- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- CREDIT REBUILD PROJECT LOG

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CREDIT REBUILD PROJECT LOG

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 soft pull frequency

@p- wrote:I learned something new... Capital One does not soft pull you when you click the luv button or ask for a CLI. In fact, they don't pull your credit at all. Instead, they use the most recent score from their own periodic soft pull of your report. As far as I can tell, it's something like quarterly.

I was discussing the free score provided when denied a CLI from cap1, and another poster pointed out that their score was two months old. I looked at all of the rejection letters that I got from failed CLI requests, and several of them referenced old scores. Looking at my report, it appears they were soft pulling me whether or not I had asked for a CLI, and did not pull a current report when I did.

This is important, because it makes utilization on the day of the request irrelevant. Normally I would wait to hit the luv button until statements cut showing me with only one balance and low util, but if they used an old pull where I had multiple balances, or high balances, that was for nothing.

Furthermore, the tactic of requesting a CLI as soon as collections or lates are removed is pointless, if they are loking at month's old data that still has the derogs.

My strategy needs to be adjusted to compensate for this. As my last CLI with them was 11-2013, then in 2-2014 I need to optimize my utilization, and keep it optimized until 5-2014 when I hit my six months and ask for another CLI.

+1. I also learned that over the summer when I was in the process of PC'ing my Cap1 Journey to QS, someone from EO had called (who was very nice) and that's what she had mentioned.

Your strategy looks awesome, keep us updated!

BOA UNC-CH Alumni $6k I Hawaiian WEMC $3k I Arrival $6.5k I IT $1.5k | Merrill+ $2k | Lowes $12k | Apple $2k | +23more

Scores: EQ:671 (FICO ↑ 11) EX:686 (FICO ↔ N/C) TU:686 (FICO ↑ N/C) *8-5-14*

Overall UTIL: 14% *Gardening Since: 1/20/16*

------------------------------------------------------------

Need to stay out of trouble.... Go Heels!!! ... GC Watchlist ( #1 since 12-12-13)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

More weirdness from Cap1

A little over a week ago I spoke with a chat rep about a PC on my Plat to a Quicksilver. This is a card that was formerly an Orchard card. As shown in the text from the chat below, he agreed to upgrade me to a Quicksilver World Mastercard.

There was not a CLI along with it, and the limit is only 1700 so I was not sure if they would raise it, or give me the worlds lowest WMC line.

I logged into my account today and the card pic has changed to Quicksilver, but the name is still "Platinum Mastercard." Also, as of Saturday I have not yet received the new card. My other one says "World Mastercard" next to the pic, but I can't remember if that showed up after I activated the replacement card or immediately when it changed.

I assume it will arrive in the mail in the next few days, but until then I am curious; will I have another World card, or did the rep make a mistake?

Ian: Glad to have you on chat! How may I assist you today?

you: I'd like to upgrade or product change my card ending in **** to another product, perhaps something with rewards.

Ian: I appreciate you taking the time and contacting us to check on this.

Ian: Let me quickly access your account and check if there is any offer on the account to upgrade your existing card to better rewards card.

Ian: To better assist you, I will need to verify a few pieces of information so that I may access your account to check on that for you. Is that ok?

you: sure

Ian: Great!

Ian: In order to access your account, please provide your name (exactly as it appears on your credit card), zip code, date of birth and last four digits of your Social Security number.

you: p

you: ****

Ian: Thank you. Please bear with me a moment while I review your account information.

you: ok

Ian: It’s great that you want to see if there are any options available to upgrade your account and make your credit card work for you.

Ian: Thank you for your patience.

Ian: p, after reviewing your account I see that you have an offer on the account to upgrade your existing card to Quicksilver card.

Ian: Upon upgrading you will receive 1.5% Cash Back on all net purchases with No Annual Membership Fee.

you: Great. Please go ahead and do that. Is it possible to raise the limit while you are at it?

Ian: Let me explain you the other terms of the Quicksilver card then I'll be happy to check the available options to submit the request for credit limit increase.

Ian: Your account will be upgraded to a Capital One Quicksilver World MasterCard.

Ian: You will receive 1.5% cash back on all net purchases...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Merry Christmas, Major Milestones.

Readers of my journal have heard me whine and complain about my twelve months of student loan forebearance that is reported as lates. Of course, having set up the forebearance on the phone back when I was not so credit-savvy meant no proof. When I finally sorted it out, they did apply the forebearance but it shows as after the fact; something I had no idea would hurt me until later when I was wiser.

After countless goodwill attempts, discussions with the ombudsman, disputes, and general whining, I have still been stuck with these 120+ lates on my closed and paid account. And there is still a year to go before the last late falls off, and the account goes positive.

So, pulling my free reports today from annualcreditreport.com I find that Experian is now showing "no data" in the payment field for these months!

But wait, there's more... That Verizon collection account is gone. Just, gone. Removed. Vanished. Disappeared. Gone. That is the last collection account on any of my reports. I thought I had another 18 months of that black mark hanging out, and it's gone. I now, for the first time ever, have no collection accounts on my credit reports. None.

This, my friends, is a red letter day! I can't wait to see what effect that has on my score. Unfortunately, due to holiday utilization there is no point in pulling it quite yet. I'll have to be patient...

The only bad marks remaining on my Experian report are two lates on a WFDS account that is closed and paid in full. That account is scheduled to go positive this summer, at which time my Experian report will be "perfect."

I checked Eq as well, and the lates are still there. Presumably they are still on TU, but I apparantly am no longer able to pull that electronically. It is in the mail.

So, the question: Should I try one last time to dispute the lates on EX and TU as forebearance, or leave well enough alone?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A New Year for Credit

My credit standing as of 1-1-2014:

Utilization - 17%

AAOA - 5.00 yr

Oldest Account - 10.35 yr

0 Scored Inquiries

6 Unscored inquiries

1 Mortgage 4+ yrs perfect history

2 Open installment accounts (car loans)

4 Active revolvers

3 Active AU revolvers

1 Active Charge Account

8 Closed in good standing accounts

Derogs:

0 Collection accounts (yeaaah)

Lates-

Experian:

1x60, 1x30, 6.5 years old

Equifax:

1x60, 1x30, 6.5 years old

12x180+, 5.9 years old

Transunion:

1x60, 1x30, 6.5 years old

12x180+, 5.9 years old

Scores:

Estimate low to mid 700's, waiting to pull until utilization is below 9%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CREDIT REBUILD PROJECT LOG

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CREDIT REBUILD PROJECT LOG

cartwrna wrote: Love your thread..6 years nearly and the OP is still an avid poster. I haven't seen that, usually these threads come to a dead end whereas yours is never ending. I've beeb reading through yours all night and have gained a great amount of knowledge!!! Bookmarking and following this

Thanks; I still have a little ways to go... I can't believe it's been almost 6 years on here. After waiting this long for the last few lates to fall off, you can bet I'll never let that happen again. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CREDIT REBUILD PROJECT LOG

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CREDIT REBUILD PROJECT LOG

eufauxria:

You can say that again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More weirdness from Cap1

So... My newest card from Capital One arrived, and it is not a World Card. Turns out the chat rep was wrong... Sigh.

My old Orchard card is still not quite there yet... What it really needs is 10x CLI and a nice upgrade. Sadly, the latest chat rep was no help.

I guess I'm waiting until my six months is up and asking for another CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Score update, high achiever with derogs!!

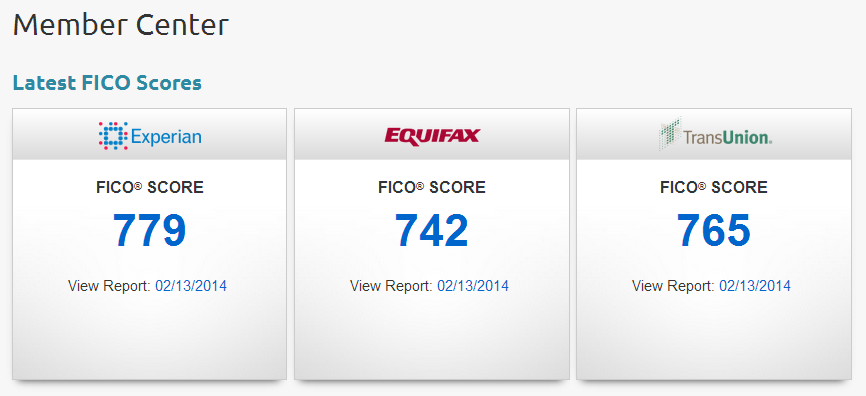

My new updated scores set a personal record, and are a major jump from just over a year ago. I'm a "High Achiever" (760+) on 2 of 3 scores. Sweet!

At the end of 2012, my scores were:

EXP: 731 - EQU: 723 - TRAN: 731 - AVG: 728

Now, they are:

FICO EXP: 779 - EQU: 742 - TRAN: 765 - AVG: 762

This represents an increase of 212 points over my scores when I joined this forum. Many thanks are due to all of you who helped me along the way. What I can't believe is how high my score went when I still have derogatory accounts, and a balance showing on two credit cards.

After the last of the lates are clear, I'll check all 3 scores again and see if I can break 800.

For those of you who have been following, the last CA from Verizon Home is gone. I lost the fight with the student loan people over misapplied forebearance, and have exhausted all options. The car loan lates were my own fault, and the CEO of WFDS essentially told me to pound sand after my flood of GW letters. I'm just about out of things to fix.

Here is a snapshot of my credit on the day the socres were pulled:

Utilization - 6.7%

Cards w/ Balance - 2 of 8

AAOA - 5.11 yr

Oldest Account - 10.35 yr

0 Scored Inquiries

5 Unscored inquiries

1 Mortgage 4+ yrs perfect history

2 Open installment accounts (car loans)

4 Active revolvers

3 Active AU revolvers

1 Active Charge Account

8 Closed in good standing accounts

Derogs:

0 Collection accounts (yeaaah)

Lates-

Experian:

1x60, 1x30, 6.5 years old - Car Loan

Equifax:

1x60, 1x30, 6.5 years old - Car Loan

9x120+, 6 years old

Transunion:

1x60, 1x30, 6.5 years old - Car Loan

12x120+, 6 years old