- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Free EQ FICO 8 at Langley

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Free EQ FICO 8 at Langley

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Free EQ FICO 8 at Langley

People looking for free FICO 8 scores often say that they don't know where to get a free EQ FICO 8.

I just realized they provide that at Langley FCU, which is a very good credit union in my opinion.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

You get this just with a savings account? And it is a FICO 8 Classic?

Thanks for the heads up. I agree that's a nice to have. Most people have to rely on a Citi card, and even then that is a FICO 8 BE score rather than a classic.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@Anonymouswrote:You get this just with a savings account?

Yes. I just confirmed it with customer service. All members get access to their FICO score.

And it is a FICO 8 Classic?

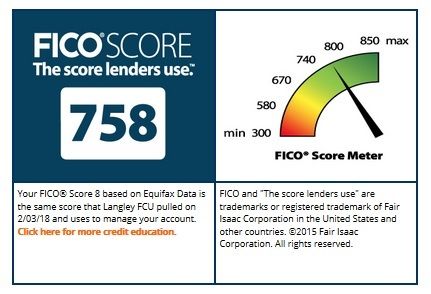

Yes it's a FICO 8 Classic. That's why I mention it. I checked and double checked and it says "Your FICO® Score 8 based on Equifax Data is the same score that Langley FCU pulled on 2/03/18 and uses to manage your account."

Thanks for the heads up. I agree that's a nice to have. Most people have to rely on a Citi card, and even then that is a FICO 8 BE score rather than a classic.

Right.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@SouthJamaica wrote:People looking for free FICO 8 scores often say that they don't know where to get a free EQ FICO 8.

I just realized they provide that at Langley FCU, which is a very good credit union in my opinion.

I did in fact just a couple of weeks ago join langley with opening savings and checking...how long does it take for the fico scores to show???

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@sarge12 wrote:

@SouthJamaica wrote:People looking for free FICO 8 scores often say that they don't know where to get a free EQ FICO 8.

I just realized they provide that at Langley FCU, which is a very good credit union in my opinion.

I did in fact just a couple of weeks ago join langley with opening savings and checking...how long does it take for the fico scores to show???

I think it shows up right away.

Go to Menu > View Accounts > View FICO Score

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@SouthJamaica wrote:

@sarge12 wrote:

@SouthJamaica wrote:People looking for free FICO 8 scores often say that they don't know where to get a free EQ FICO 8.

I just realized they provide that at Langley FCU, which is a very good credit union in my opinion.

I did in fact just a couple of weeks ago join langley with opening savings and checking...how long does it take for the fico scores to show???

I think it shows up right away.

Go to Menu > View Accounts > View FICO Score

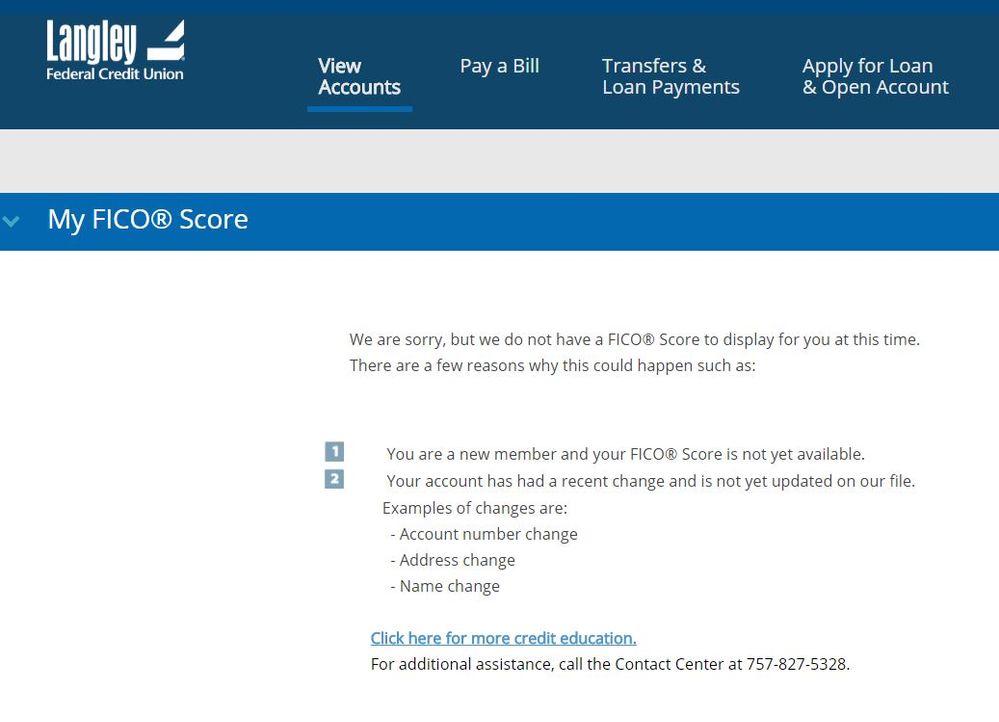

I have, and it says score not available yet and gives new account as a possible reason...which is strange considering they did a pull to open the account. Some things could only make sense to bankers or credit unions. They told me on the phone their pull was 826 at the time, but why they can't have it at the accounts own fico score link is beyond anything I can understand. Maybe it will show as of the first printed statement.

Right now...just this!!! By the way, I also asked for a LOC to cover overdrafts for 5k and was declined due to too much existing credit lines...with all scores over 800!!!

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@sarge12 wrote:

@SouthJamaica wrote:

@sarge12 wrote:

@SouthJamaica wrote:People looking for free FICO 8 scores often say that they don't know where to get a free EQ FICO 8.

I just realized they provide that at Langley FCU, which is a very good credit union in my opinion.

I did in fact just a couple of weeks ago join langley with opening savings and checking...how long does it take for the fico scores to show???

I think it shows up right away.

Go to Menu > View Accounts > View FICO Score

I have, and it says score not available yet and gives new account as a possible reason...which is strange considering they did a pull to open the account. Some things could only make sense to bankers or credit unions. They told me on the phone their pull was 826 at the time, but why they can't have it at the accounts own fico score link is beyond anything I can understand. Maybe it will show as of the first printed statement.

Right now...just this!!! By the way, I also asked for a LOC to cover overdrafts for 5k and was declined due to too much existing credit lines...with all scores over 800!!!

Sorry

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

This is a hard pull (EQ?) to open a checking or savings?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@SouthJamaica wrote:

@sarge12 wrote:

@SouthJamaica wrote:

@sarge12 wrote:

@SouthJamaica wrote:People looking for free FICO 8 scores often say that they don't know where to get a free EQ FICO 8.

I just realized they provide that at Langley FCU, which is a very good credit union in my opinion.

I did in fact just a couple of weeks ago join langley with opening savings and checking...how long does it take for the fico scores to show???

I think it shows up right away.

Go to Menu > View Accounts > View FICO Score

I have, and it says score not available yet and gives new account as a possible reason...which is strange considering they did a pull to open the account. Some things could only make sense to bankers or credit unions. They told me on the phone their pull was 826 at the time, but why they can't have it at the accounts own fico score link is beyond anything I can understand. Maybe it will show as of the first printed statement.

Right now...just this!!! By the way, I also asked for a LOC to cover overdrafts for 5k and was declined due to too much existing credit lines...with all scores over 800!!!

Sorry

Not your fault....by the way what the CSR told me the exact reason for the credit denial was that I had too low of credit balances in relation to very high credit limits. He said they look at the highest ever balance reported on revolving lines compared to my credit limits. So even though AZEO is great for high scores, it can and in this case did cause the LOC decline. It appears that lenders are starting to use this to identify those who always PIF as less profitable transactors! The CSR said that only 1 card has ever even reported a balance over 5k, and that many of them had never reported a balance at all even though many of them have over 10k credit limits. This is the case with almost all my cards because I PIF before the statements cut. It may lead to very high credit limits, but if almost all your cards show highest credit balance ever as 0, it can lead to declines. Might be time to start allowing alternate cards to report by waiting until after the statement cuts to pay them.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free EQ FICO 8 at Langley

@Anonymous wrote:This is a hard pull (EQ?) to open a checking or savings?

Yes, and is at most banks and credit unions if you have never had an account there. They do so because some idiots open accounts with stolen identities and write bad checks. Also some have a history of writing bad checks with their own identity. It might be a SP at some banks and CU's, but they told me upfront it would be a HP!

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20