- myFICO® Forums

- Types of Credit

- Credit Cards

- Why does my PPMC EQ report update daily?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why does my PPMC EQ report update daily?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

Same here. My PPMC did frequent reporting for 2 months until settled down, and now reports on the 14th or 15th every month. Just one of those odd Synchronary things...😉😂

@Anonymous wrote:Sync did this to me the first few months after I got my Amazon and PayPal cards. It stopped and hasn't occurred since. Just one of their quirks.

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

Everyone knows Vantage is better than Fico....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

Hmm that's really strange. They mid-cycle me once a year on my Marvel and caught me off guard and a little annoyed but never heard of daily reporting from them. Until now.

If it really bothers you then call them about it with a threat to AA them if they don't fix it! 😛

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

@JR_TX wrote:

If it really bothers you then call them about it with a threat to AA them if they don't fix it! 😛

and don't forget to report back here with the outcome from the call 😁

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

Not to be sour, but it has indeed updated every single day since i've posted this thread. There is no way in hell I am calling those people lol.

#letitendplease

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

@Anonymous wrote:Not to be sour, but it has indeed updated every single day since i've posted this thread. There is no way in hell I am calling those people lol.

#letitendplease

It's weird, but what's also weird is your EQ score isn't changing despite all the balance increases and decreases. Why is that?So they hard pull Transunion to get the card, then try to screw you over on Equifax when you go to Walmart? lol.

I knew the chronies were bad, but I'm a 2% junkie...what a mousetrap.. On the bright side, it looks like payments to the card credited the same day? How long have you had the card? I read that the chronies have all kinds of bs controls for new accounts (2-3 months old). Some of the others:

1) It can take up to 9 days for a payment to settle to the card (so they won't release your credit line until then...)

2) Pesky fraud locks

Have any of these been true for you?

Also, why is it so hard to find the statement closing date? Where is it in the app? This is not my daily driver, so not a big deal, but would like better app integration with Paypal. The bootleg portal to Synchrony is a bit unprofessional...I wanted to be able to make payments from my paypal balance too (Read this was possible but don't see it anywhere). The card doesn't have contactless payment, and can't be added to Apple Pay (likewise, Apple Card can't be added to Paypal....what a bunch of cronies and mouthbreathers...)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

@Credit12Fico wrote:

@Anonymous wrote:Not to be sour, but it has indeed updated every single day since i've posted this thread. There is no way in hell I am calling those people lol.

#letitendplease

It's weird, but what's also weird is your EQ score isn't changing despite all the balance increases and decreases. Why is that?So they hard pull Transunion to get the card, then try to screw you over on Equifax when you go to Walmart? lol.

I knew the chronies were bad, but I'm a 2% junkie...what a mousetrap.. On the bright side, it looks like payments to the card credited the same day? How long have you had the card? I read that the chronies have all kinds of bs controls for new accounts (2-3 months old). Some of the others:

1) It can take up to 9 days for a payment to settle to the card (so they won't release your credit line until then...)

2) Pesky fraud locks

Have any of these been true for you?

Also, why is it so hard to find the statement closing date? Where is it in the app? This is not my daily driver, so not a big deal, but would like better app integration with Paypal. The bootleg portal to Synchrony is a bit unprofessional...I wanted to be able to make payments from my paypal balance too (Read this was possible but don't see it anywhere). The card doesn't have contactless payment, and can't be added to Apple Pay (likewise, Apple Card can't be added to Paypal....what a bunch of cronies and mouthbreathers...)

My account is 1yr 1mo old and this has never happened. I don't even want to call, in fear they'll close my account lol.

Nonetheless, we are receiving daily reports. Gonna be interesting to see how this incoming $3.5k car repair charge posts ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why does my PPMC EQ report update daily?

@Anonymous wrote:

@Credit12Fico wrote:

@Anonymous wrote:Not to be sour, but it has indeed updated every single day since i've posted this thread. There is no way in hell I am calling those people lol.

#letitendplease

It's weird, but what's also weird is your EQ score isn't changing despite all the balance increases and decreases. Why is that?So they hard pull Transunion to get the card, then try to screw you over on Equifax when you go to Walmart? lol.

I knew the chronies were bad, but I'm a 2% junkie...what a mousetrap.. On the bright side, it looks like payments to the card credited the same day? How long have you had the card? I read that the chronies have all kinds of bs controls for new accounts (2-3 months old). Some of the others:

1) It can take up to 9 days for a payment to settle to the card (so they won't release your credit line until then...)

2) Pesky fraud locks

Have any of these been true for you?

Also, why is it so hard to find the statement closing date? Where is it in the app? This is not my daily driver, so not a big deal, but would like better app integration with Paypal. The bootleg portal to Synchrony is a bit unprofessional...I wanted to be able to make payments from my paypal balance too (Read this was possible but don't see it anywhere). The card doesn't have contactless payment, and can't be added to Apple Pay (likewise, Apple Card can't be added to Paypal....what a bunch of cronies and mouthbreathers...)

My account is 1yr 1mo old and this has never happened. I don't even want to call, in fear they'll close my account lol.

Nonetheless, we are receiving daily reports. Gonna be interesting to see how this incoming $3.5k car repair charge posts

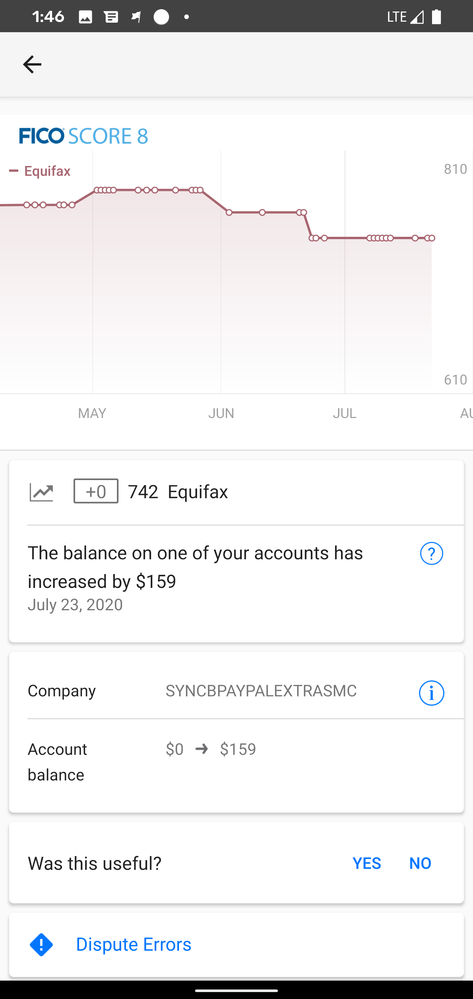

Indeed. I'm still suspicious of what exactly or how exactly Sync is reporting because as I mentioned, your credit score only changes once a month based on the image you posted above. You would think the score jumps all over the place daily due to balance increases and decreases. At one point you paid off $352 and the score didn't change which is unfathomable considering the CL is 7K according to your signature. That's a 5% drop in utilization with no change in actual credit score. From June 22nd through July 13th, your Fico 8 has not moved from 742.

I'm a little less worried now. What they are doing seems relatively harmless if it's not actually triggering a daily change in the Fico score. I was concerned that the Fico scoring model would not take well to daily reporting (could accidentally drive a longterm downward trend) but seems that is not the case. Seems like it's some kind of "soft reporting" akin to "soft pulling". Maybe other lenders can only see the statement balance?

I agree with you though, I wouldn't bother calling in either. Best to be paranoid and avoid any undue attention to the account in these times.