- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Year old late payment still hurting?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Year old late payment still hurting?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Year old late payment still hurting?

So as the title suggests I gave a little of a year old 90 day late payment that I think is still hindering my credit score. Back in Feb 2020 I got dinged with a 90 day late payment from NelNet. NelNet reports at the end on every month so I didn't see it until March 9th when I pulled my credit. That one hurt bad because It hit on all four of my account with them. My credit score with from 650(Mortgage score) to a 580 It was my fault so whatever. I've since cleaned up my credit report pretty aggressively. Fast forward today my credit score is 614, UT is at 30%, 1 inquiry, no other negative marks on my report. According to this (https://www.zilchworks.com/credit-score-calculator.asp) estimator , my credit score should go up 10-20 points based on the fact that's its been over a year. However I pulled my report today and still showing 614 with no significant movements. Please help me understand why it hasn't moved up. Do I need to wait until end of March?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Year old late payment still hurting?

Significant derogatories like 90+ lates will generally hold their strength the entire 7.5 years they're reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Year old late payment still hurting?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Year old late payment still hurting?

Hi and welcome to the forums!

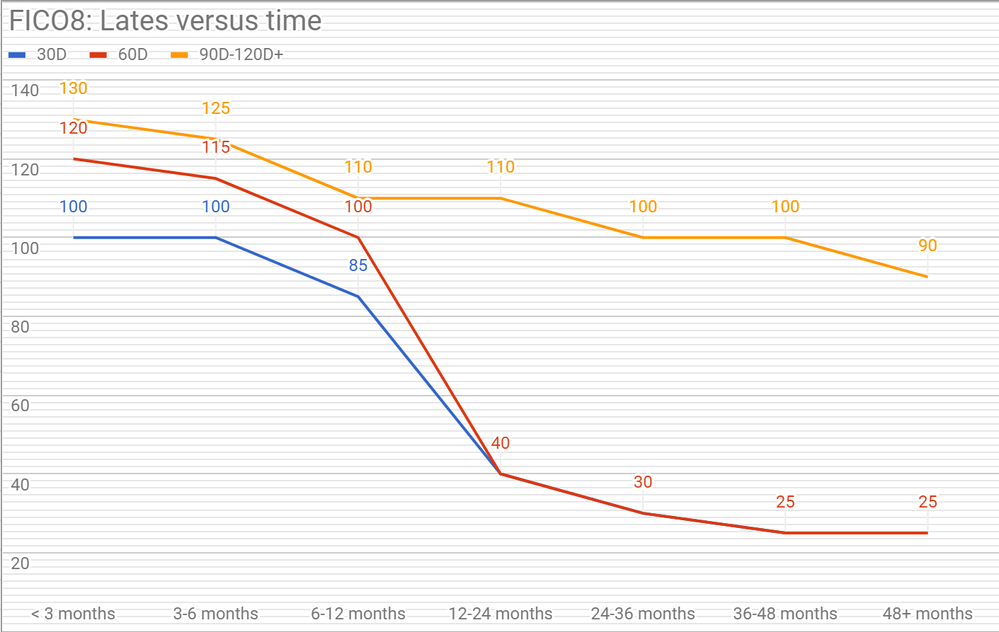

As stated by @Brian_Earl_Spilner, a 90day late will hurt your scores for the entire time it remains on your reports (see the above chart posted by @AllZero for estimated point penalty over time). Other factors, such as credit profile/account aging, will help your scores increase over time, but they will remain suppressed until the 90 day lates reach their 7 year mark.

Unfortunately, since the lates are on federal student loan tradelines, there is nothing you can do to remove them as fedloan servicers will not agree to goodwill removals (HigherEd Act prevents it). You'll just have to do whatever you can to optimize your credit profile so to obtain the highest scores possible with the late payments.

On another note, as an FYI:

That site you linked does not offer FICO scores and their score simulator is not based on the FICO scoring model. In fact - their T&C doesn't even provide a name for the scoring model they use, they just refer to your "credit score" and it states: "The credit scores provided to you are not FICO scores".

Any site that does not provide a scoring model is not worth using - and any simulation of scores would have no resemblance to FICO behavior.

Sites offering FICO scores will clearly indicate that they are FICO scores.

From where did you obtain your mortgage score and which FICO version is it (5, 4, or 2)?

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()