- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Remedios wrote:

@Anonymous wrote:

@Remedios wrote:I've been employed at the same place for a well over a decade, income in six figures, mortgage paid off, paid off auto loans, utilization typically ultra low, and yet, here I am slumming in the mid 60s because I let card report like it should and had no active loan...because I paid them off.

Hey, you're probably still a much lower credit risk than many companies in the United States. Their debt levels were alarming well before this crisis.

I looks like this score was a joint development. Equifax says in their product sheet that FICO ran the analysis on credit profile data around the time of the Great Recession. Maybe they only used Equifax collected profile data rather than the 3 CRA aggregate data. It does say that it's used in conjunction with a FICO score, which I assume to be EQ 8.

From the Equifax product sheet (direct PDF link):

Higher resilience customers tend to have:

- Fewer credit inquiries in the last year

- Fewer active accounts

- Lower total revolving balances

- More experience managing credit

My inq are sparse now (didnt used to be that way), I've managed many accounts successfully, and if I can make sure 15 are paid on time, how is that more complex than one or two, unless that is a reference to available credit.

I'm unclear what an "active" account is. Is it any account that's open, or literal meaning *account showing signs of activity reflected as presence of balance*.

I'd bet my bum and left kidney that next time instead of bishing about me not having an open loan, it's going to bish about me having an open loan.

Now imagine a situation in which they started "resilience score if you live in hurricane prone areas"...wouldnt fly, there would be an outrage.

Perhaps next time Halley's comet passes near by, they can include that as a risk factor, because some may anticipate apocalypse and quit paying their bills in anticipation.

I guess it's a way to say "Our regular scoring models only work during rainbows and unicorn economy stages. Everything else sold separately"

I could reach 800 if I sit in the garden for six months, but I'm higher risk than someone with charge offs and open collections (no offense to the members im just trying to wrap my mind around this).

As soon as everything is reflected on EQ, I'll pull my reports and see what, if anything changed. My utilization will be rounded to 1%, maybe $2500 reporting, there will be a brand new, fully utilized loan with tiny payments $101.00 iirc.

Im assuming this score changes just like all others do with changes on CR.

I certainly wont be doing anything differently because of this, but I find it somewhat irksome.

If I sound extra salty, it's because I'm extra salty 😂

@Remedios, you always make sense of of nonsense and in this instance, 🧂-y is apropos. Fear appears be what this score is inciting. Many here have a mix and makeup of credit, combined with high salary, mortgage and basic overall "credit experience", that far outweighs mine, to be honest and so how on earth could my score be lower and less risky given my newer credit and SL amounts, it is nonsensical.

I actually feel better after your explanation, I will just try to keep chugging along, following the sage advice I found here on MYFICO and ignore these Equifax gloom and doomsday marketeers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

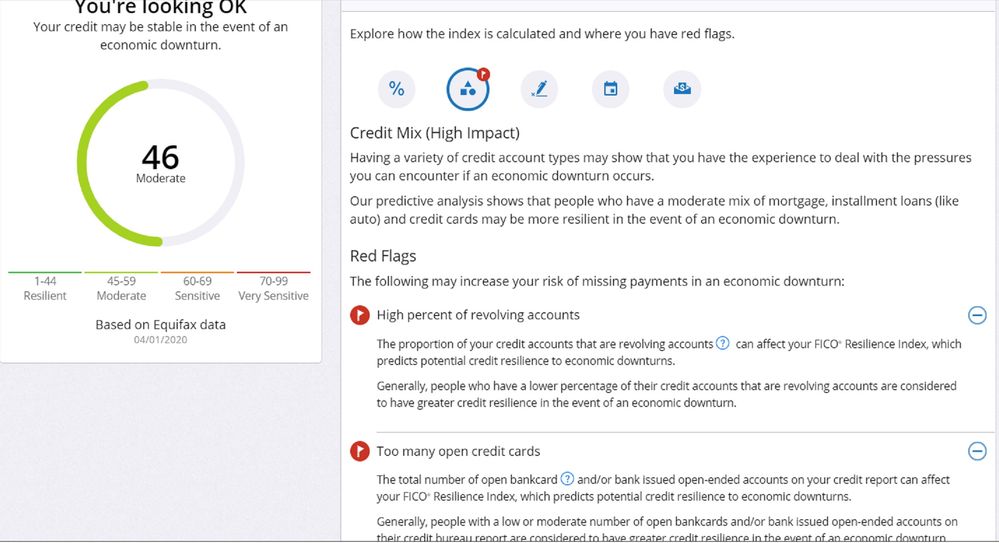

My FICO Resilience Index Score is 46, which indicates "You're Looking OK", and about middle of the road on the pie chart. As a comparison to my FICO 8 and FICO 9 Scores, they are 850 across the board, which has been the case for about the last several months.

It appears that I have two red flags:

1) High Percent of Revolving Accounts. Well, I guess that would be accurate. I have about a dozen open revolving accounts, and just one open install account. I am not sure that I agree that this means I have less credit resilience in an economy downturn, but I guess FICO does not agree.

2) Too Many Open Credit Cards. I guess that is similar to above. I have about a dozen open credit card or store accounts. For the last several years, only one has ever shown with a balance at any given time. It appears that the fact that all but one are zero balance makes no difference, just the fact that I have several credit card accounts open.

Any idea if FCO is selling or giving this score/index number to any lenders?

April 2024: EX8: 840; EQ8: 832; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

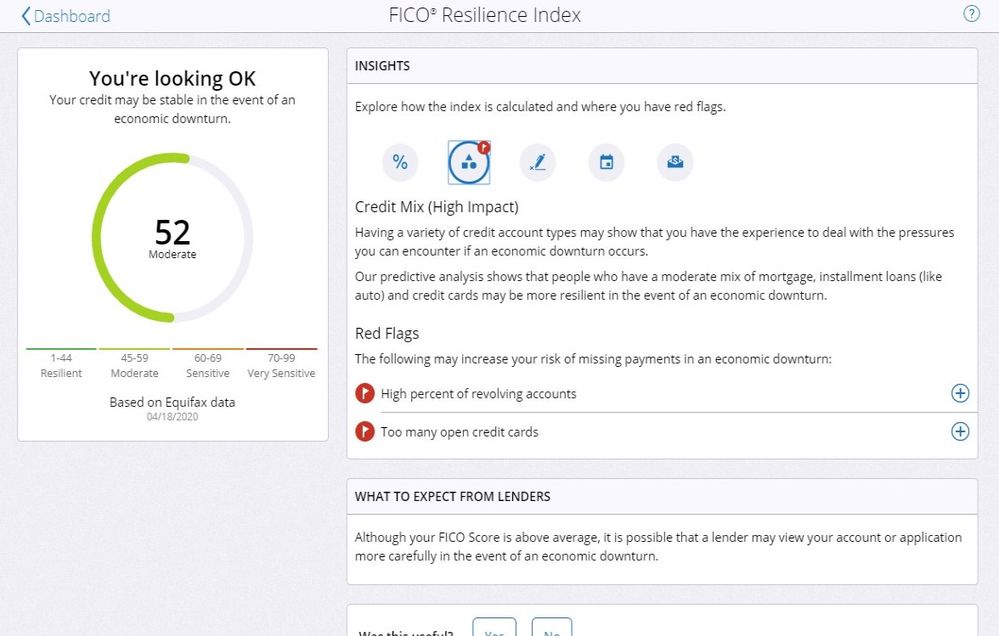

My score is 52. It seems odd that folks with high scores have just ok resilience scores.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@EW800 wrote:My FICO Resilience Index Score is 46, which indicates "You're Looking OK", and about middle of the road on the pie chart. As a comparison to my FICO 8 and FICO 9 Scores, they are 850 across the board, which has been the case for about the last several months.

It appears that I have two red flags:

1) High Percent of Revolving Accounts. Well, I guess that would be accurate. I have about a dozen open revolving accounts, and just one open install account. I am not sure that I agree that this means I have less credit resilience in an economy downturn, but I guess FICO does not agree.

2) Too Many Open Credit Cards. I guess that is similar to above. I have about a dozen open credit card or store accounts. For the last several years, only one has ever shown with a balance at any given time. It appears that the fact that all but one are zero balance makes no difference, just the fact that I have several credit card accounts open.

Any idea if FCO is selling or giving this score/index number to any lenders?

@EW800 May I ask how many credit cards do you have open? And how many do you have both open and closed at Equifax? Because I'm quite surprised that I do not have that code myself having over 20 credit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Resilience Score??

has anyone checked out their FICO Resilience Score...(how your credit would fair in an economic turndown)? Thoughts on your score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Score??

How is it obtained?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Score??

I saw it in my MYFICO app...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Score??

There is a thread that talked about it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Score??

Ok, my last quarterly didn't include it yet.

I have one that I can run now, but I'm waiting until June for it to see impact of new car loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Resilience Score??

A resiliancy to the economy is really based off of how you budget yourself before a rough economy. And if you think about things like this happening. It is like saving for a rainy day.

Starting Score: 544

Starting Score: 544