- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Should I try Amex 'Pay over time'?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Should I try Amex 'Pay over time'?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should I try Amex 'Pay over time'?

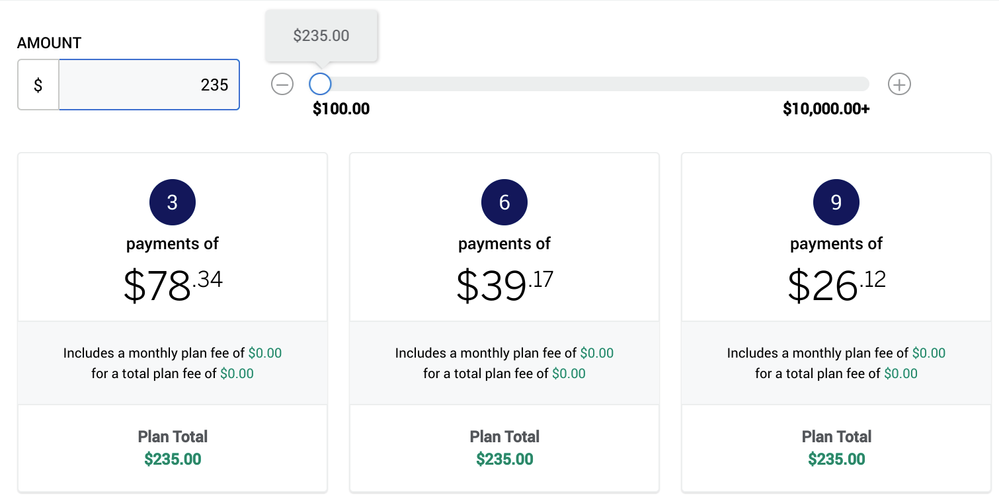

I recently received my new Amex ED card and was looking at this feature available to me. Given that my limit is $2,000 and I need to meet a SUB minimum of $1,000 over 3 months. I wanted to book tickets to see a Wizard of Oz play, which will set me back $235 respectively. Considering it my Christmas treat. My ED has 0% apr.

Would Amex frown upon a $235 transaction for pay over time? I don't want to reduce my chances of getting future cli's. I kinda want to just try it out before I do it with a larger purchase, if I ever need to. If not, I can use my NFCU Amex as I need to meet their $3k SUB and immediately pay it off after.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

Plan it works for anything over $100. They don't care if you use it. I tried it twice and ended up paying both of them off the next month. It's the only time I've ever paid amex interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

Pay Over Time is a feature of charge cards (like Platinum, Gold, Green, etc.).

Revolving credit cards like ED have Plan It. You could carry a modest balance at 0% for a while without needing to pay any fees for a Plan, though.

@Brian_Earl_Spilner wrote:Plan it works for anything over $100. They don't care if you use it. I tried it twice and ended up paying both of them off the next month. It's the only time I've ever paid amex interest.

But the ED is already at 0%. Why pay fees for a Plan? OP can just carry a balance normally by paying more than the minimum but less than the full statement balance.

Sometimes Amex offers no-fee Plan It promotions. I've done several of these, and have a few thousand dollars on my BCP stretched out over another 21 months or so.

And FWIW, Amex gave me a $20k SL on Delta Platinum while I was carrying about $10k at 0% on my BBP.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

So, it wouldn't hurt to do this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

@Anonymous wrote:

So, it wouldn't hurt to do this?

No, it wouldn't hurt and you could take your time to pay it off without fees or interest...

...but keep in mind that's just a hypothetical projection. You can't actually put purchases into a Plan until the transactions have posted. I don't think there is any guarantee of what Plan lengths Amex will offer. No-fee Plans are nice, but I think the Plan lengths aren't known until it's too late not to use a different card!

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

No, Amex won't frown on that. Anything over $100 qualifies. I would assume that Amex WANTS people to use the feature, seeing as the user has to pay a small monthly fee (unless you're in a promo period). You can see it through for the entire payment period or pay it off early. Either way, it works. I think it's a great feature personally.

Enjoy your play!

Amex Cash Magnet: 24.4k

Fidelity Visa: 21.5k

Apple Card: 13k

CapOne Venture X: 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

So, for the duration of Plan, that will be your new minimum payment.

If you create any additional plans, those amounts will be added, too.

If you have any doubts that you wont be able to pay that much, just carry it as a balance during 0% because should you encounter financial issues, you'd owe lesser amount

Dont bite more than you can chew

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

IMO, I wouldn't even bother. The ED card already has 0% APR for whatever the promo period is, so you can essentially pay thet $35 minimum payment over the course of 7 months interest free ayways.

Plan it is really only useful on larger balances if the fee is less that your standard APR, like if you had $1-2K that you couldn't pay back within one statement period. etc.

I recently set one up on my BCP because i had two large charges hit the same month, and wasn't expecting it to. So I set up a plan for one charge and paid off the rest because I PIF on this card due to the high APR. This was the only time I saw it as useful, and will pay it back much sooner than the time allotted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Should I try Amex 'Pay over time'?

With the promo 0% I woul pay it over several months.

Plan It can be very interesting DW got a 0% fee and 0% interest plan it promo approved upto $15,0000