- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- I think I will retire...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I think I will retire...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I think I will retire...

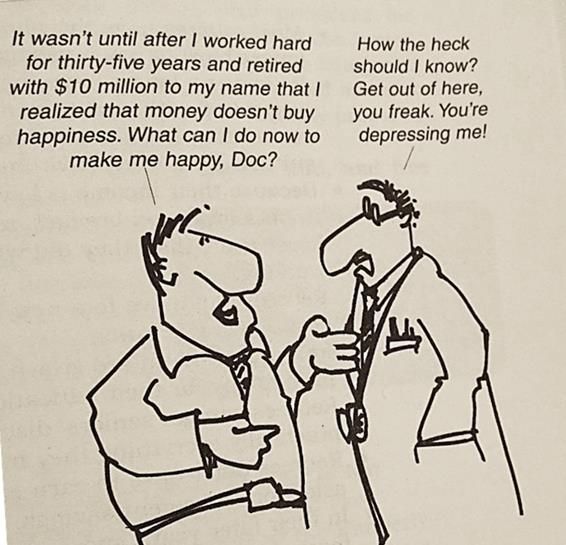

I think I will retire... in about 5 years or maybe less. I'm 58. In March 2023 I will be mortgage free - I am currently 11 years ahead in payments on the 25 amortization. I have a credit card debt that will disappear by April 2020, a car loan that I will zero out in May 2020 and I am paying the max amount into my RRSP fund [similar to a 401(k) for you Americans]. I plan not to have any debt when I give notice and retire. I increased my charitable donations in the last 2 years - may as well help out the less fortunate. I will have multiple sources of income - government pension (CPP and OAS), company pension, work-related RRSPs, private RRSP, deferred income and precious metals. Life is good. But it wasn't always so - 20 years ago I was nearly penniless. Then I decided to get serious with my finances, changed jobs and worked at changing some habits. ![]()

Right now, I transferred some of my investments into conservative funds from the aggressive growth funds. I have this feeling that a major market correction (15-25%) is just around the corner and I want to protect my wealth. We are long overdue and it wouldn't take much to get the markets skittish.

Oldest Reporting EQ Account: 20.4 years; EQ AAoA: 9.9 years;

ACTUAL Oldest account 40.1 years; ACTUAL AAoA 19.3 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

I look forward to the day I can retire. Congrats on your plan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

Congratulations. It is a shame that this particular sub-forum doesn't have more posts dedicated to retirement. After all, this sub-forum was originally requested as a place for "Retirement" posts and still has that as it's HTML address. Last couple years the evolution has been towards subjects like debt consolidation loans and strategies to get in with restrictive CU's. I hope that members are thinking more about the important topics of saving and planning for retirement than they are posting about.

I am right in the same zone with the OP. I am 59 and have targeted 2020 for retirement at age 61, 2 more years. Things have come together nicely in the last 10 years, & especially the last 5. I have a modest pension, a max'ed SS earnings record, company provided retiree health coverage and a modest portfolio in place. A small self-employed gig is up and running profitably and is something I'll enjoy doing for beer money until maybe age 70. It only involves work during the month of July. No debts at all and a paid for house.

I still lurk here occasionally, but the interests of the group at MyFICO aren't my focus anymore. I haven't made a credit app in 5 years, my bureau reports all frozen. MyFICO was a great help 5-10 years ago in managing my credit. I may chase sign-up bonuses again once I retire, or maybe not.

Anyway, congratulations again. Good to read a post from a kindred spirit.

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

@bada_bing

I can relate. Also 59 and plan to retire in 2020 at 61.

Daughter will be done with grad school 5/2019 and be off our medical insurance and car insurance plans soon thereafter. House will be paid off 9/2020. Replaced cedar deck with larger Azek deck, all new kitchen appliances, new central air conditioner, replaced garage doors and new vehicles for me and DW in the last couple years. Plan to replace roof next year.

Goal is to have all large ticket items taken care of prior to retirement. Expect DW will retire next year. My biggest concern is medical insurance after retirement but before medicare eligibility. Not lucky enough to work for a company that offers medical benefits to retirees - that's a rare thing these days. Fortunately, both DW and I will receive pensions from prior employers.

I do have sufficient after tax savings and both 401k and IRA savings to cover the gap between retirement and pension/social security income. I could pull funds from tax deferred plans at 59 1/2 without penalty but, proceeds in those accounts can continue to grow tax free.

Current thinking is to cover yearly expenses from after tax sources until age 65. Then start pension, SSI distributions and medicare insurance (assuming medicare is still viable).

I am contemplating signing up for long term health care insurance at age 60 with based on a plan that offers 3 year coverage at $250/day + COI adjustment. However, I'm a bit torn on this and DW is not an advocate of LTHC insurance. I realize the LTHC value proposition is situation dependent. Nonetheless, other's thoughts on this are welcome.

P.S. My last credit application was 7 years ago athough I did go for a couple HP CLIs last year. For me analyzing/understanding Fico scoring is a hobby.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

@Thomas_Thumb wrote:

I can relate. Also 59 and plan to retire in 2020 at 61.

Daughter will be done with grad school 5/2019 and be off our medical insurance and car insurance plans soon thereafter. House will be paid off 9/2020. Replaced cedar deck with larger Azek deck, all new kitchen appliances, new central air conditioner, replaced garage doors and new vehicles for me and DW in the last couple years. Plan to replace roof next year.

Goal is to have all large ticket items taken care of prior to retirement. Expect DW will retire next year. My biggest concern is medical insurance after retirement but before medicare eligibility. Not lucky enough to work for a company that offers medical benefits to retirees - that's a rare thing these days. Fortunately, both DW and I will receive pensions from prior employers.

I do have sufficient after tax savings and both 401k and IRA savings to cover the gap between retirement and pension/social security income. I could pull funds from tax deferred plans at 59 1/2 without penalty but, proceeds in those accounts can continue to grow tax free.

Current thinking is to cover yearly expenses from after tax sources until age 65. Then start pension, SSI distributions and medicare insurance (assuming medicare is still viable).

I am contemplating signing up for long term health care insurance at age 60 with based on a plan that offers 3 year coverage at $250/day + COI adjustment. However, I'm a bit torn on this and DW is not an advocate of LTHC insurance. I realize the LTHC value proposition is situation dependent. Nonetheless, other's thoughts on this are welcome.

P.S. My last credit application was 7 years ago athough I did go for a couple HP CLIs last year. For me analyzing/understanding Fico scoring is a hobby.

I hate to be a spoil sport but why retire? Keep the mind active as well as the body. Just consider cutting back to parttime. Dw and I are both in our 60's. We have been self employed almost our entire life. Our house has been paid for for years. Our only debt is 2018 Car debt. Our assets include interests in our main biz plus minority interest in several related firms all total more than enough to retire. At some point in another 2 or 3 years we will start selling off everyhting but our core business.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

Super Congrats on your retirement plan way to go!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

@Roarmeister wrote:I think I will retire... in about 5 years or maybe less. I'm 58. In March 2023 I will be mortgage free - I am currently 11 years ahead in payments on the 25 amortization. I have a credit card debt that will disappear by April 2020, a car loan that I will zero out in May 2020 and I am paying the max amount into my RRSP fund [similar to a 401(k) for you Americans]. I plan not to have any debt when I give notice and retire. I increased my charitable donations in the last 2 years - may as well help out the less fortunate. I will have multiple sources of income - government pension (CPP and OAS), company pension, work-related RRSPs, private RRSP, deferred income and precious metals. Life is good. But it wasn't always so - 20 years ago I was nearly penniless. Then I decided to get serious with my finances, changed jobs and worked at changing some habits.

Right now, I transferred some of my investments into conservative funds from the aggressive growth funds. I have this feeling that a major market correction (15-25%) is just around the corner and I want to protect my wealth. We are long overdue and it wouldn't take much to get the markets skittish.

If you think having your investments in a "conservative" stock fund will "protect [your] wealth" you may be in for a rude awakening.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

SouthJamaica: Perhaps you could elaborate?

Oldest Reporting EQ Account: 20.4 years; EQ AAoA: 9.9 years;

ACTUAL Oldest account 40.1 years; ACTUAL AAoA 19.3 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

Retiring at 60 is a pipe dream for me.

At 41, we've only got about 25% of our target number saved up, so we're still looking at about another 30 years to the finish line. If the markets are favorable over the next 20 years, we might be able to move our date up, but for now we're looking at around 2047. To try to catch up, we've taken an aggressive savings stance and we're putting just under $50k/year into various retirement savings. I despair to think it still won't be enough.

We've also hit 40 quarters of maxed SS contributions, but by the time I retire I suspect SS won't be a thing anymore. No pensions, either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think I will retire...

Well said, Doc.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950