- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Discover Checking vs Capital One 360 Checking?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Checking vs Capital One 360 Checking?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover Checking vs Capital One 360 Checking?

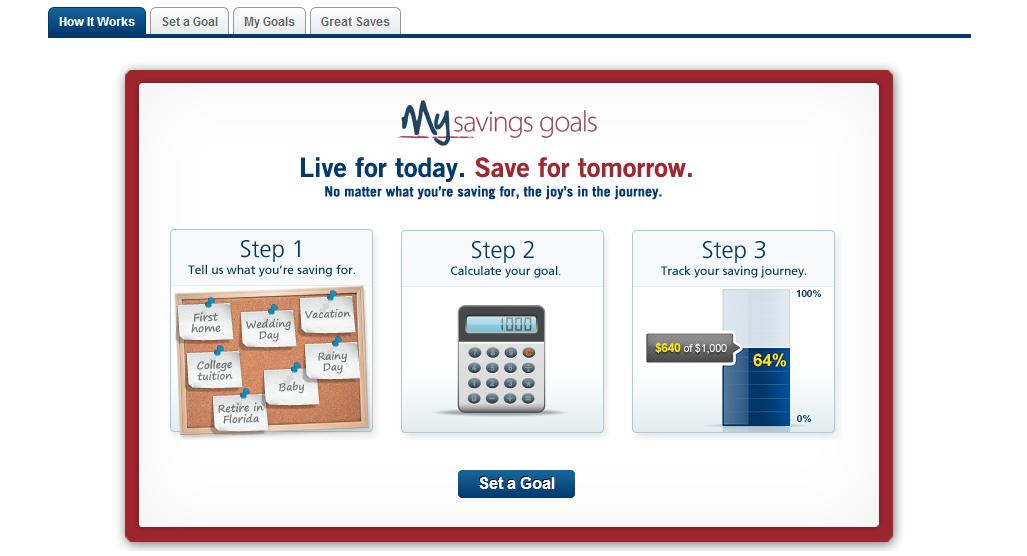

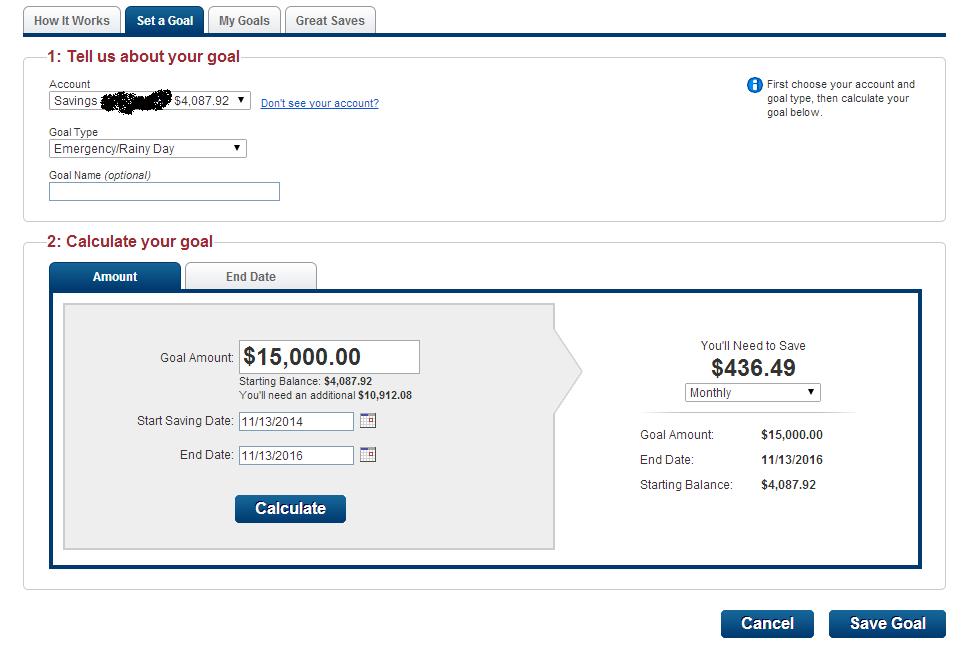

I currently have a Discover Checking and a Discover savings. I heard Capitak One 360 has a neat tool that allows you to set savings goals and see the process. He said it also show syou how close you are with a percentage.

Can somone post an image of this? I want to know if its worth it to move to capital one banking.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

Thanks for alerting me about this feature. I went in and set up a goal for ya ![]()

I did this with the savings account. Let me go check if it's available for checking too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

I think you'll need to have a savings account with them to set this up. I accessed this tool from My Accounts>My Savings Goals. I have both checking and savings accounts. When I specifically went to the checking account, I didn't see a link to the feature anywhere, just general checking ledger stuff.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

@Simply827 wrote:I think you'll need to have a savings account with them to set this up. I accessed this tool from My Accounts>My Savings Goals. I have both checking and savings accounts. When I specifically went to the checking account, I didn't see a link to the feature anywhere, just general checking ledger stuff.

Thanks a bunch fo ryour help. I find this automated feature very useful. I can have one for my next car downpayment, iMac 5K, etc...

Do you know if they require a certain amount to open each the checking and savings?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

Here's the caveat which I've always disliked. You can't have separate line items(read:goals) in an account. If you want to have separate goals set up, you'll need to open another savings account.

I'm not sure what the funding amount is. I've had these accounts since back when they were with ING DIRECT. I can't imagine it being more than $25-50.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

@Simply827 wrote:Here's the caveat which I've always disliked. You can't have separate line items(read:goals) in an account. If you want to have separate goals set up, you'll need to open another savings account.

I'm not sure what the funding amount is. I've had these accounts since back when they were with ING DIRECT. I can't imagine it being more than $25-50.

No problem.. if there is no many in the checking account and the auto transfer is set to automatically tranfer X amount to a savings. Will it still transfer and give a negative balance to the main account or will it know that there is no funds and hold the transfer?

I just dont want any overdraft problems ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

I'm unsure as I've never run into that situation. I'd think if the savings was the backup account and you overdrafted trying to put money in savings, it wouldn't take it out to put it back in, but I dunno.

I will say that the overdraft fees are very reasonable. It's treated like a loan so you pay a percentage on the overage for how many days you need to repay it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Card - Capital One 360 Checking and Savings.

Before Lexie09 mod puts this thread in the shmorgas board can someone please tell me if the Capital One 360 Checking or Savings has the option to transfer a percentage of any incoming money by percentage?

For example 1 week an amount of $2500 goes into the bank. Can capital one 360 checking automatically split it and send $1250 to two different accounts?

What bank can do this?

Nope, merged with your exiting thread in Personal Finance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Checking vs Capital One 360 Checking?

@Anonymous wrote:

Josh, do you have a Roth IRA account? If not, fund that first before putting your money in a savings account.

Yes I am currently with Vanguard