- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Best Credit Card Usage Strategy - Purely From a Cr...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

General rule of thumb, I know, is to pay off your credit cards each month in full from a general financial best practices perspective (so don't need a lecture on that.) I also realize that credit utilization is a much less important credit score factor than things like on time payments, length of credit history, etc (so don't need a lecture on relative importance either.) But there seems to be either some misinformation out there and/or "misunderstood information." I just want to confirm I am understanding correctly.

The misunderstood information is that showing a small amount of credit utilization (talking if you only have credit cards, no loans) is better than no utilization at all. It seems a lot of people have taken this to mean leaving a small balance on your credit card each month, which my understanding is this is different than utilization.

However there is other information about trying to keep your "balance" to lower than 30% (9% seems to be the figure that is being kicked around as ideal.) This is where I get a little lost. If you have a credit card with a $3K limit, 9% is $270. To get points/rewards/cashback you want to charge as much as possible to your credit card each month.

So my first question is, how is "utilization" percentage actually calculated?

My second question is, if utilization is the percentage of your limit that your statement balance reflects before you pay off your balance each month in full, the wouldn't maximizing out your limit each month to get cashback on purchase negatively effect your credit score even if you paid the entire balance each month?

My third question is, forgot for the sake of this question about any interest charges (or cashback/rewards), just purely from a credit score perspective. What's the best strategy to max your credit score?

(A) Don't charge more than 9% and pay off the entire balance each month?

(B) Charge as much as you want and pay off most the charges *when you get your statement*, always leaving a 9% balance?

(C) Charge as much as you want and pay off the entire balance each month when you get your statement?

(D) Charge as much as you want but pay off all but 9% of your charge BEFORE you get your statement each month?

(E) Other?

I've seen answers to these types of questions that are all over the map on this subject which means it must be commonly misunderstood by a lot of people.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

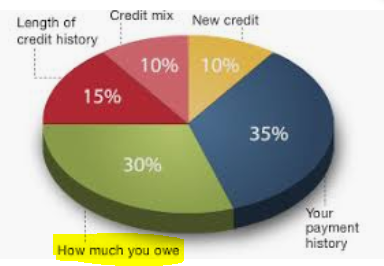

@Jazee wrote:General rule of thumb, I know, is to pay off your credit cards each month in full from a general financial best practices perspective (so don't need a lecture on that.) I also realize that credit utilization is a much less important credit score factor than things like on time payments, length of credit history, etc (so don't need a lecture on relative importance either.) No lecture but UTL has a bit less impact than payment history but is a much more important credit score factor than the other pieces of the pie as seen in the graph below. But there seems to be either some misinformation out there and/or "misunderstood information." I just want to confirm I am understanding correctly.

The misunderstood information is that showing a small amount of credit utilization (talking if you only have credit cards, no loans) is better than no utilization at all. It seems a lot of people have taken this to mean leaving a small balance on your credit card each month, which my understanding is this is different than utilization.

However there is other information about trying to keep your "balance" to lower than 30% (9% seems to be the figure that is being kicked around as ideal.) This is where I get a little lost. If you have a credit card with a $3K limit, 9% is $270. To get points/rewards/cashback you want to charge as much as possible to your credit card each month.

So my first question is, how is "utilization" percentage actually calculated?

UTL for scoring purposes is calculated based on the amount your creditor reports to the bureaus, regardless of how much you may have used throughout the month. Only the creditor knows this, not the CB's. So the $270 of the 3K example you provided would = 9%.

My second question is, if utilization is the percentage of your limit that your statement balance reflects before you pay off your balance each month in full, the wouldn't maximizing out your limit each month to get cashback on purchase negatively effect your credit score even if you paid the entire balance each month?

No. As noted above, your creditor will reward you based on how much you spend. The CB only know what is reported which is usually your statement balance. So you could spend $2900 on that 3K card and get rewards for spending $2900. If you make payment(s) before the next due date or statement close date and bring the outstanding balance down to $270 and this is the amount that reports on you statement, therefore reported to the CB then your UTL for credit scoring purposes will only be 9%. Your rewards and usage requirement or what you choose to spend does not impact what is reported to the CB, only the remaining balance that is reported is used by the CB to determine UTL that can impact your score. Many people nearly max their cards throughout the month to receive the rewards but pay it down before the statement close date so only a smaller amount is reported to the CB

My third question is, forgot for the sake of this question about any interest charges (or cashback/rewards), just purely from a credit score perspective. What's the best strategy to max your credit score?

(A) Don't charge more than 9% and pay off the entire balance each month?

(B) Charge as much as you want and pay off most the charges *when you get your statement*, always leaving a 9% balance?

(C) Charge as much as you want and pay off the entire balance each month when you get your statement?

(D) Charge as much as you want but pay off all but 9% of your charge BEFORE you get your statement each month?

(E) Other?

In regard to the above - D, meaning you can charge as much as you want, ($2900 for example of you 3K example above) pay along the way and leave a small balance to report on the statement which is what's reported to the CB and then pay off your statement balance by the due date to not incur interest. In this scenario you benefit from a rewards perspective, you report a small balance to show the CB that you're using your credit that will give you the scoring benefit. The new billing cycle is in fact new. So you can continue to charge after receiving the statement to maximize your rewards but you want to pay at least the statement balance you received and repeat the process by paying down the balance if you charged it up again in the new cycle (greater than the statement balance) and leaving a small balance again. It doesn't have to be 9%, it can be less. The 9% or stated 8.9% is a thresshold that if exceeded for you aggregate UTL (all revolvers) will cause a penalty to your score. It is said that for a single individual card the balance can be up to 28.9% without penalty although some see a change if crossing 25% for individual cards. Keeping in mind the disclaimer that all profiles are different. I personally see a difference when exceeding 25% on a single card even if aggregate UTL is below 9%.

I've seen answers to these types of questions that are all over the map on this subject which means it must be commonly misunderstood by a lot of people.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

It also depends on how many cards you have which you didnt mention. If its a single card. Charge all you want and pay it down to <8.9% before statement date. Let it report. You'll see a new due date and thats your clue the new statement cycle began. Then pay your <8.99% before the due date. For best scoring only have 1 card report a balance if you have at least 3 cards. This is ideal because FICO doesnt care for more than 50% of cards reporting a balance. Thats a ding. If you have 2 cards, let 1 report. Your on the border of the 50% reporting. No real harm. This is why you'll see 3 cards and a installment loan is best for FICO scoring.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

@Jazee wrote:General rule of thumb, I know, is to pay off your credit cards each month in full from a general financial best practices perspective (so don't need a lecture on that.) I also realize that credit utilization is a much less important credit score factor than things like on time payments, length of credit history, etc (so don't need a lecture on relative importance either.)

Wrong. It's a huge factor.

But there seems to be either some misinformation out there and/or "misunderstood information." I just want to confirm I am understanding correctly.

The misunderstood information is that showing a small amount of credit utilization (talking if you only have credit cards, no loans) is better than no utilization at all.

It's optimal for one card to report a small balance, while the others report a zero balance.

It seems a lot of people have taken this to mean leaving a small balance on your credit card each month, which my understanding is this is different than utilization.

It's ok to report a small balance, not ok to 'leave' it.

However there is other information about trying to keep your "balance" to lower than 30% (9% seems to be the figure that is being kicked around as ideal.)

It is best that no individual card exceed 28.9% and that overall revolving utilization not exceed 8.9%. Lower numbers are even better.

This is where I get a little lost. If you have a credit card with a $3K limit, 9% is $270. To get points/rewards/cashback you want to charge as much as possible to your credit card each month.

"Utilization" in FICO scoring has nothing to do with how much you've "utilized" the card, it has to do with what the balance is when it reports.

So my first question is, how is "utilization" percentage actually calculated?

It's calculated exactly the way you think it is, but it is calculated as of the date of the reported balance

My second question is, if utilization is the percentage of your limit that your statement balance reflects before you pay off your balance each month in full, the wouldn't maximizing out your limit each month to get cashback on purchase negatively effect your credit score even if you paid the entire balance each month?

If your reported balance were a maxed out balance, yes it would very negatively affect your credit scores.

My third question is, forgot for the sake of this question about any interest charges (or cashback/rewards), just purely from a credit score perspective. What's the best strategy to max your credit score?

(A) Don't charge more than 9% and pay off the entire balance each month?

No

(B) Charge as much as you want and pay off most the charges *when you get your statement*, always leaving a 9% balance?

No

(C) Charge as much as you want and pay off the entire balance each month when you get your statement?

No

(D) Charge as much as you want but pay off all but 9% of your charge BEFORE you get your statement each month?

Yes that's a good one. Even better would be to pay off all of the charges before the reporting date on all but one of the accounts, and on the account that reports to let a small balance report.

(E) Other?

I've seen answers to these types of questions that are all over the map on this subject which means it must be commonly misunderstood by a lot of people.

BTW you seem to assume that the statement balance is the reported balance. That is usually but not always true.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

And there are # of revolver thresholds under 50%. Some algorithms have a 20% threshold, meaning you would need 5 cards to squeeze all available points everywhere. Either way, 1 card with a small balance reported is best, no matter the situation.

And although utilization is way more important than age, no lecture.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

So going back to what someone said, if you have 10 accounts and more than 5 are reporting a balance, thats a ding on FICO regardless if the balance is under certain utilization thresholds?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

@Anonymous wrote:So going back to what someone said, if you have 10 accounts and more than 5 are reporting a balance, thats a ding on FICO regardless if the balance is under certain utilization thresholds?

Yes. Number of accounts reporting a balance can impact your score. More so on certain scoring models, particularly MTG scores. This is where AZEO (all zero's except one) comes up the most. But other scoring models may not respond the same as the MTG with AZEO but could cause a scoring penalty when a certain # of accts reporting is exceeded. Someone would need to chime in to clarify which scoring models and # of accts or % of accts would cause a penalty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

@Trudy wrote:

@Anonymous wrote:So going back to what someone said, if you have 10 accounts and more than 5 are reporting a balance, thats a ding on FICO regardless if the balance is under certain utilization thresholds?

Yes. Number of accounts reporting a balance can impact your score. More so on certain scoring models, particularly MTG scores. This is where AZEO (all zero's except one) comes up the most. But other scoring models may not respond the same as the MTG with AZEO but could cause a scoring penalty when a certain # of accts reporting is exceeded. Someone would need to chime in to clarify which scoring models and # of accts or % of accts would cause a penalty.

In my experience, the threshold for "too many accounts with balances" varies account to your specific credit profile and also by credit bureau. Equifax dinged my score when I allowed more than one-third of my accounts to report balances, while Experian and TransUnion seemed to allow one-half of accounts to report balances before a penalty is imposed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

On many scores, I get dinged as soon as a second card out of six reports a positive balance. If you need to optimize your scores, only allow one card to report a postive balance. If you're not needing to optimize, letting less than half of your cards report positive balances is a good look in lenders' eyes.

As mentioned, to optimize your scores, that single balance should be tiny, i.e. at least $5 but not much more. If you're not needing to optimize, keeping all individual card balances at 28.9% or lower offers up a good look.

Besides utilization, total balances may be a factor. A $200 balance on a 7k card with 69k total credit appears to be enough to ding me on three scores. I'm testing $99 once TU catches up with the other bureaus and reports that balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card Usage Strategy - Purely From a Credit Score Perspective

For example there appears to be a 20% line on EX2, that would be no more than 2 of your 10 reporting. More than that, ding, ding, ding.

Gotta test it out on your scorecard, but rest assured, AZEO when it counts.