- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Chase GW success - sort of

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase GW success - sort of

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase GW success - sort of

Hi all

thanks again for everyone's help. I just got started with the rebuild process and I already have some response from the CC companies.

I send of a GW letter earlier this week. I got a response the next day from a woman who wanted to verify my phone number and best time to call me. She called me again this morning (Thursday) and she said that since my account was about to freeze off their system soon anyway that they were just going to delete the whole account. (she was extremely nice BTW, it was nice to not speak to someone at a CC company who had some personality). Seven yrs from the DoFD would be 6/2014 (my DoFD = 6/07). Do the negative accounts completely disappear from your account completely after 7 years?

I know that deleting an account hurts my AAoA. However, did I want this negative tradeline on my account anyway? After Katrina I was in a bad situation and was pretty irresponsible. MY accounts went from 30 to 60 to 120 day lates, then eventually charged off (I did pay them off a few years ago) The rep said that they could not delete just the negative portions. Regardless if this is true or not. Would it have been better for me just to wait it out for a few years? Does such a baddie that was charged off help your AAoA? How does AAoA work? If a report falls off in 7 years, does it still stay on my CR just not in a negative manner?

Also, my current AAoA is not that great anyway = 1 yr 11 months. I have had credit since the early 90's but not all ended well. I do have positive remarks since '98 that is still on my report, however, when I started rebuilding I got 3 cards (1 secured and 2 unsecured) about 6 months apart from each other so this this had an impact on my AAoA. If an extremely marred account is on my report could that still be positive in some way? Should I just wait it out if the alternative if just deleting the (negative) tradelines completely? -- of course, I'm not disputing the positive tradelines.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase GW success - sort of

@Anonymous wrote:Hi all

thanks again for everyone's help. I just got started with the rebuild process and I already have some response from the CC companies.

I send of a GW letter earlier this week. I got a response the next day from a woman who wanted to verify my phone number and best time to call me. She called me again this morning (Thursday) and she said that since my account was about to freeze off their system soon anyway that they were just going to delete the whole account. (she was extremely nice BTW, it was nice to not speak to someone at a CC company who had some personality). Seven yrs from the DoFD would be 6/2014 (my DoFD = 6/07). Do the negative accounts completely disappear from your account completely after 7 years?

I know that deleting an account hurts my AAoA. However, did I want this negative tradeline on my account anyway? After Katrina I was in a bad situation and was pretty irresponsible. MY accounts went from 30 to 60 to 120 day lates, then eventually charged off (I did pay them off a few years ago) The rep said that they could not delete just the negative portions. Regardless if this is true or not. Would it have been better for me just to wait it out for a few years? Does such a baddie that was charged off help your AAoA? How does AAoA work? If a report falls off in 7 years, does it still stay on my CR just not in a negative manner?

Also, my current AAoA is not that great anyway = 1 yr 11 months. I have had credit since the early 90's but not all ended well. I do have positive remarks since '98 that is still on my report, however, when I started rebuilding I got 3 cards (1 secured and 2 unsecured) about 6 months apart from each other so this this had an impact on my AAoA. If an extremely marred account is on my report could that still be positive in some way? Should I just wait it out if the alternative if just deleting the (negative) tradelines completely? -- of course, I'm not disputing the positive tradelines.

Congrats on the deletion! It's always a mixed bag whether or not it'll hurt your score when deleted. It depends on how it reports, number of lates, severity of those lates, and DOFD if charged-off. It also depends on the age of the TL in relation to your AAoA and whether or not it is your oldest overall TL, oldest revolving, oldest installment,etc. DW had a CapOne paid CO deleted due to being 7 years old. It showed 26 90+ day lates on EQ and when deleted, her EQ FICO dropped by about 20-30 points. It was one of her oldest TLs, her oldest revolving, and older than her AAoA by 4 years. Conversely, TU reported no lates, reported as a CO, and when deleted, she gained around 30. YMMV.

Let's say your score did drop...it'll be worth it to have a cleaner report.

Lates drop right at 7 years. COs and CAs will typically drop by 7 years, but can report up to 7.5 years from DOFD. In some cases, a baddie like a CO can revert to a positive account at 7 years and report as a positive for 3 additional years before it deletes. This isn't that common, but it can happen. I had a Zales CO that was CO'd in 1997. It finally fell off at the start of this year (and my EQ FICO dropped).

AAoA = average age of accounts. AAoA (per FICO scoring) is the average age of ALL OC accounts, whether good or bad, charged-off or not charged-off, opened or closed. It includes all OC accounts. Now there are some FAKOs and some CMSs out there, like CreditKarma, that calculate AAoA differently. Ignore them anyway.

I calculate AAoA by adding up the age from the open date to November (as of this post) and add up the total month for each account. Then I divide the number of OC accounts into that sum to create an average. FICO reads AAoA as a whole number only. So, a 4 year and 9 month AAoA is really only 4 years. If you look on your FICO report, and age is a pos or neg factor, it should list the AAoA for that report. And another thing, AAoA could easily differ between reports. It's not that common to have differing info across all 3 reports.

Based on what you posted, if you have at least one account from 1998 reporting, and you mentioned 3 CCs. Assuming those 3 CCs were only 1 month old, then a 156 month old TL (13 years x 12 months) + 3 one-month old TLs = 159 months. 159 divided by 4 = 39+ months divided by 12 months = a 3+ year old AAoA. Based on what you posted, your AAoA is over 3 years old. I'm sure there are older accounts to factor in there too (e.g. I know your new CCs weren't all opened this month).

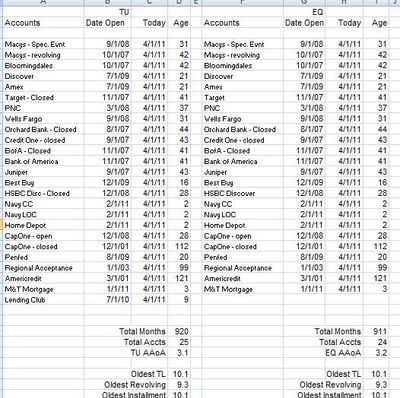

Here's what I use for AAoA...this is an older copy I've pasted before and I tweak the current date to see the AAoA change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase GW success - sort of

Wow. That's a great answer and very helpful.

I need to go back and calculate my own AAoA. The 1 yr 11 mts (or whatever it is), is a FAKO from Credit Karma. 2 of the 3 cards that I have recently obtained are about 2 yrs old and the 3rd is about 8 months old.

It sounds like my AoAA isn't as bad as the FAKO is telling me. Does MyFico CR show the AoAA?

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase GW success - sort of

@Anonymous wrote:Does MyFico CR show the AoAA?

Usually, but not always. It is listed (w/ your length of history) if it is considered a positive or negative factor on your FICO report (somewhere on pages 2 or 3).