- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- What happens when you freeze a bureau?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What happens when you freeze a bureau?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What happens when you freeze a bureau?

Lets say you freeze Experian, and Transunion. Do all your new credit applications get forced to pull EQ? There has been some fradulent hard pulls on my Experian and TU, so I am looking to freeze them. Would a lender instead of trying to pull another bureau outright reject your application? Experiences?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

@Anonymous wrote:Lets say you freeze Experian, and Transunion. Do all your new credit applications get forced to pull EQ? There has been some fradulent hard pulls on my Experian and TU, so I am looking to freeze them. Would a lender instead of trying to pull another bureau outright reject your application? Experiences?

Usually they reject it or send a letter/call asking to unfreeze.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

When you apply, you are giving the bank permission to investigate your creditworthiness. Frozen or thawed.

found this....

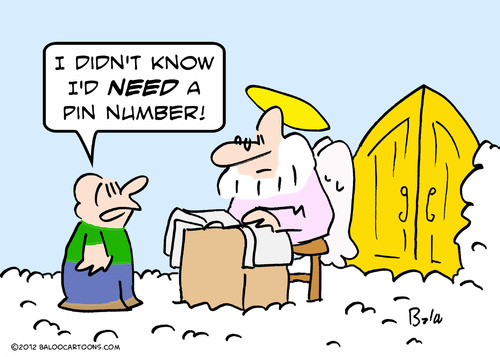

"A credit freeze – also referred to as a security freeze – is something you can request from each credit bureau (Experian, Equifax and Transunion) to essentially seal your credit report. This freeze makes your credit report inaccessible, unless you give specific authorization with a password or personal identification number. It’s like putting a padlock on your credit profile – and has been used by some as a method for identity protection."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

@Anonymous wrote:

@Anonymous wrote:Lets say you freeze Experian, and Transunion. Do all your new credit applications get forced to pull EQ? There has been some fradulent hard pulls on my Experian and TU, so I am looking to freeze them. Would a lender instead of trying to pull another bureau outright reject your application? Experiences?

Usually they reject it or send a letter/call asking to unfreeze.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

When ive done that ive had to wait for a letter from the CC company to verify my identity or I would get a call after I apply to verify who I am, if you apply it doesnt force them to pull a certain report. And from what I was told my experian they may freeze all your reports although you only tried to freeze 1.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

And for some reason Experian will opt you out of prescreened offers. I froze my reports and received a letter from them stating they had. I don't remember reading anywhere on the site that they would automatically do that as part of the freeze. I had to opt myself back in.

Keep both your credit and your body in top shape!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

I received the opt out letter from experian also. I couldn't understand it and was going to ask a question about it here but you've already answered it for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What happens when you freeze a bureau?

If you are not opted out, creditors have acess to your credit file to the extent that the CRA will screen the contents of your file against the creditor's stated criteria.

If your file meets the stated criteria, you name is then included on the listing they receive. They are getting info about your qualifications.

They cannot get any account-specific info, only your name and address, but they do get a screening of your file.

The CRAs, and rightfully so in my opinion, thus consider a freeze to include access to screening of your file, and thus consider it to also be an implied opt-out request.

The opt-out process always provides the right to opt back in should you so desire.