- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Simulation quirk?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Simulation quirk?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

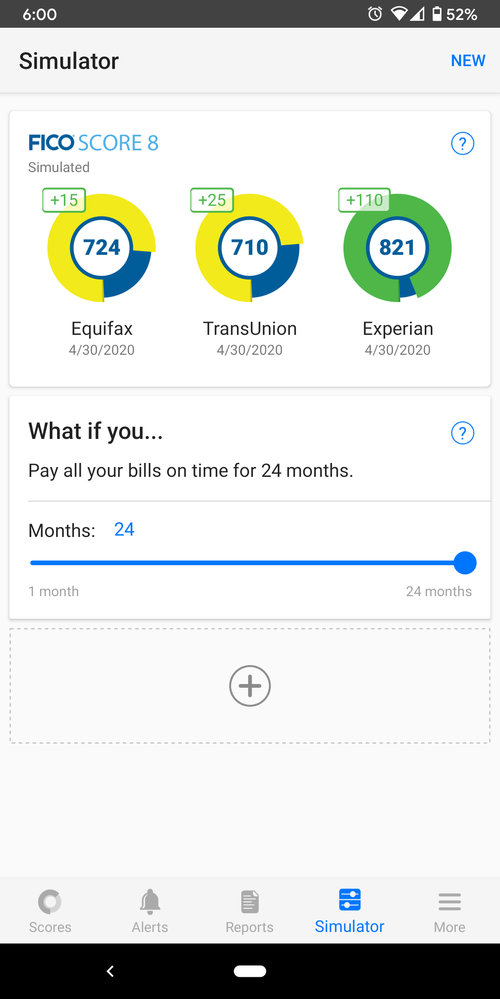

Simulation quirk?

One of these guys is doing the wrong thing... 😂

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

I mean, if they're offering it'd be rude not to take it...right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

@Schwartzinator wrote:I mean, if they're offering it'd be rude not to take it...right?

Yea... Guess Experian is handing out points like nfcu hands out exposure 🤣

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

I am in for FIFY EX FICO points![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

I like your simulator better. Mine says +15, +15, +20.

Can we trade?

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

I would assume that you likely have baddies that will drop of EX sooner than off TU/EQ? And this is a distinct possibility. My actual FICO EX score is 80 points higher (804) than my EQ score (724) because EX dropped all the 90 days lates reporting from two BOA CCs in 2018 because date of first lates was 2011 (and EX has a policy of dropping all lates in a string of lates starting with first late). BTW, I also closed both accounts in 2011, never charged off, and made monthly payments on them for three years until they were fully paid off. Anyhoo, EQ refuses to drop lates from the date of the first late. EQ drops each late month by month so I still have 90 day lates reporting until mid-2014 when I brought the accounts current. I would think a huge difference in your simulated scores indicates that there is a major difference in when any baddies you have will be dropped off your report by the differnt CR. If you have multiple lates in a string of lates, you very likely could get a huge score bump from EX that you won't see with EQ as they drop these negatives differently. I also got TU to drop the lates from these two credit lines by contacting them but they just deleted the entire accounts so my score there is 789. Since TU just deleted the accounts instead of just deleting the lates, my overall credit history length is lower for them than for EX explaining the 15 point score difference. But I don't think TU has an actual policy to automatically delete lates starting with the first in a chain of lates like EX does. I got TU to drop the lates by calling after the 7 year mark passed on the first reported late so I would think that the simulator would assume that lates would still be on your CR for TU whereas for EX, it would drop any lates after first in string of lates because that is EX's policy. This may not be the case with your CRs...perhaps you don't have any lates in a long string of lates. Maybe there is a different negative that will drop sooner with EX then it will with TU and EQ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

@Anonymous wrote:I would assume that you likely have baddies that will drop of EX sooner than off TU/EQ? And this is a distinct possibility. My actual FICO EX score is 80 points higher (804) than my EQ score (724) because EX dropped all the 90 days lates reporting from two BOA CCs in 2018 because date of first lates was 2011 (and EX has a policy of dropping all lates in a string of lates starting with first late). BTW, I also closed both accounts in 2011, never charged off, and made monthly payments on them for three years until they were fully paid off. Anyhoo, EQ refuses to drop lates from the date of the first late. EQ drops each late month by month so I still have 90 day lates reporting until mid-2014 when I brought the accounts current. I would think a huge difference in your simulated scores indicates that there is a major difference in when any baddies you have will be dropped off your report by the differnt CR. If you have multiple lates in a string of lates, you very likely could get a huge score bump from EX that you won't see with EQ as they drop these negatives differently. I also got TU to drop the lates from these two credit lines by contacting them but they just deleted the entire accounts so my score there is 789. Since TU just deleted the accounts instead of just deleting the lates, my overall credit history length is lower for them than for EX explaining the 15 point score difference. But I don't think TU has an actual policy to automatically delete lates starting with the first in a chain of lates like EX does. I got TU to drop the lates by calling after the 7 year mark passed on the first reported late so I would think that the simulator would assume that lates would still be on your CR for TU whereas for EX, it would drop any lates after first in string of lates because that is EX's policy. This may not be the case with your CRs...perhaps you don't have any lates in a long string of lates. Maybe there is a different negative that will drop sooner with EX then it will with TU and EQ?

I have 2 baddies on any given report and only 1 on some.

Baddie A) 30/60/90/closed account string (WF secured) starting 12/2013

Baddie B) PIF collection with diversified.

Baddie A has no payment info on EQ so that account isn't hurting me there actually.

Baddie B has been disputed on all 3. Removed on EX, and I pulled a 3B report last night (to inquire about a 70 point EQ bump) and it's apparently removed (even though the dispute still remains in progress).

So...

EQ

Baddie A (no payment history and appearing positive) now sits FICO 8 779.

TU

Baddie A

Baddie B

EX

Baddie A

I'm getting really close to a clean file if TU comes through on the dispute.

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

Simulated scores are worthless. On Experian simulator I was shown that if I paid down 50% of my credit card balance my score would go up around 25 points!! So my balance was $820 and I paid it down to $300, well my scores just updated today and they reflect the new balance and my score went up ONE POINT!!!......Nothing else on my credit changed at all and my score only moved ONE POINT.

🥴🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

@firemartinez1980 wrote:Simulated scores are worthless. On Experian simulator I was shown that if I paid down 50% of my credit card balance my score would go up around 25 points!! So my balance was $820 and I paid it down to $300, well my scores just updated today and they reflect the new balance and my score went up ONE POINT!!!......Nothing else on my credit changed at all and my score only moved ONE POINT.

🥴🤔

@firemartinez1980 wrote:Simulated scores are worthless. On Experian simulator I was shown that if I paid down 50% of my credit card balance my score would go up around 25 points!! So my balance was $820 and I paid it down to $300, well my scores just updated today and they reflect the new balance and my score went up ONE POINT!!!......Nothing else on my credit changed at all and my score only moved ONE POINT.

🥴🤔

I get that... 5-25 point sims seem fairly normal (whether or not they're reliable). What I thought was interesting was seeing one hit 110 points while the other bureaus remained "normal" with equal to or better files and the thread was really raised to bring light to the product devs.

Rebuild start: 5/15/19

Financial Institutions:

Wells Fargo | NFCU | Penfed

Products:

Discover It CB $2.1k | WF Propel $22.5k | PenFed PCR $20k | NFCU Platinum $10k | NFCU More Rewards $25k | NFCU Flagship $30k | NFCU CLOC $500 | NFCU SSL 60mo | NFCU Auto loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Simulation quirk?

Starting Fico Scores:November 2019

Current Fico Scores: January 6, 2021

Goal Scores: 700 across all three

Goal Scores: 700 across all three