- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Score Incongruencies

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Incongruencies

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Incongruencies

I hear you. I'm sorry if I came off as snippy. Thanks for trying to brainstorm this with me. I find this whole world of credit and credit reporting to be interesting. Saw a gentleman on YouTube who is FICO certified, saying something that Equifax won't be counting hard pulls anymore. This might be a thing as suddenly, all my hard pulls I had with them disappeared and this was, I wanna say a few months ago -- I remember asking people about it. Now, I know I didn't have as many as on my other reports -- which is normal for Equifax as it isn't used as much like the other two -- but I did have some that hadn't expired. But now they're just gone. Only soft pulls now.

I've also started seeing some places designate hard pulls as only listed for 12 months, and deeming that part of my credit as "good." Discover's credit report -- which is a pull from Experian -- does this. It won't even list the inquiries as if they didn't exist anymore. I know they're there in the real 3B's, and places like CK list them and tell you when they're supposed to drop off and whatever, but... things seem to be changing a bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Incongruencies

@lizmariposa wrote:I hear you. I'm sorry if I came off as snippy. Thanks for trying to brainstorm this with me. I find this whole world of credit and credit reporting to be interesting. Saw a gentleman on YouTube who is FICO certified, saying something that Equifax won't be counting hard pulls anymore. This might be a thing as suddenly, all my hard pulls I had with them disappeared and this was, I wanna say a few months ago -- I remember asking people about it. Now, I know I didn't have as many as on my other reports -- which is normal for Equifax as it isn't used as much like the other two -- but I did have some that hadn't expired. But now they're just gone. Only soft pulls now.

I've also started seeing some places designate hard pulls as only listed for 12 months, and deeming that part of my credit as "good." Discover's credit report -- which is a pull from Experian -- does this. It won't even list the inquiries as if they didn't exist anymore. I know they're there in the real 3B's, and places like CK list them and tell you when they're supposed to drop off and whatever, but... things seem to be changing a bit.

Yeah not sure about EQ no longer counting inquiries at all... haven't heard that report before. Not sure why you had inquiries fall off before their time either - I feel like I remember a few posts saying something similar a while back tho, and I think it was chalked up to being a glitch- of course, i wasn't blessed with such an incident...lol.

Inquiries are only scoreable for the first 365 days - after that, any points lost from the inquiries are regained - tho they remain on your reports for a full 2 years, as a record. Because it no longer affects scoring after a year, some platforms don't include any that are older than 1 year when they display report data to the consumer - but the inquiries remain part of your full report.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Incongruencies

Okay, so I have an update and it's kind of an odd one. I have 3 revolving credit cards, and two installment loans Sometimes it shows up as three installment loans, but it's just that my many years ago my student loands were consolidated, and so one of them is "closed." Not an acctive account.

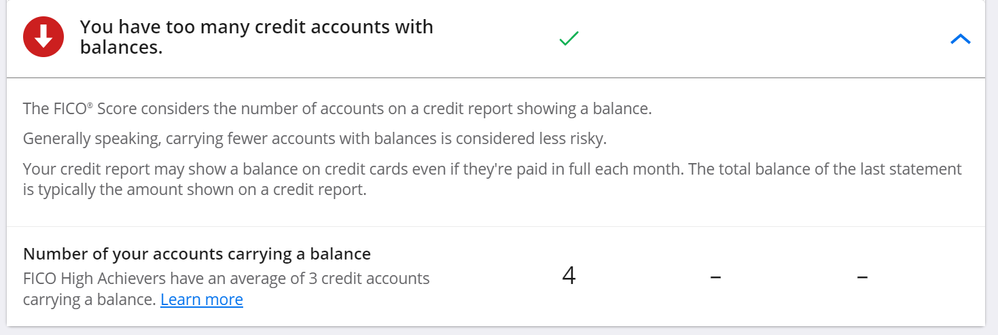

Anyway... In this report, Equifax (as opposed to the other bureaus) claims I have too many credit cards accounts carrying a balance, and it claims I have 4. That high achievers only have three. But I only have three credit accounts, and all three of them have 2% usage each. There is NO fourth credit account listed anywhere with any balance on my reports.

I am not really sure what to do with this since I have no way of contesting it...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Incongruencies

Too many accounts with a balance is a negative reason statement that many get that isn't avoidable without taking on a different penalty that's worth more than the too many accounts penalty.

I get the too many accounts with a balance negative reason statement with 2 balances... 1 revolvers and 1 loan. If I were to eliminate the revolver balance, I'd take on the no revolving credit penalty. If I were to eliminate the loan, I'd take on the no installment loan information penalty. Therefore on my profile the too many accounts with a balance penalty is the best way to go, so long as it's optimized (1 revolver, 1 loan) and not greater than that such as 2+ revolvers, 1 loan.