- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 2 pt. TU FICO increase & comments

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2 pt. TU FICO increase & comments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

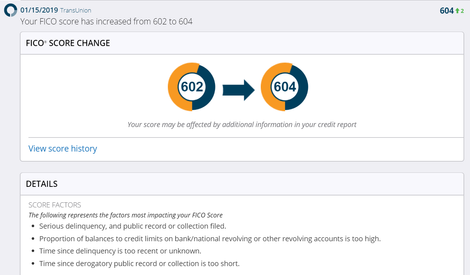

2 pt. TU FICO increase & comments

Hi all, I started my pay down plan two weeks ago and the first payment posted, statement cut at 0, and reported to TU.

I've been so focused on the mortgage scores, that I didn't think about improving the others. lol.

I have questions about the comments.

1. I assume the first and last bullets are for two paid collections (same CA...trying to GW them now). Is my assumption correct?

2. Is there a specific UTIL threshold that will rid me of the second bullet?

3. I have a single 30-day late from NFCU 8/2018 - only 4 months old (Is this what the third bullet refers to?)

4. Is there a difference between derog and delinquency?

Current Fico9/Fico8/Mortgage Score:

MyGoal Fico8/Mortgage Score:

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 pt. TU FICO increase & comments

It's possible to see a negative reason statement related to utilization if your aggregate utilization is 9% or greater, as a scoring penalty would be imposed at that point. This is one of the reasons it bothers me to hear the recommendation/suggestion that keeping utilization "under 30%" is considered ideal, as anything in the 9%-30% range isn't ideal in terms of FICO scoring.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 pt. TU FICO increase & comments

1. I assume the first and last bullets are for two paid collections (same CA...trying to GW them now). Is my assumption correct?

2. Is there a specific UTIL threshold that will rid me of the second bullet?

3. I have a single 30-day late from NFCU 8/2018 - only 4 months old (Is this what the third bullet refers to?)

4. Is there a difference between derog and delinquency?

Regarding item 3, when were the collections? If long ago, then probably the late.

Re: item 4, derog is a more generic/wider description, but the terms are often used synonymously. All delinquencies are derogs, but I don't believe the converse to be true.

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 pt. TU FICO increase & comments

@expatCanuck wrote:1. I assume the first and last bullets are for two paid collections (same CA...trying to GW them now). Is my assumption correct?

2. Is there a specific UTIL threshold that will rid me of the second bullet?

3. I have a single 30-day late from NFCU 8/2018 - only 4 months old (Is this what the third bullet refers to?)

4. Is there a difference between derog and delinquency?

Regarding item 3, when were the collections? If long ago, then probably the late.

Re: item 4, derog is a more generic/wider description, but the terms are often used synonymously. All delinquencies are derogs, but I don't believe the converse to be true.

Collections were opened in 4/2017 and 4/2018...paid in 11/2018. I originally had 3 collections, one CA agreed to remove immediatly so, I am really hoping that my GW campaign works on these last two so I can be rid of my baddies.

Current Fico9/Fico8/Mortgage Score:

MyGoal Fico8/Mortgage Score:

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2 pt. TU FICO increase & comments

@Anonymous wrote:It's possible to see a negative reason statement related to utilization if your aggregate utilization is 9% or greater, as a scoring penalty would be imposed at that point. This is one of the reasons it bothers me to hear the recommendation/suggestion that keeping utilization "under 30%" is considered ideal, as anything in the 9%-30% range isn't ideal in terms of FICO scoring.

Yikes! I won't be down to the <8.9% for a VERY long time without adding new tradelines with insanely high limits lol. I will focus on 30-day late and collections this year.

Current Fico9/Fico8/Mortgage Score:

MyGoal Fico8/Mortgage Score:

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content