- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- DCU Quick Loans, Approvals, No HP, etc.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DCU Quick Loans, Approvals, No HP, etc.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

@Pit-Smoker wrote:in my case, @Anonymous , the only preapproval is the $2k Quick loan. My other options remain green. I can apply, but there's no preapproval.

I agree with you on a 0.0% or 0.9% new car purchase from a dealer, but for a used car, a private seller, a new-but-dealer-used vehicle, or just in general, it's good to know what you might 'walk into a dealer' with up your sleeve.

If I could refi out of my near-7% auto loan rate, I most assuredly would.

You can talk to the loan specialist and ask what score you need to get their best financing. I think it was ~730 to get the 2.49%. I've had the banking and CC account for about 4 years with no increases or offers. However, I got a used car loan at the beginning of 2020 through them and with the same HP asked if they could increase my CL and lower my interest rate which they did. Only a $2.5k increase from $5k starting limit, but didn't cost me anything.

| TCL = $356,650 | TU FICO 8: 789| EX FICO 8: 790| EQ FICO 8: 790|

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

I got 2.49 on a auto refinance last year with a 708 Eq fico (mortgage)

Starting Score: Eq 485 TU 467 Ex 400 BK filed Dec 2016

Starting Score: Eq 485 TU 467 Ex 400 BK filed Dec 2016Current Score: Eq 723 TU 665 Ex 682

Goal Score: 700 All 3

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

Does anyone know how these show up on your credit report after you accept? I could see how the new accounts could lower the average age of your accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

@fm92555 wrote:Does anyone know how these show up on your credit report after you accept? I could see how the new accounts could lower the average age of your accounts.

As a brand new account, lowering your average age of accounts.

IMHO it also resets your age of newest account, but at least one member of this forum disagrees with my opinion.

Total revolving limits 586020 (520820 reporting) FICO 8: EQ 706 TU 701 EX 692

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

@SouthJamaica wrote:

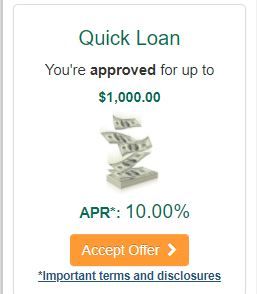

@Wavester64 wrote:Question: I know, or I should say I read when you see the gold "Accept Offer" on one of DCU Credit products like below...

Approvals are looking good.

However just seeing a video from "Credit Plug" YT channel concerning such loans, or approvals for quick loans thru DCU, that if approved, does NOT involve a HP from your credit report nor a credit inquiry.

Is this true?

I don't need the loan, but if this is true, I was thinking of taking a loan for $500 or even the full $1000 and pay it off rather quickly to help my credit score that much more and to get in better with DCU to get one of their cards someday.

I already have a savings account with them.

Your thoughts?

+ @Gmood1 + @nuohlac + @M_Smart007 + @cashorcharge

I wouldn't if I were you. If it does anything, it will cost you some points rather than gain points. It's not worth getting a new account in your profile.

Question concerning "new account in your profile."

Even though this is a different product than a CC, does that new account apply to a lender considering you for a credit card?

Let me explain if that isn't clear: lets say I am 2/6 in new accounts (only CCs). If I opened a personal loan, or even an Auto Loan today, does that make me still 2/6 in new accounts for a credit card, or does that auto or personal loan count even though its a different product, making me now 3/6?

Adding @Remedios to this because I think she might of schooled me on this in another thread, but I can't find it.

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

Only revolving accounts contribute to 5/24

Auto loans, mortgage, personal loans do not count, however chase may deny with 2 PLs on file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Quick Loans, Approvals, No HP, etc.

@Remedios wrote:Only revolving accounts contribute to 5/24

Auto loans, mortgage, personal loans do not count, however chase may deny with 2 PLs on file.

Thanks @Remedios that's good to know!

So right now I am 2/6, soon to be 0/6. I will be getting a new car before the end of the year, accepting a DCU Financing offer to pay for the vehicle. I was worried that would again put me @ 1/6 for a card, but per what you are saying here, I would still be 0/6. 👍👍

Potential Future Cards

Closed Accounts