- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- HMBradley hybrid saving/checking account

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HMBradley hybrid saving/checking account

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HMBradley hybrid saving/checking account

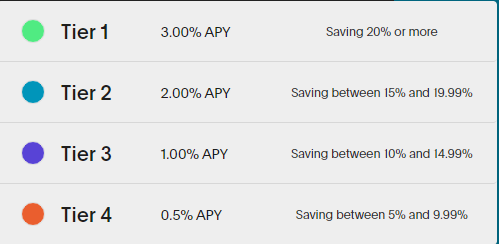

Has anyone started banking with HMBradley? It's a new bank I found this week, partnered with FDIC insured Hatch bank (also new - last year) that seems to have a good return structure.

The way I was thinking of doing it is to move some savings there, set up my second job to direct deposit the full check there because it's all going to be saved anyway, then let it grow at the 3% rate for as long as it lasts. With that plan, I would always be saving 20% or more because it is only based on incoming direct deposits.

Only issue is, I got denied when I applied for the account but it doesn't really give any information which sucks.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

I've looked into this bank before too as spliting DD into it would easily give the 3% and that's pretty good uncapped.

My problem was

a. the fact they don't have an app and only work on web;

b. hatch bank being brand new along with HM so both are unproven;

c. their website seems to be very minimal to where finding information on it is quite difficult;

d. challenger banks like this one have terrible customer service so with the above points something is GOING to go wrong and when it does I'm sure you would be offered almost no help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

What did you end up going with instead? I'm open to options, but most of the better rates seem to have dropped with the Fed rate (duh).

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

@ccquest wrote:

Fair points there, but I'm hoping to never really need to interact with them since I want to park the money away from me so I don't ever really see it then I can check it on occasion if I need to, but it's going to be the house down payment fund.

What did you end up going with instead? I'm open to options, but most of the better rates seem to have dropped with the Fed rate (duh).

I have multiple savings accounts such as Amex, Marcus by GS, Discover, and BECU. DCU is also a good option as they still hold up the 6% up to $1k. Personally I believe rates are going to stay stupid low for a while anyway so if your goal is to keep it away from yourself I would open an account with a bank you don't already use and just park it until you need it. My favorite is Marcus by GS.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

I just opened an account and I will be shifting some of my savings there until the better rate kicks in next quarter. I tried to update my direct deposit in time for my Friday check, but that didn't work out.

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

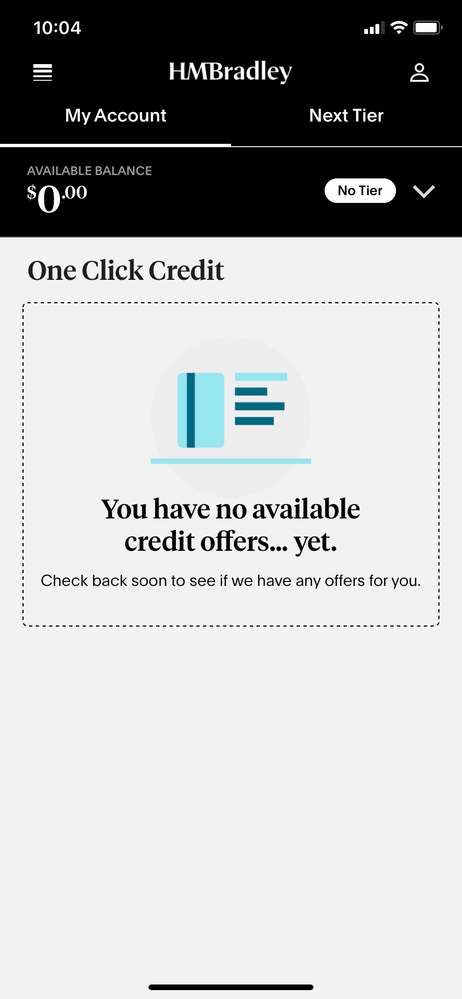

I opened one as well. They have a cash back credit card you can get if you direct deposit enough (I think $200) and fulfill some other conditions. They have an app as well

credit card eligibility : https://faq.hmbradley.com/hc/en-us/articles/360046636331-What-are-the-eligibility-requirements-for-t...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

Bumping this thread in hopes there may be more/updated thoughts on HMBradley.

Knowing I would save at least 20% of my deposits, the 3% tier would make it worth moving my direct deposit over. I'm just a bit skeptical with this being a NOW account, and the fact that there doesn't appear to be a human being you could ever speak to unless its through chat. Anyone move any serious funds over to this challenger?

Other options I'm considering:

-Evansville Teachers FCU for 3.3% on 25k, but I'll have to jump through hoops for debit card and fake DD's

-Morgan Stanley Access Investing + CashPlus for the annual free Amex plat bonus

-Converting money to cash and using for firewood (save on this winter's heating bill)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HMBradley hybrid saving/checking account

as of 1/1/23

as of 1/1/23Current Cards: