- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Why are so-called FICO scores all over the map?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why are so-called FICO scores all over the map?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

I've found as many threads saying it's a EX FAKO (Vantage 1 to be exact) as EX 08 Bankcard now, so I don't know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Anonymous wrote:I have several credit cards that offer free credit score options and I check those regularly. Trouble is, the scores are all over the place. There can be a 60 point difference in supposed FICO score depending on which credit card site I'm checking, even those that claim to use the same bureau (TransUnion or Experian, for example). Why do the scores vary so much and how reliable are those "free credit score" options.

That's chump change; I have a 140 point spread between my lowest and highest FICO scores.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

So to recap, there are three reasons why two FICO scores could be very different:

(1) The data that are generating the score are different because they come from different bureaus.

The three credit bureaus each could have very different accounts listed for you. Even if the accounts appear to be the same, there could be subtle differences that end up having a big scoring difference. For example, you may have paid down a big CC debt, and EQ has updated its database but TU hasn't yet.

But let's assume that the two scores are drawn on the same bureau, say Equifax.

(2) The FICO model used by each score could be different.

For example, you could have three FICO scores: one is the old mortgage model (which you got when you did a pre-qualification from a mortgage lender). Another is the FICO 8 Classic score (which you got from Credit Check Total). Another is a FICO 8 Bankcard Enhanced (which you got from Citibank). Those three models could give very different scores with different ranges as well.

But let's suppose you are comparing two scores that use the same bureau and the exact same model.

(3) The scores could be generated on different dates.

Here we are back to the issues of the possibility of different data. Suppose the difference in dates is small, four days say. In those four days some major changes could happen on your report, causing that same model to create very different scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@SouthJamaica wrote:

@Anonymous wrote:I have several credit cards that offer free credit score options and I check those regularly. Trouble is, the scores are all over the place. There can be a 60 point difference in supposed FICO score depending on which credit card site I'm checking, even those that claim to use the same bureau (TransUnion or Experian, for example). Why do the scores vary so much and how reliable are those "free credit score" options.

That's chump change; I have a 140 point spread between my lowest and highest FICO scores.

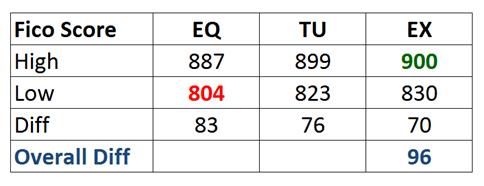

@on my last 3B report I had a spread of 96 points in Fico scores [high EX Bankcard Fico 8 @ 900, low EQ Classic Fico 04 @ 804]. All high scores are Fico 8 Bankcard version. All low scores are Fico 04 Classic version

As many know Citi uses EQ Fico 8 bankcard (range 250 to 900) while some other card issuers (AMEX, Discover) use Classic Fico 8 (range 300 to 850). Wells Fargo and/or other credit card issuers may report an older Fico 04 or even Fico 98 score. As an example, if EQ Fico 04 is reported, that version has range 334 to 818.

If someone had credit cards that reported the above combination of credit versions and highest score for each version, range in scores would be 82 points (900 - 818).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Anonymous wrote:I have several credit cards that offer free credit score options and I check those regularly. Trouble is, the scores are all over the place. There can be a 60 point difference in supposed FICO score depending on which credit card site I'm checking, even those that claim to use the same bureau (TransUnion or Experian, for example). Why do the scores vary so much and how reliable are those "free credit score" options.

That's chump change; I have a 140 point spread between my lowest and highest FICO scores.

@on my last 3B report I had a spread of 96 points in Fico scores [high EX Bankcard Fico 8 @ 900, low EQ Classic Fico 04 @ 804].

As many know Citi uses EQ Fico 8 bankcard (range 250 to 900) while some other card issuers (AMEX, Discover) use Classic Fico 8 (range 300 to 850). Wells Fargo and/or other credit card issuers may report an older Fico 04 or even Fico 98 score. As an example, if EQ Fico 04 is reported, that version has range 334 to 818.

If someone had credit cards that reported the above combination of credit versions and highest score for each version, range in scores would be 82 points (900 - 818).

Interestingly my highest and lowest are all Bankcard models. My lowest is EX Bankcard 2 and my highest are in a tie: EQ Bankcard 9 and TU Bankcard 8. On May 6th the spread was 142 points!

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@SouthJamaica wrote:

Interestingly my highest and lowest are all Bankcard models. My lowest is EX Bankcard 2 and my highest are in a tie: EQ Bankcard 9 and TU Bankcard 8. On May 6th the spread was 142 points!

@Thomas_Thumb wrote:@on my last 3B report I had a spread of 96 points in Fico scores [high EX Bankcard Fico 8 @ 900, low EQ Classic Fico 04 @ 804].

As many know Citi uses EQ Fico 8 bankcard (range 250 to 900) while some other card issuers (AMEX, Discover) use Classic Fico 8 (range 300 to 850). Wells Fargo and/or other credit card issuers may report an older Fico 04 or even Fico 98 score. As an example, if EQ Fico 04 is reported, that version has range 334 to 818. If someone had credit cards that reported the above combination of credit versions and highest score for each version, range in scores would be 82 points (900 - 818).

FYI - EX Bankcard score 2 is EX Fico 98 Bankcard. It has a score range of 276 to 878. If your EX Fico mortgage score lower than your EQ and TU mortgage scores?

One thing of note - Fico 98 model looks at B/HB on NPLS chage cards as a scoring factor. Fico 04, Fico and Fico 9 models do not look at charge card B/HB.If you have a closed NPLS charge card with a balance or open one with a very high B/HB, it could be impacting your Fico 98 score - but not to the extent you report. Also, data suggests Fico 8 and Fico 9 are more forgiving to new accounts and # cards reporting balances than Fico 98.

Beyond that a small collection, paid or unpaid, will negatively influence Fico 98 perhaps up to 80 points but not Fico 8 or Fico 9 if paid. Does your EX file have some dirt while TU and EQ are clean?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Thomas_Thumb wrote:

@SouthJamaica wrote:

Interestingly my highest and lowest are all Bankcard models. My lowest is EX Bankcard 2 and my highest are in a tie: EQ Bankcard 9 and TU Bankcard 8. On May 6th the spread was 142 points!

@Thomas_Thumb wrote:@on my last 3B report I had a spread of 96 points in Fico scores [high EX Bankcard Fico 8 @ 900, low EQ Classic Fico 04 @ 804].

As many know Citi uses EQ Fico 8 bankcard (range 250 to 900) while some other card issuers (AMEX, Discover) use Classic Fico 8 (range 300 to 850). Wells Fargo and/or other credit card issuers may report an older Fico 04 or even Fico 98 score. As an example, if EQ Fico 04 is reported, that version has range 334 to 818. If someone had credit cards that reported the above combination of credit versions and highest score for each version, range in scores would be 82 points (900 - 818).

FYI - EX Bankcard score 2 is EX Fico 98 Bankcard. It has a score range of 276 to 878. I[s] your EX Fico mortgage score lower than your EQ and TU mortgage scores?

Yes. EX FICO 2 = 723; EQ FICO 5 = 733; TU FICO 4 = 753.

One thing of note - Fico 98 model looks at B/HB on NPLS chage cards as a scoring factor. Fico 04, Fico and Fico 9 models do not look at charge card B/HB.If you have a closed NPLS charge card

I have no NPLS charge cards in my personal profile

with a balance or open one with a very high B/HB, it could be impacting your Fico 98 score - but not to the extent you report. Also, data suggests Fico 8 and Fico 9 are more forgiving to new accounts

This would seem to be the case, because 8 and 9 are my highest scores, and the only bad thing about my profile is the array of 'newness' factors.

and # cards reporting balances than Fico 98.

Beyond that a small collection, paid or unpaid, will negatively influence Fico 98 perhaps up to 80 points but not Fico 8 or Fico 9 if paid. Does your EX file have some dirt while TU and EQ are clean?

I have no negatives of any kind on any bureau.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Thomas_Thumb wrote:

One thing of note - Fico 98 model looks at B/HB on NPLS chage cards as a scoring factor. Fico 04, Fico and Fico 9 models do not look at charge card B/HB.If you have a closed NPLS charge card with a balance or open one with a very high B/HB, it could be impacting your Fico 98 score - but not to the extent you report.

I always find your posts fascinating. I knew about the B/HB thing on older models, which is one reason a lot of us used to just bite the bullet and try to run up the balance as high as we could reasonably afford to pay at least once to not have that ding every month. Do you happen to know where the NextGen2 model falls? I've been wondering why my NG2 score from PenFed is far and away my highest score that I have access to (more so than just the change in scale would suggest), and now I wonder if it's because of my two Amex charge cards. My gold has a high balance of $19k or so and is sock drawered until November when I may close it ($0 balances reporting every month), while my Platinum has a high balance north of $22k and lately has only been seeing $1-3k a month in spend. As my profile is almost entirely hindered by revolving utilization (if I were under 10%, I'd likely be somewhere in the 800-810 FICO 08 range right now), could it be that the additional close to $40k of "available credit" is helping me tremendously by pushing my util down?