- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Upfront Mortgage Insurance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Upfront Mortgage Insurance

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upfront Mortgage Insurance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upfront Mortgage Insurance

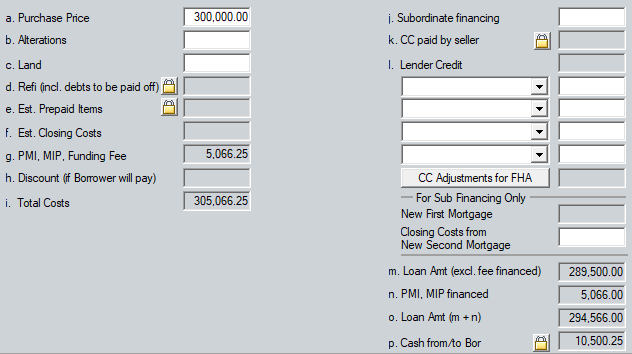

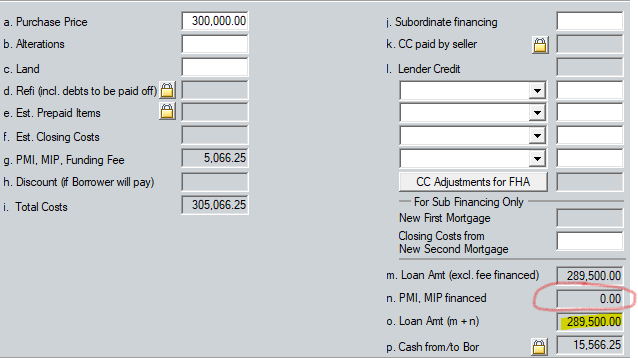

The down payment amount is 3.5% of the sales price, which would be $10,500 and so your base loan amount will be the $289,500 figure you mentioned. The upfront mortgage insurance premium (UFMIP) can either be completely paid out of pocket or completely financed into the loan (rounded down to the nearest dollar, the remaining cents are added to the funds you bring in at closing). In your situation the 1.75% UFMIP is $5,066.25 so $5,066 can be financed into the loan, bringing the loan amount up to $294,566 and the remaining $.25 is added to your funds to close.

Below is a graphic showing it being financed into the new loan amount:

If it wasn't financed in then it'd look like the below, increasing the amount of funds due at closing from you:

Mortgage Broker located in Southern California and lending in all 50 states

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upfront Mortgage Insurance

Thanks for the response. So it appears that the closing cost will be less the $5066 then. I will patiently(not really) wait on the final CD