- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Best way to improve scores?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best way to improve scores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best way to improve scores?

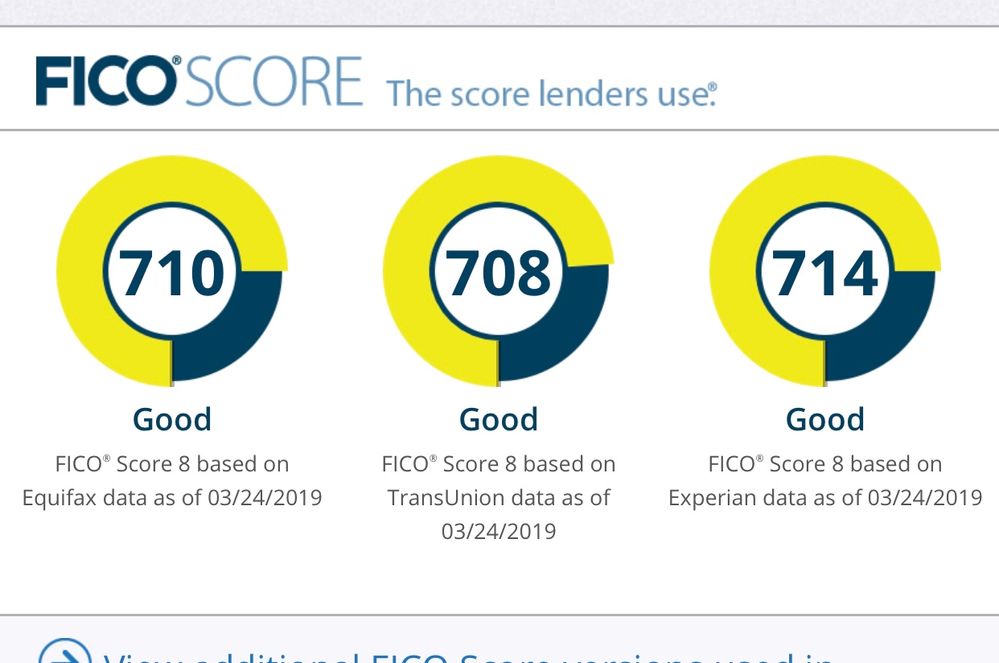

Hello all! We are trying to get our scores to 720 to qualify for a lower down payment on our construction loan. I would love any and all advice on the quickest way to do this!

Remaining CC debt and scores below!

NFCU $22,000/$27,000

NFCU $10,000/$14,000

USAA AMEX $9,000/$11,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

Remaining CC debt and scores below!

NFCU $22,000/$27,000

NFCU $10,000/$14,000

USAA AMEX $9,000/$11,000

Lowering your debt % should do the trick. Each of these are well over 50% UTI. IMHO this is what's keeping your scores below 720.

Is this all the debt you have? No car loans ect?

I'm sure others will chime in with more help.

Good Luck!

Updated Feb 2023:

Citi Double Cash: $26,300

Citi Costco: $33,800

PenFed Power Cash: $50,000

Chase Freedom Unlimited: $33,400

NFCU Cash Rewards: $29,000

BoA Unlimited Cash: $99,900

Wells Fargo Active Cash: $50,000

Citi AAdvantage Executive: $30,500

Wells Fargo Mortgage 30yr fixed 3.625%

Business Cards:

BoA Business Advantage Unlimited Cash: $8,000

Chase Ink Business Unlimited: $75,000

Chase Ink Business Unlimited: $75,000

RIP: EECU PLOC | BBVA PLOC | Chase SP | Chase Amazon | Chase Freedom | WF Propel | Cap1 QS | AMEX Gold | BoA Custom Cash | Lowes | Barclays Aviator Red

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

Thank you for your response! We do have two car loans, a mortgage, a personal loan and I have student loans. No lates on anything in the last 11 years. I know it is our heavy util that is holding my scores back. Ugh.

Thanks, again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

These appear to be your FICO 8 scores. You need to look at your MORTGAGE scores, which are your FICO 2, 4, and 5. You can get them on this site as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

I was in a similar situation a few years ago and was 20 points shy of qualifying. Once I paid down my balances I was able to qualify.

You are so close you can almost taste it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

Thanks for the advice!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

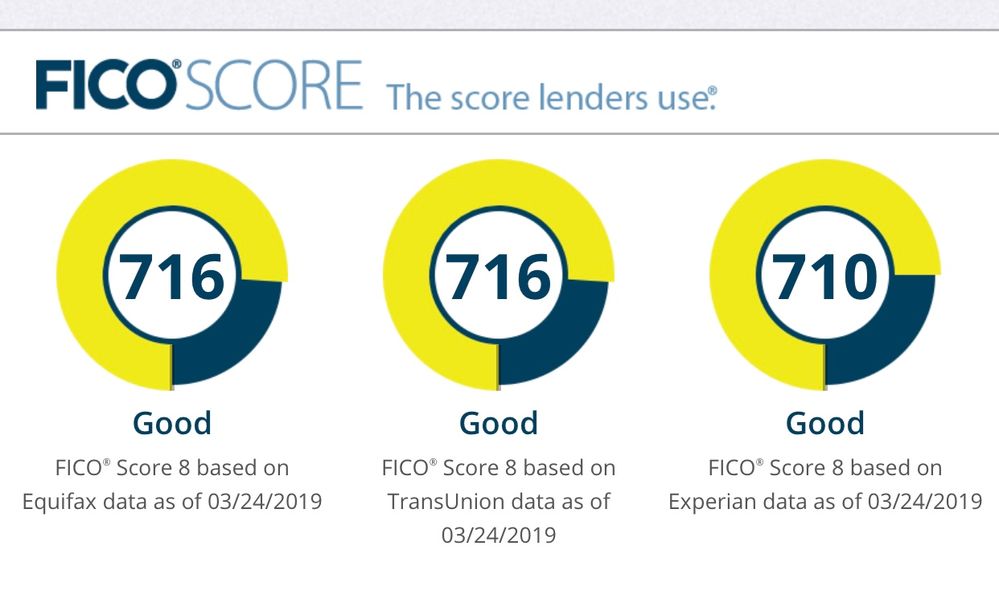

@armywifelong wrote:

Sorry! To clarify, our mortgage scores are 707 and 717. We. Are. Right. There. I think I’m going to pay one card off and the other two below 48% and see what happens.

Thanks for the advice!

That is certainly the right thing to do. Be certain that the remaining card is a true credit card (not a charge card) and that it has a credit limit of < 34.9k.

After you execute your plan, what will your total utilization be? (All credit limits combined?)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to improve scores?

Then it sounds like a good plan. You will most certainly get all the scoring points you need.