- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Help! What's Capital one no hassle check?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help! What's Capital one no hassle check?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help! What's Capital one no hassle check?

Help! What's Capital one no hassle check? Can I cash the check after I received the capital one no hassle check? Will it be counted as cash advanced? Can I use no hassle check to pay the credit card bill for my younger bro? If anyone has the experience please tell me !Thanks a lot !!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

Pretty sure it's a balance transfer that you can request in check form. If that's the case, then it would not be counted as a cash advance. The rules of your balance transfer will apply along with the applicable fees.

Balance transfer checks can be used to pay for anything. They do not know what you do with them nor do they care. They only want the upfront fees, potential fees from not paying the total amount due in the allotted timeframe, and your on-time monthly payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

Are you talking about a 0% check?

If so, the ones I get (0% for 18 months with 2% fee) are blank checks.

I just write myself a check and deposit it into my checking account.

A day or two later it is cash just like any other deposit.

Yes, I verified it was OK with Cap One before I deposited them.

The checks I get are considered balance transfers and not cash advances.

Make sure you double check with Cap One because there are different types of checks.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

What if I use the normal purchase balance transfer as it counts as purchases ? Does it count as cash advanced? Have you ever used this kinda no hassle checks? Please

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

It is a balance transfer that cost 0% upfront then your current APR on the balance each month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

So you meant I can use "APR is same as current " this option to send me a no hassle check and then I could deposite it into my bank account (cash the check) and it wont be counted as cash advanced? Ive never done it before. Please tell me all details about the no hassle checks at once.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

Why don't you ask capital one by using chat feature and print out their answer so you have it as proof?

There are different Cap One checks. Some are blank, some are requested and recieved a week or two later, etc.

Did you get a 0% blank check offer in the mail?

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

From within your Capital One account...

1.)Go to More Account Services(the last tab, in the middle, on the right)

2.)Scroll all the way down to the Transfer a Balance(on the left)

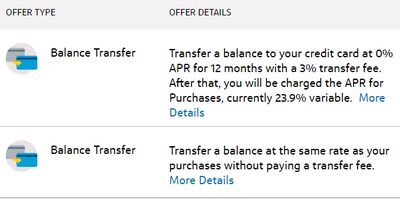

3.)View your offers for your account. I have two at this time.

4.) Select an offer and choose how you'd like to transfer the balance.

======================================================

This is NOT considered a cash advance. Cash advances are assigned a cash advance fee. This is considered a balance transfer. Weigh the pros and cons depending on the time you plan to repay, as well as if the fees are worth it(ie if doing a BT saves you money).

Option 1 allows me to pay an upfront 3% fee of the amount I wish to transfer. I won't have to pay any monthly fees(unless I put new charges on the account and I'm not in a 0% APR for purchases period). I would have 12 months of no interest. After that, my standard purchase rate would apply to any remaining balance.

Option 2 allows me to NOT pay an upfront fee but every month pay my current purchase rate(23.99%) on the amount I transferred for an indefinite amount of time. Option 2 makes no sense on the pockets unless I planned to transfer a balance and pay it off the very next month.

Selecting, "Transfer a balance" allows me to send money from my Capital One Card to pay any other credit card that isn't Capital one. It's limited to a, "card to card" transfer and can take a couple of weeks for the receiving bank to get the money.

Selecting, "Send a hassle free check" allows you to receive a check from Capital One to deposit into a checking account and pay anything---(car insurance, another credit card, home repairs, a family member etc.) They do not know(nor care) what you do with the check once it's deposited into your account. A check also gets to you quicker and pays whatever you want to pay faster than card to card transfers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

JSS3 ,

Thank you so much and other perople replied me in such a short time ! I would like to check one last thing , the option 2 , Can I pay for someone's credit cards or car loans and not be counted as cash advanced? Really appreciated all you guys's help. Thank you all!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help! What's Capital one no hassle check?

Personally, I have never seen any BTs get coded as a cash advance. The only time(s) cash advances are coded as such are when you go to an ATM and withdraw money off of your card or you use your card on certain websites(ie Western Union).

Discover and Walmart both have a cash over feature where you can withdraw money from the register when checking out. Limited to 60-100 per day. And it needs to be paid back within a month.

BTs tell you the fees and time for repayment. I've done many BTs from many companies. Never resulted in it be coded as a cash advance. I look for the associated fees for doing BTs. Comenity has offered 0% fees and 2% fees for balance transfers for a 12 month period. Discover, BofA, and Citi have offered 3% fees on a 0% APR for 12 months or 4.99% for 18 months. Sometimes the fee will be 4% or 5%. Most are 3% though. So you pay attention to the fees and the time given. You also look for verbiage that states if you'll incur interest on new purchases(if you are out of your 0% introductory period on purchases).