- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- I need to raise my credit up to 720 how long and w...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I need to raise my credit up to 720 how long and what to do?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to raise my credit up to 720 how long and what to do?

I have credit card Limit of 14k and balance of 12k so I’m at 85% I know it’s bad.

My dad added me as authorized user on both of his card 16k Limit he have 3% usages on them - I’m gonna pay 4K off my balance in a month or so with my tax return - I have no collection - one late payment of 30 days that I’m trying to dispute now-

What else can I do for my credit to go up and get to the 720 range ? Is That only to pay my balance down and wait ? A waiting game or there’s more tricks I can use ?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

Do you have an installment loan, such as a car loan, or student loans? Not having one can leave 20ish points on the table.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

Balance at 20k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

How old is the 30D late?

You probably could be at 720 after that late ages a little bit and you get your utilization down to below 8%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

When it stop effecting credit ?

I read that a 30d isn’t as bad as 90d and 120d. And %8 is the ideal ?

What’s with the under %30 myth ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

@Anonymous wrote:

The late it a year and a half ago.

When it stop effecting credit ?

I read that a 30d isn’t as bad as 90d and 120d. And %8 is the ideal ?

What’s with the under %30 myth ?

The 30% myth is just a myth. It doesn't mean much.

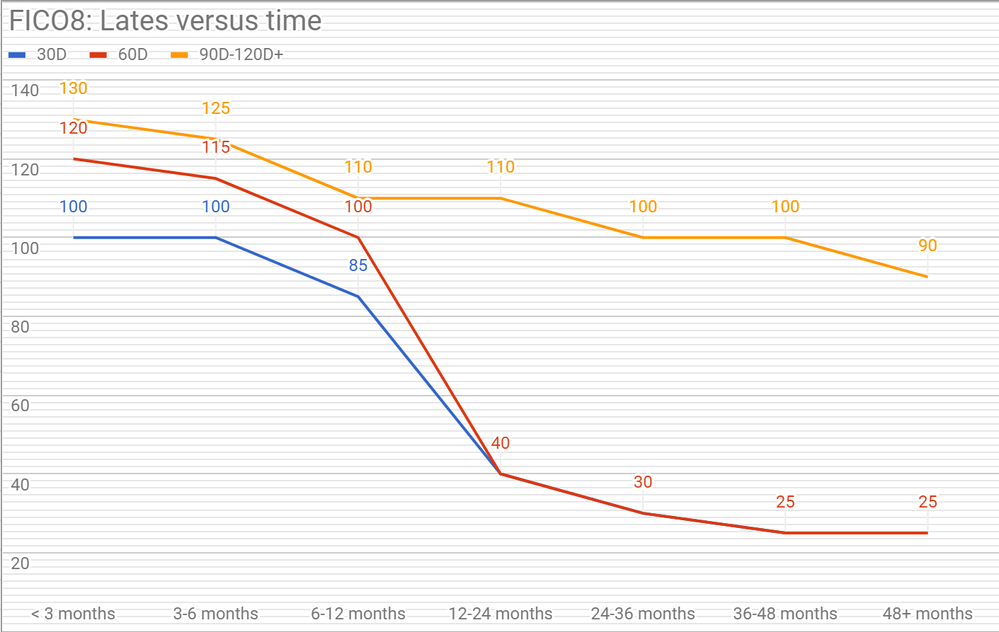

Late payments hurt more or less depending on YOUR profile, but I've been tracking what hundreds of people have submitted to me on their profiles and did an average based on the age of the late. This chart is just averages, and it's only if you have ONE late and no other derogatory accounts:

After 2 years, a 30D late hurts for very little compared to 6 months old!

The best FICO points come from the following:

- Having at least 3 credit cards open. FICO gives even more points if you have 5 credit cards that are all 24 months old or more.

- Reporting a balance on only ONE card

- Reporting a balance of at least $3 but no more than 8.9% on that card (less if you have interest posting)

- Reporting a balance on at least ONE installment loan

- Reporting a balance of less than 8.9% of the original balance on that loan

So doing all of these things can raise a score anywhere from a mere 20 points to as much as 130 points, depending on how bad the utilization was, how many cards they have open, how many cards had a balance, etc.

In your case, your score may be crushed quite a bit since you only have one credit card (I assume) so your overall utilization and individual utilization are both hammered if you report over 68.9% utilization. 8.9% utilization is THE threshold, but you never want to report $0 balance on all your credit cards as that also hurts for some FICO points (10-20 points lost versus carrying a $10 balance, for example).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

@Anonymous wrote:

How did you raise your score from the 500s to the 700s in 9 months ?

I expect to be in the 800s in about 20 months total from when I was in the 500s.

I had 4 derogatory accounts including a collection, a chargeoff, a late paid account and an unpaid tax lien. I got rid of all of those to bring me to about 620 points with only 1 credit card.

I opened more credit cards (don't do this if you're getting a mortgage in 6 months or less) to help with FICO.

I opened a secured loan for $500 and paid it down to 8% ($40 balance) to help with FICO.

So my scores are about 705 average and in July I believe I'll be at 750 doing nothing else, and I think by next January I should be at 800, doing nothing else. I won't see 850s for at least 4-6 more years of just aging my oldest accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need to raise my credit up to 720 how long and what to do?

I also have ONE late payment on the personal loan.

I’m not sure what I’m doing wrong. Like I said my dad added me on his cards that have 16k combined (2 cap one cards) and I will pay my ccs balance down by 4-5k in a month or so. The fico simulator shows me that if I pay 500 a month for 2 years on my credit card my score will be at 730

So if I pay it earlier it won’t go up that much ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content