- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Possible Score Increase Soon To Be?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Possible Score Increase Soon To Be?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Possible Score Increase Soon To Be?

After years of waiting for bads to fall from my reports I have 3 months left For these lates to be gone.

120 Day Late

90 Day Late

As of today my scores sit 771,761,768 What would be the chances of breaking 800 Once these fall? I have no bads left on my report but those 2, I Been sitting around letting accounts age No pulls for the last 16 Months. Also I have 1 Inquiry showing on TU... It's been a long journey for this But it's finally almost over, I've also read that once you have so many days for a bad to fall you can dispute the age of it as old? And have it removed sooner, Please correct me if I'm wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

@Neches7 wrote:After years of waiting for bads to fall from my reports I have 3 months left For these lates to be gone.

120 Day Late

90 Day Late

As of today my scores sit 771,761,768 What would be the chances of breaking 800 Once these fall? I have no bads left on my report but those 2, I Been sitting around letting accounts age No pulls for the last 16 Months. Also I have 1 Inquiry showing on TU... It's been a long journey for this But it's finally almost over, I've also read that once you have so many days for a bad to fall you can dispute the age of it as old? And have it removed sooner, Please correct me if I'm wrong.

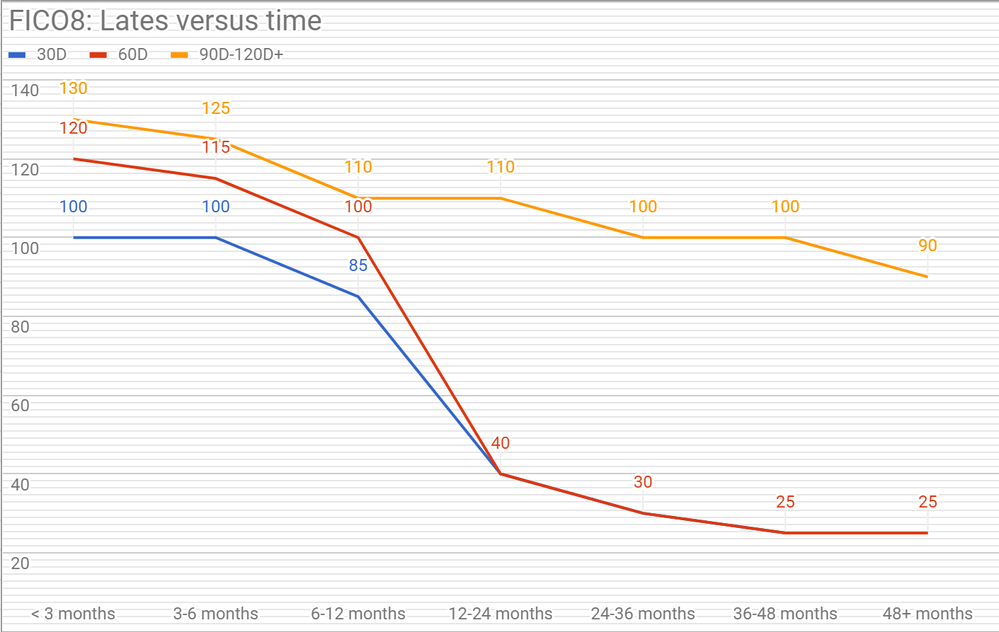

I imaigne you will be over 800 once a 120 falls off, it hurts a ton for the entire time it's on the report

you can technically be granted an early removal for the lates, but if you're just a few months away, I wouldn't touch a thing and just let it all fall off naturally

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

As of now my scores are rock solid in those numbers, they been the same for months now I have 8%UT and it's been this way for sometime. 3 months isn't to far way I waited 7 years But I'll take your advise and just leave it for now, I'm more Curious on how many points it's actually holding against me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

@Neches7 wrote:As of now my scores are rock solid in those numbers, they been the same for months now I have 8%UT and it's been this way for sometime. 3 months isn't to far way I waited 7 years But I'll take your advise and just leave it for now, I'm more Curious on how many points it's actually holding against me.

a lot, expect a sizable score bump IMO

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

@Neches7 wrote:After years of waiting for bads to fall from my reports I have 3 months left For these lates to be gone.

120 Day Late

90 Day Late

As of today my scores sit 771,761,768 What would be the chances of breaking 800 Once these fall? I have no bads left on my report but those 2, I Been sitting around letting accounts age No pulls for the last 16 Months. Also I have 1 Inquiry showing on TU.

What's your highest individual card utilization? Do you have any open loans on file? Is your inquiry under 12 months age?

Utilization levels are given more weight on clean scorecards. You want to hold aggregate UT under 9% and highest UT on any of your cards under 29%.

Your clean file scores should be 810 low side (assumes a deduct for no open loans, and a card UT above 29%). If you have an open loan with low B/L ratio, low revolving utilizations and no accounts under 12 months, scores should jump to the 830-840 range.

A few more account details would be helpful. Looking forward to some data points.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

Only accounts open are,

Mortgage.

2 auto loans.

6 Cards.

All cards have a zero balance but 1 with an 8% UT, No new account open in the last 16 months. My score card will be clean soon as those latest fall off, As of now my scores are hitting a wall and are no longer going up as they was. The 120/90 lates is what I'm thinking is stopping movement My score drops 1-3 then rises 1-3, Only thing that's changes is payments on what is owed for home and auto loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

Thanks for the additional detail. Yes, you are experiencing a dirty scorecard ceiling.

How old is the open mortgage? What are the balance to loan ratios on the loans? What are your AoOA and AAoA values?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

Home loan is fresh 32 months, My car will be paid off at the end of this year 9k/58k My SUV is 19/31k, With this being said my home is the highest balance I have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

I am in a very similar situation. FICO 8 scores 718, 749, 762. The 718 is from Experian, and my mortgage company only reports to my wife's EX credit score, not mine. No other terribly significant differences.

My DOFD on my 180 day derogatory is from Jan 2018 (EQ says it is from Nov 2017), so I am 7 months out unless I bother to ask for EE. No other missed payments, chargeoffs or other negative marks.

My FICO almost never changes. Last 8 months it has been unchanged for all bureaus, with the exception of one month where it dropped by approximately 12 points becuase I hit 19% utilization on a single card/12% overall (airline tickets), bounced right back when I did my normal PIF.

3 open revolvers, AoOA is 13y8m (account now closed, but still aging), AAoA is 8y4m, youngest account is 13 months. Gross credit limit $40k, typical utilization 2-5%, both collectively and individually.

1 open mortgage account, 11 years, 77% of original loan balance. No negatives.

1 closed revolver (the delinquency naturally), 2 closed car loans (paid in full, always on time).

One open inquiry, only shows on EX, 14 months old, so should not be counting against me.

It looks to me that I am on a dirty scorecard capping my score because of that old derogatory, otherwise clean history, decent age, and even when my last hard pull aged to >12 months, and my youngest account aged to >12 months, I gained no points.

I am not shopping for credit, and have no plans to do so in the foreseeable future, so credit score is mostly an matter of interest for me rather than necessity. Like OP, my guess is that I will see a sustantial jump once this old derogatory ages off. I may ask TU for EE because it sounds easy to do and precedes the other agencies by a number of months, just to see what happens. Not worth asking the other two because of their shorter lead time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Possible Score Increase Soon To Be?

@Neches7 wrote:Home loan is fresh 32 months, My car will be paid off at the end of this year 9k/58k My SUV is 19/31k, With this being said my home is the highest balance I have.

Thanks. No 850 for you.

The mortgage is too new for that score. Your aggregate loan B/L might be a hold back as well. I'm thinking the 810-820 range for all 3 after both lates fall off. Possibly a bit higher

When exactly is the last one supposed to age off? I'm guessing 3-5 months based on your comments.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950