- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Opened SSL, dropped score 45 pts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Opened SSL, dropped score 45 pts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opened SSL, dropped score 45 pts

So I was anticipating my new SSL reporting now that's it's been paid down to under 8.9% and it did today, and dropped my score 45 pts across all reports. Nothing else in my file changed. I only have two cards that report the same balance every month, no collections or baddies except one medical on Experian. No new hard pulls, as Navy did not HP for membership or the loan.

Only thing that changed was debt went from 6 dollars (balance on cards) to that plus the remainder of the loan.

I do not or have ever had a loan of any kind, does this just not work for very thin profiles?

It was paid down in time and reported as under the 8.9%. Super bummed...how do I fix this? Pay it off? Just wait?

I also had my husband do this, assuring him this would help and I hope this dosnt tank his already very low score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

What are you using for credit monitoring? And are you sure the balance was reported and not the entire loan amount?

@Bees18 wrote:So I was anticipating my new SSL reporting now that's it's been paid down to under 8.9% and it did today, and dropped my score 45 pts across all reports. Nothing else in my file changed. I only have two cards that report the same balance every month, no collections or baddies except one medical on Experian. No new hard pulls, as Navy did not HP for membership or the loan.

Only thing that changed was debt went from 6 dollars (balance on cards) to that plus the remainder of the loan.

I do not or have ever had a loan of any kind, does this just not work for very thin profiles?

It was paid down in time and reported as under the 8.9%. Super bummed...how do I fix this? Pay it off? Just wait?

I also had my husband do this, assuring him this would help and I hope this dosnt tank his already very low score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

Just the balance paid under 8.9% (8.5 to be exact) not the full loan amount. I have credit monitoring through discover and capital one, my only two cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

I don't think you're looking at your genuine FICO 8 scores. As far as I know Capital One Credit Wise uses VantageScore 3.0 scores that are vastly different from FICO 8 scores, especially for thin files/few accounts. The Discover credit score seen when logged into your account is provided by TransUnion but in my experience its always about one month behind the actual score. (The free Discover Credit Scorecard is based on Experian data).

My suggestion is to spend $1 and sign up for your true FICO 8 scores from the three major bureaus at CreditCheckTotal.com. The $1 gives you a 10 day trial subscription where you can pull your scores twice. Just make sure to cancel your trial subscription before the 10 day period ends so you don't get hit with the full monthly fee.

@Bees18 wrote:Just the balance paid under 8.9% (8.5 to be exact) not the full loan amount. I have credit monitoring through discover and capital one, my only two cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

Yeah, Capital One Credit Wise really isn't worth anything: Credit Karma provides a better interface in my experience for seeing the TU report data, and both providers give Vantage 3.0 scores, which really don't have much of anything to do with FICO frankly and shouldn't be used for score monitoring.

In addition to what's already said, I think some people have posted in thin file situations new accounts are even harder penalized than if I were to say pick up a new one. I'm not recommending going and getting a slew of cards just to get them, but generally 4-5 longer term is a good thing to shoot for.

Regardless I wouldn't worry about dips now during the initial building phase (expected while establishing new accounts), for FICO 8 having a SSL and paying it down is nothing but goodness always in the long term but usually in the short term too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

Thin files, particularly young ones, do see a magnified impact on score associated with new account opening. A substantial score drop is common with Fico due to the new account (AoYA drop to zero) and reduction in AAoA.

The greatest score drop is associated with young, thin files that had an AoYA over 12 months age.

VantageScore treats new account openings more harshly than Fico and does not appear to offer open loan score boost that Fico 8 and Fico 9 provide at a low B/L ratio. Your VS 3.0 score will rebound nicely in 90 days. I suspect you will see an increase in Fico score as well.

As others have said, you should check your Fico scores. Unfortunately, you have no before Fico scores as a reference to see how Fico treated the SSL when it reported.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

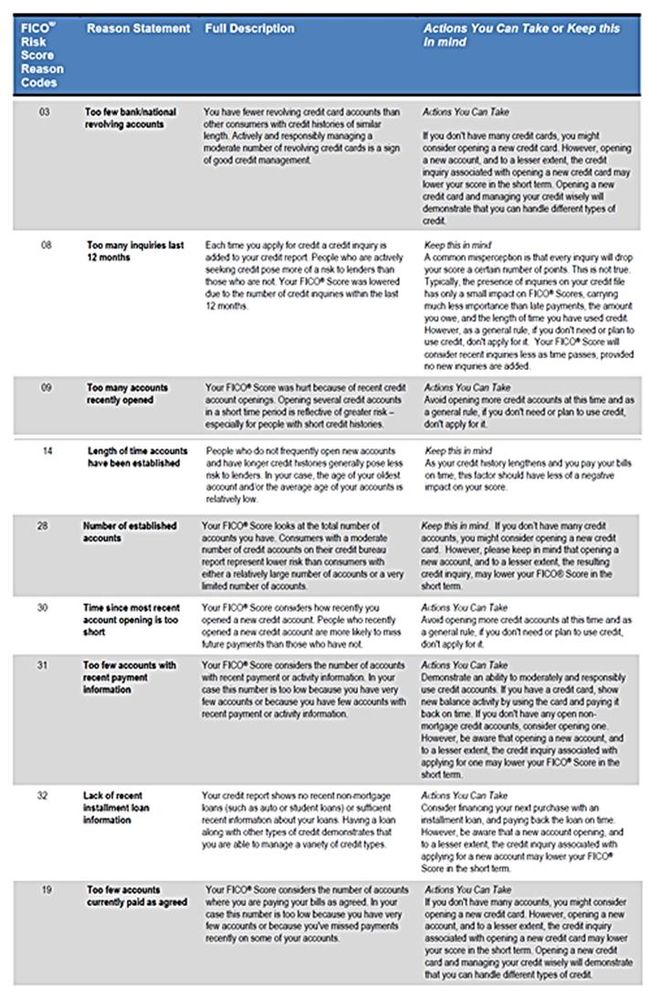

Pasted below are some reason statements from Experian that come into play for thin, young files.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

@Bees18 wrote:Just the balance paid under 8.9% (8.5 to be exact) not the full loan amount. I have credit monitoring through discover and capital one, my only two cards.

1. The Capital One is not a FICO score. Disregard.

2. The Discover FICO 8 TU score is updated once a month, and is outdated by a week or two. Please check the date on the score and make sure that the SSL was in fact reported prior to that date. Usually when a paid-down SSL is added to a profile which has no open installment loans, it causes a significant increase in FICO 8 and FICO 9 scores, despite the new account demerits.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

SJ,

Good catch, I missed the Discover monitoring comment.

My Discover scores update on the 17th of each month. Not sure how date is established but it is consistent month to month.. As mentioned, the OP may not be seeing a paid down SSL in the score. Either way, the new INQ, new account and drop in AAoA & AoYA are likely to mute the benefit of the SSL short term

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opened SSL, dropped score 45 pts

@Thomas_Thumb wrote:SJ,

Good catch, I missed the Discover monitoring comment.

My Discover scores update on the 17th of each month. Not sure how date is established but it is consistent month to month.. As mentioned, the OP may not be seeing a paid down SSL in the score. Either way, the new INQ, new account and drop in AAoA & AoYA are likely to mute the benefit of the SSL short term

Regrettably, reliance on free scores (a) gives far from real time information, and (b) provides zero information as to what data has or hasn't been reported at the time the score is pulled.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682