- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Closing cost seem high? *UPDATE*

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closing cost seem high? *UPDATE*

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing cost seem high? *UPDATE*

Hi guys,

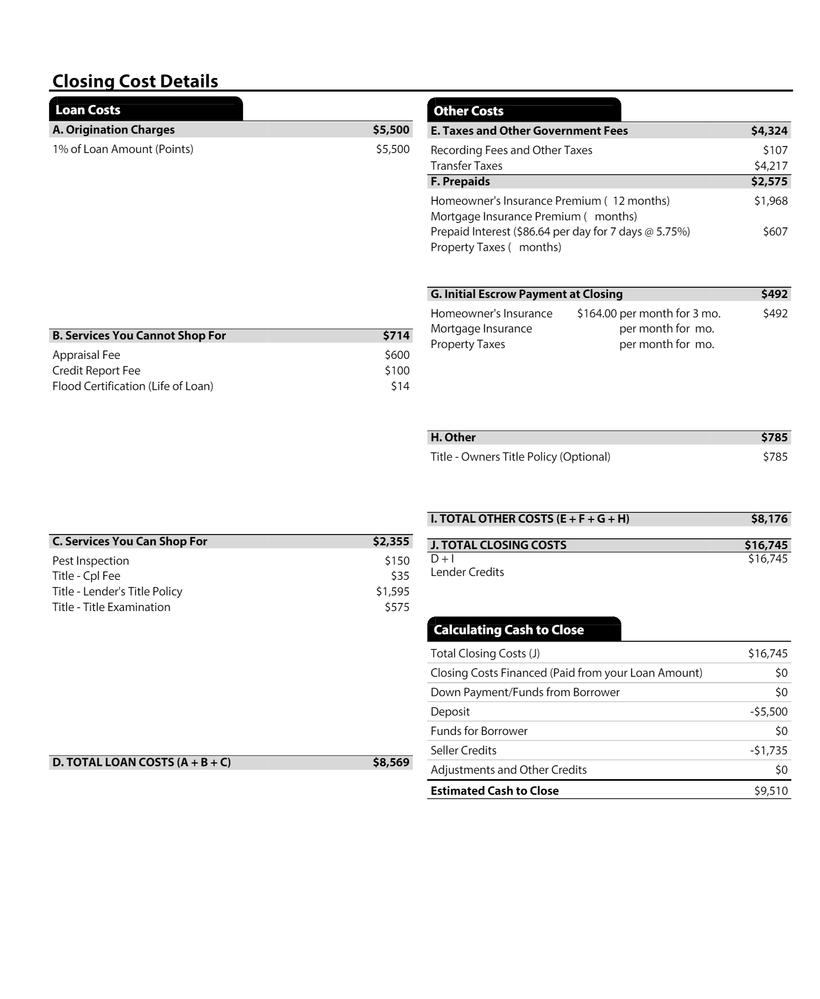

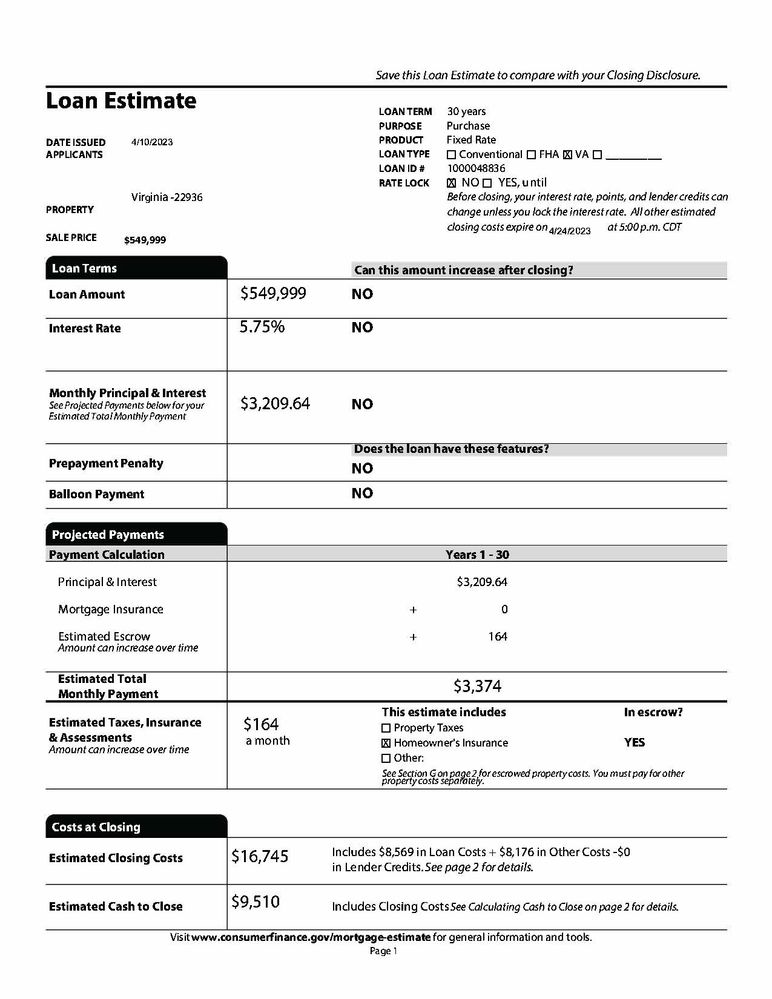

I am set to close in May and have a ratified contract that i am reviewing. Im having difficulties understanding these costs and why the closing costs are so high, or maybe i just do not know how to interpret? Its a VA loan and I had planned on putting 10k down. 5.5k is already in the earnest account. Am I offbase here?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

For the rate quoted, the costs are reasonable. In some states the transfer taxes are either paid by the seller or split between the seller and the buyer so there is a chance your closing costs will go down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

It's hard to tell.

What's your rate?

Are you using a lender or a mortgage broker?

Mortgage brokers on borrower paid compensation are capped at 1%, while lender paid compensation is 2.75%.

Lenders can get compensation up to about 5% on the backend.

See if you can find a mortgage broker that will do the deal for 1% borrower paid compensation. In that scenario the rate will be super sharp.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

Do you have the ability to lock the rate without having to pay any discount points?

IMO, in this market it's crazy to pay points to buy the rate down when rates are artificially still too high (thanks to the FED's inability to fight inflation along with Congress' willingness to give money away) because when rates return to normal you will be able to conduct a VA IRRL which typically only costs you .5% of the loan but allows you to finance it.

SO I'd compare the cost and monthly payment difference of a zero discount point rate loan term for about 12 months to see if it's more than $2750.

Licensed NC Mortgage Loan Originator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

I wouldn't say they are artificially high.

The spread is there because market makers think long term rates are going higher before going lower.

If the fed sees through the job report and acknowledges that higher paying jobs are being replaced with lower paying jobs, then rates could go lower.

However, last summer, Powell said he wants 10% unemployent and 20% retreat in real estate prices. If this means across the board, he has a lot more rate hiking to go.

That said, lock the rate you are happy with and can live with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

@CreditFun wrote:What's your rate?

Are you using a lender or a mortgage broker?

Mortgage brokers on borrower paid compensation are capped at 1%, while lender paid compensation is 2.75%.

See if you can find a mortgage broker that will do the deal for 1% borrower paid compensation. In that scenario the rate will be super sharp.

On the right side of the LE under interest it's being charged at 5.750% so I assume that's the interest rate. The 1% origination fee indicates to me that OP is probably using a mortgage broker going borrower paid compensation as well, since mortgage lenders typically don't charge origination fees and would charge discount points to buy down the rate instead. Depending on the credit score a 5.750% rate costing 1 point could be reasonable. With excellent credit might be able to get that rate about .250% lower.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

@ShanetheMortgageMan wrote:

@CreditFun wrote:What's your rate?

Are you using a lender or a mortgage broker?

Mortgage brokers on borrower paid compensation are capped at 1%, while lender paid compensation is 2.75%.

See if you can find a mortgage broker that will do the deal for 1% borrower paid compensation. In that scenario the rate will be super sharp.

On the right side of the LE under interest it's being charged at 5.750% so I assume that's the interest rate. The 1% origination fee indicates to me that OP is probably using a mortgage broker going borrower paid compensation as well, since mortgage lenders typically don't charge origination fees and would charge discount points to buy down the rate instead. Depending on the credit score a 5.750% rate costing 1 point could be reasonable. With excellent credit might be able to get that rate about .250% lower.

Correct - my rate is 5.75% with a credit score used for calculation of 688

I think im working with a broker. I was never offered any buy downs for points or whatever, but they did provide me with a document that outlines how that works. Does that mean I have the option to buy down my rate?

I am not sure how to determine if I am able to do any of this. And it was not clear what, if any, costs are covered by my funds in earnest, or if my downpayment later will be applied to the loan? This reads as if I am financing the entire cost of the house, but I am not. Wouldnt that change my payment and such?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

@rosco75 wrote:Correct - my rate is 5.75% with a credit score used for calculation of 688

I think im working with a broker. I was never offered any buy downs for points or whatever, but they did provide me with a document that outlines how that works. Does that mean I have the option to buy down my rate?

I am not sure how to determine if I am able to do any of this. And it was not clear what, if any, costs are covered by my funds in earnest, or if my downpayment later will be applied to the loan? This reads as if I am financing the entire cost of the house, but I am not. Wouldnt that change my payment and such?

You can ask your loan officer if you can buy down your interest rate, you should have the option to do so. To determine if it's worthwhile you'll divide the monthly savings of the lower interest rate payment into the amount of discount points, which will be your "breakeven" point on how many months you'll need to be in the mortgage in order for the total savings to exceed the amount of discount points you paid at closing.

The earnest money deposit is first applied towards your down payment (if any), then to any closing costs the seller isn't giving you a credit for, and then finally anything remaining is refunded back to you at closing.

The first page of your Loan Estimate is missing, which indicates the sales price and the new loan amount. However if you do the math in the lower right corner ($16,745 in closing costs minus $5,500 deposit minus $1,735 seller credit = $9,510 remaining to be paid by you) it seems like the loan amount is the same as the sales price (which you seem to explain isn't what you want to do). If you'd like to put money down/finance less, then you can request your loan officer to change the loan amount and ask for a new Loan Estimate to be disclosed to you.

Located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

Please post Page 1 of the Loan Estimate? There are some details there that would be useful. Please redact your name and address, but provide the State and County info? Also, I'm not seeing property taxes in Section G. Generally, you will be loading up your escrow account to pay taxes going forward. Lastly, unless you are excempt from the VA Funding Fee, that should be listed in Section B.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cost seem high?

@MortgageMama wrote:Please post Page 1 of the Loan Estimate? There are some details there that would be useful. Please redact your name and address, but provide the State and County info? Also, I'm not seeing property taxes in Section G. Generally, you will be loading up your escrow account to pay taxes going forward. Lastly, unless you are excempt from the VA Funding Fee, that should be listed in Section B.

There are no property taxes because I am a 100% P&T disabled Veteran. It is in Albemarle co Virginia. Same with the funding fee, I believe I am exempt. Here is sheet 1.

I just feel like closing costs are far above what was discussed with my realtor and with others who have purchased homes whom ive spoken to. Or maybe this is normal I guess lol