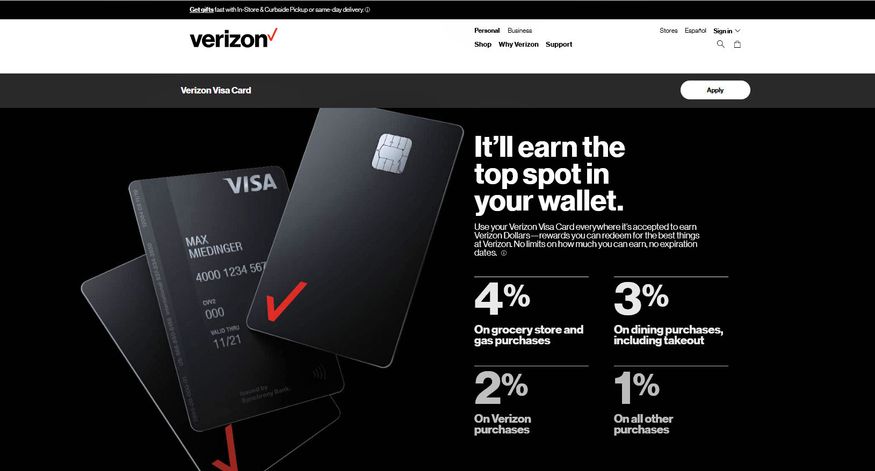

We're almost at the six-month point for the Verizon Visa card, so I wanted to start a new thread for opinions from our members who have been carrying the card. For those who got in on the pre-release SUB and netted over $400, that was awesome but let's separate that from the rest of the card impressions since that's no longer available. What do you like and what don't you like? Discuss. ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

I like that I'm saving about $15 a month on bill. $4.17 a month from $100 statement credit over 24 months, and $10 for autopay. Very easy to cash dollars on bill and products.

I like that my Walmart codes Groceries, so 4% on shopping. Don't like that Verizon Dollars earned don't show until statement close, but minor gripe.

Recently they've started emailing unique offers to earn statement credits, or Verizon Dollars.

One other minor gripe. I did earn that $400 SUB. Couldn't use a portion of that to payoff phone. Their system only allows use on bill and purchasing products.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

I missed the original SUB offer, however I got it becuase it offered higher cash back % in some high spend categories than the Citi DC which was our daily driver.

I don't mind the Verizon dollars it's virtually the same as cash back to me, I'm paying Verizon for 5 lines of service either way.

However, I only use it for Gas, Groceries and my Verizon bill currently. It is linked to a few dining apps, so if I order pizza from my phone it charges to the Verizon Visa by default. I was initially excited for the 3% dining with no AF, that is a big spend category for us, getting an additional 50% cash back is a big deal. The plan was to move the Verizon Visa into those spend catergories. Then Chase revamped their Freedom cards and gave 3% on dining, I tend to use Chase Freedom for dining now and transfer my UR points to my CSP.

The synchrony/Verizon Visa website and mobile ap is very basic, sometimes I have had purchases that doesn't show pending for days. Those are minor gripes.

The biggest regret I have is Chase changed the Freedom program for dining, which I could live without the Verizon Visa now. I would have rather used the HP and got the AmEx BCP instead.

The Chase revamp is really just my personal issue and not really Verizon or Synchrony's problem. Overall though if you're not going away from Verizon service and want to reduce your cell phone bill or save up rewards to buy a new phone, it's a decent card. Oh and some people are into the look and feel of the card, it is metal and exactly how it is pictured, all black on the front with a small red Verizon logo in the corner. It came in a fancy packaging from Verizon delivered via FedEx, they obviously were going for the feeling of opening a high end phone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

We are liking the card and it gets its use from us! Several people have looked at the card closely after picking it up for charges (its rather hefty when compared to other cards). Another plus for me that hasn't been mentioned yet is that each month Verizon offers a $5 Verizon purchase Up reward that converts and transfers into your Verizon Dollars bank easily. That reward was somewhat useless to me because before acquiring the card it couldn't be used towards bill pay.

A negative is the portal interface (and this seems to be a common Synch gripe in general). A charge rarely appears in the "Pending" section. Several days after use, the charge typically appears in the transaction history and never appearing in "Pending". Unless it happens to be statement cut day, and a charge made that very day appears suddenly in your transactions and is included in your statement of charges. Also, payments take days to process and credit to your account. So if you are doing AZEO, this card is hard to get that $0 balance when you pay the card bill thru their website. If you are pushing a payment, you could probably push a higher amount than your balance shows and not use the card a few days before statement cut for extra insurance of getting that $0 balance to report. Its a lot of hassle if doing the AZEO method...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

Have only used it a few times since sub has hit.. Sub is still covering the bills ![]() . Although Will use in 3-4% cats as find beneficial don't care of verizon dollars or what not as eventually hve to pay my phone bill regardless and not leaving verizon as bar none they have best service where i live.. Auto pay benefit is obviously nice as well for extra % off from card, etc

. Although Will use in 3-4% cats as find beneficial don't care of verizon dollars or what not as eventually hve to pay my phone bill regardless and not leaving verizon as bar none they have best service where i live.. Auto pay benefit is obviously nice as well for extra % off from card, etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

I'm still waiting for it to become available for Fios customers without wireless, given the autopay discount now applies to Fios as well and I'd rather not use a debit card or bank account to pay them after my next renewal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

@MASTERNC wrote:I'm still waiting for it to become available for Fios customers without wireless, given the autopay discount now applies to Fios as well and I'd rather not use a debit card or bank account to pay them after my next renewal.

I'm using paypal key, which gets the debit discount, and is currently linked to a 3% card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Verizon Visa - Revisited

My only gripe is how the Verizon Visa phone app will push you over to the MyVerizon app to see certain things on your account. It has improved a little since the beginning, but still annoying. I typically net $35-40 off my bill each month between rewards, the autopay discount, and the $5 Verizon Up credit.