- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Confusing utilization rate

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Confusing utilization rate

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confusing utilization rate

I have 7 cards with a total CLI of $43,000. Here are my current debt balances as of last week:

Discover $0

Amex $0 (not yet reported to CRAs)

Credit One $90

Chase Slate $400

Chase Preferred $400

BofA $515 (not yet reported to CRAs)

Chase $0

On Friday, I paid off the Credit One balance, the Chase Slate Balance, and the BofA balance. When credit one reported payment to EQ, I received an alert that my EQ score dropped 9 points (from 754 to 745). Today my Chase Slate reported to EQ and my EQ score went up 5 points. Why did paying off debt decrease score in one instance and increase score in other? Both cards reported to TU today, and my TU scored increased 19 points!!!!--from 749 to 678. Is there any pattern to all this madness? Or is maximizing one's score above the 750 level simply a matter of trial and error in terms of utilization rate?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing utilization rate

You can't simply rely on alerts to determine the reason(s) for scoring changes. Revolving utilization is a significant factor but it's not the only thing that affects your scores. To determine the cause(s) of any scoring change you have to carefully review reports from before and after the change. If your reported utilization significiantly dropped and your score dropped then you're overlooking other changes that impacted your score.

If you're relying on myFICO monitoring then make sure you understand the triggers. Only triggers will cause a scoring update/alert. However not all activity with a scoring impact is a trigger. See also:

If you want to understand what's going on I'd recommend using a service with daily pulls versus a trigger based service.

@Anonymous wrote:Or is maximizing one's score above the 750 level simply a matter of trial and error in terms of utilization rate?

Regardless of score the usual advice applies for revolving utilization:

- Do not exceed 30%

- Both individual and overall matter

- Lower is better as long as you're not reporting all zero balances

- To optimize and eke out every possible point when applying for new credit allow only one balance to report at 10% or less.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing utilization rate

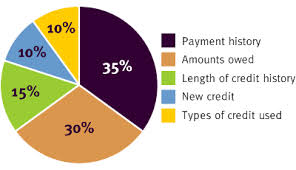

Here is how everything is calculated. I hope it helps...