- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Why are FICO 9 scores so much lower than 8?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why are FICO 9 scores so much lower than 8?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are FICO 9 scores so much lower than 8?

All I've read of the changes in FICO 9 seem to be positives that would help someone's score, yet mine are 30-40 points lower with each bureau on FICO 9. I can't figure out why.....

Seems like a big scam just to lower scores across the board andjustifylenders charging higher interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

It really depends on the specifics of your profile. In my case, my FICO 9 scores are abount 45-50 points higher than my FICO 8 scores. I went through some very ugly times about five years ago, so the way I interpret this is that FICO 9 is possibly a bit more forgiving about issues from years ago, or is giving me more credit for my good behaviour since then, or a combination of the two,

As far as your FICO 9 scores being lower, can you share what the negative aspects are of your profile? It sounds like there is something that FICO 9 is less forgiving about than FICO 8 is.

I suspect one of your resident experts will be able to weight in on this as well.

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

Well my past credit really isn't an issue. 3 years ago I went to buy a new car and found out I was a "ghost". In general I've usually used cash for things under $20k, but I decided to go for a new car over the 3yo used I normally buy. I had not had active revolving accounts or loans in so long (at least 5 years) that everything was off my report and I had no score.

I ended up getting financed with a high interest loan and set about building a score again to refinance. Grabbed a couple secured cards to start. Over the past 3 years I refied the car loan and had a personal loan for 2 years, just paid off early. I also opened a few more major cards and couple store cards, mainly because my # of accounts was low and showing as a negative.

So I have a relatively short history now. 11 accounts (1 car, 8 revolving, 2 closed). 100% on time payments. 3-5 inquiries depending on the bureau. One 2 year old collection (medical-$700). Credit utilization is usually under 10%. Total credit around $15k. Sometimes it might spike to 25-30% if I forget to pay something by the grace period, but it's paid in a week or two. I have a decent income ($100k+) and really don't need to use cards, just do for rewards, so balances have never been an issue.

That's my credit in a nutshell. The easy answer would be to say it's the collection, but here's my problem with that. I'm sure I'm already taking a 30 point hit or more for that collection on FICO 8. So if that really is it, that would mean FICO 9 dings 60-70 points for one sub $1k collection, which I'd still consider bull**bleep** and a scam to keep scores lower and help the lending industry. That's just too much for 1 single collection when all other parts of the report are pretty decent.

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

That is a puzzle. If anything, FICO 9 is supposed to be more forgiving of medical collections thann FICO 8. Are you certain that the collection is tagged in your reports as being for a medical debt?

It's possible that FICO 9 considers a person with a very short history who is opening many credit cards to be risky -- much more than does FICO 8. (It's also possible that FICO 9 only views this as a big red flag when the person has at least one major derog.) Certainly that's plausible -- it wouldn't surprise me if FICO's statisticians have discovered that people who have little history and are opening 8 credit cards in that very short period involve significant risk (as a class).

That's all very speculative on my part. FICO 9 is been studied very little compared to FICO 8, so nobody knows.

Do bear in mind that almost no lenders are using FICO 9 right now. I am sure your FICO 9 scores will grow over the next few years, assuming you are opening few new cards and are being good with your payments and CC balances.

I can suggest a few things you might want to do moving forward, if you like.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Anonymous wrote:Well my past credit really isn't an issue. 3 years ago I went to buy a new car and found out I was a "ghost". In general I've usually used cash for things under $20k, but I decided to go for a new car over the 3yo used I normally buy. I had not had active revolving accounts or loans in so long (at least 5 years) that everything was off my report and I had no score.

I ended up getting financed with a high interest loan and set about building a score again to refinance. Grabbed a couple secured cards to start. Over the past 3 years I refied the car loan and had a personal loan for 2 years, just paid off early. I also opened a few more major cards and couple store cards, mainly because my # of accounts was low and showing as a negative.

So I have a relatively short history now. 11 accounts (1 car, 8 revolving, 2 closed). 100% on time payments. 3-5 inquiries depending on the bureau. One 2 year old collection (medical-$700). Credit utilization is usually under 10%. Total credit around $15k. Sometimes it might spike to 25-30% if I forget to pay something by the grace period, but it's paid in a week or two. I have a decent income ($100k+) and really don't need to use cards, just do for rewards, so balances have never been an issue.

That's my credit in a nutshell. The easy answer would be to say it's the collection, but here's my problem with that. I'm sure I'm already taking a 30 point hit or more for that collection on FICO 8. So if that really is it, that would mean FICO 9 dings 60-70 points for one sub $1k collection, which I'd still consider bull**bleep** and a scam to keep scores lower and help the lending industry. That's just too much for 1 single collection when all other parts of the report are pretty decent.

Thoughts?

Is your medical collection paid? If not, I suspect the difference relates to the unpaid medical collection.

Fico 8 treates medical collections over $100 the same regardless of paid/unpaid. In Fico 9 paid medical collections don't count against you. The model was tweaked to provide an incentive to pay up. Conversely, unpaid medical collections mayy be treated more harshly.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Thomas_Thumb wrote:Is your medical collection paid? If not, I suspect the difference relates to the unpaid medical collection.

Fico 8 treates medical collections over $100 the same regardless of paid/unpaid. In Fico 9 paid medical collections don't count against you. The model was tweaked to provide an incentive to pay up. Conversely, unpaid medical collections mayy be treated more harshly.

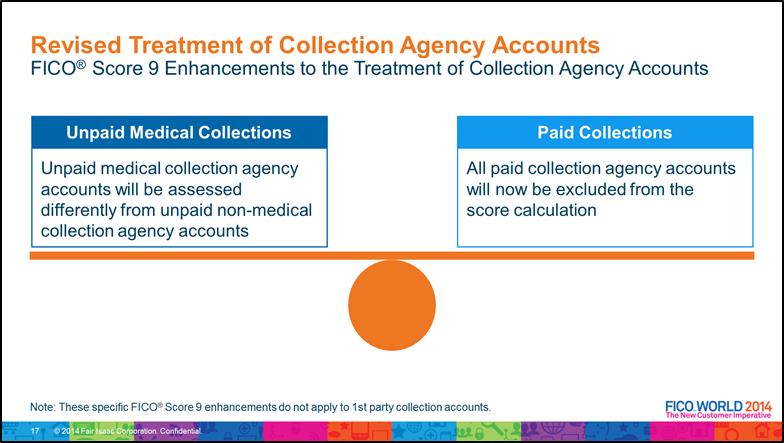

Hi TT. Actually, in FICO 9, all paid collections are ignored (medical or otherwise). The change in FICO 9 that specifcally deals with medical collections has to do with unpaid medical collections -- and here FICO 9 is supposed to treat them more softly then did FICO 8.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

But if his collection is not being tagged as a medical debt, then it is quite possible that FICO 9 treats unpaid non-medical collections more harshly than did FICO 8. Which is why I brought that possibility up earlier.

If our OP has a strong desire to improve his FICO 9, he could certainly pay the collection, which under FICO 9 would remove the penalty altogether.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Anonymous wrote:

@Thomas_Thumb wrote:Is your medical collection paid? If not, I suspect the difference relates to the unpaid medical collection.

Fico 8 treates medical collections over $100 the same regardless of paid/unpaid. In Fico 9 paid medical collections don't count against you. The model was tweaked to provide an incentive to pay up. Conversely, unpaid medical collections mayy be treated more harshly.

Hi TT. Actually, in FICO 9, all paid collections are ignored (medical or otherwise). The change in FICO 9 that specifcally deals with medical collections has to do with unpaid medical collections -- and here FICO 9 is supposed to treat them more softly then did FICO 8.

Yes, I am aware that Fico 09 ignores all paid collections. Your point regarding unpaid medical collections receiving beneficial treatment on Fico 9 is correct. I had read that unpaid collections may be treated more harshly in Fico 9 (perhaps due to lender feedback) and overlooked splitting out medical COs. Per the below Fico 9 enhancements do not apply to 1st party collections

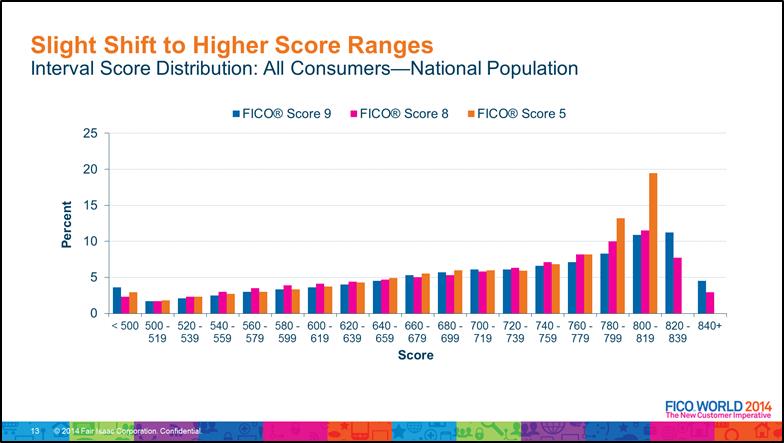

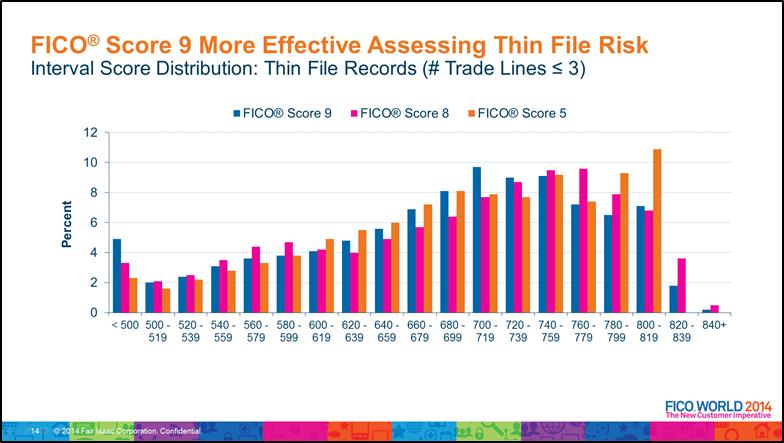

Here are a couple interesting score comparison charts from a Fico World presentation

The below link has some good Q/A on Fico 9.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

Does beg the question how FICO is determining whether a collection is medical or not; if we're sorting users between paid and unpaid collections though, it wouldn't surprise me in the slightest if unpaid (sigh, typo) were more heavily weighted under FICO 9 to TT's point.

Derp, what are your scores, and out of curiosity what are the reason codes you have for FICO 9 (and FICO 8 too, but it'd be interesting to see if you have the PR/collection one under FICO 9, you will on FICO 8 probably as your top reason code).

I simply don't have much good FICO 9 data though I would suggest new accounts or inquiries might be treated more harshly there... EX has always been my busiest report and I was missing on the order of 40 points there compared to EQ FICO 9 (I know I know, different bureaus be different but that's supposedly addressed in FICO 9 and when my EX got cleaner the score was nearly identical to EQ for an identical file tradeline wise) so it'd be interesting to me anyway on the codes and also what your new account history looks like.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are FICO 9 scores so much lower than 8?

@Revelate wrote:Does beg the question how FICO is determining whether a collection is medical or not; if we're sorting users between paid and unpaid collections though, it wouldn't surprise me in the slightest if paid were more heavily weighted under FICO 9 to TT's point.

Not fully sure I understand what you mean. Paid collections are not counted at all under FICO 9, right?

Derp, what are your scores, and out of curiosity what are the reason codes you have for FICO 9 (and FICO 8 too, but it'd be interesting to see if you have the PR/collection one under FICO 9, you will on FICO 8 probably as your top reason code).

I simply don't have much good FICO 9 data though I would suggest new accounts or inquiries might be treated more harshly there... EX has always been my busiest report and I was missing on the order of 40 points there compared to EQ FICO 9 (I know I know, different bureaus be different but that's supposedly addressed in FICO 9 and when my EX got cleaner the score was nearly identical to EQ for an identical file tradeline wise) so it'd be interesting to me anyway on the codes and also what your new account history looks like.

Derp has a very short account history (three years) with many accounts (11) being opened in that period, including 8 credit cards. That's why I conjectured that a change in FICO 9 from FICO 8 might be (speculation) that it views opening many credit cards by a person with a very short total history to be a sign of risk, especially if the person has at least one substantial derog. If that were true, it would explain why his FICO 9 is substantially lower.