- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 50% may be utilization threshold for individual ca...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

50% may be utilization threshold for individual card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Anonymous wrote:

@SouthJamaicaWell I definitely appreciate the DPs, that’s something I’ve been wondering about for awhile. What other “common wisdom” about utilization have you found to be incorrect?Too many examples, I could be here all day trying to locate them, but here are some of the more respected ones:

[B] "9-29% utlization: subtract 10 points

29%-49% aggregate utilization: subtract 10 points

49%-69% aggregate utilization: subtract 10 point

69%-89% aggregate utilization: subtract 20 points

89%-99.9% aggregate utilization: subtract 20 points

100% or higher aggregate utilization: subtract 20 points"

[C]

- Individual card with 29-49% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 49%-69% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 69%-89% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 89%-99.9% utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 100%+ overlimit utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

[D]

i. The major recognized Aggregate revolving utilization thresholds occur at 9%, 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

ii. The major recognized Individual revolving utilization thresholds occur at 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

[E]

1) Total utilization breakpoints: 9%, 29%, 49%, 69%, 89%

2) Individual utilization breakpoints: 29%, 49%, 69%, 89%

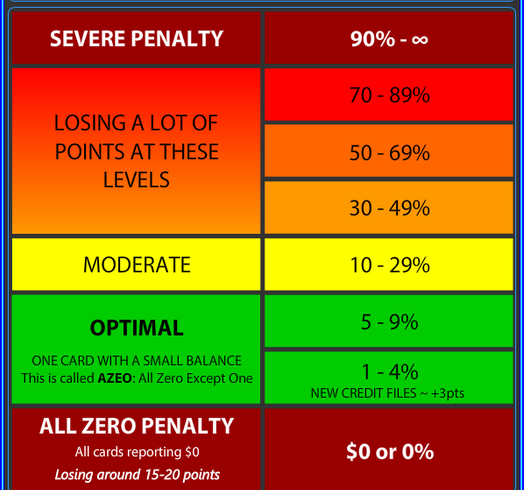

Also, I question the utility of this chart. I think it could be quite misleading:

In my experience there are just a few "well defined" breakpoints in revolving utilization -- 29% and 49% in individual account utilization.

The rest of the "collective wisdom" (or madness of crowds) is conjecture.

I actually dispelled that, to my own satisfaction, months ago

This year, unfortunately, has been my opportunity to learn about high utilization

Which is why I'm not happy with much of the wrong 'common wisdom' that's been bandied about suggesting 'acceptable' utilization levels which are in fact hurting people's scores

@SouthJamaica, As always .. Great DP's .. Thank You

The revolving utilization "formulas" (B&C) which state crossing certain thresholds yield specific point gains or losses are misguided and highly inaccurate. Not all thresholds have equal impact and individual profiles certainly experience widely diverging results. Very bad info there which is a disservice IMO.

Fico reason statements are pretty clear in stating absolute dollar amount of revolving debt is a scoring factor. Therefore, unless the cards are rather low limit, elevated card utilizations on multiple cards are likely to trigger scoring penalties associated with an absolute dollar amount.

My experience is revolving debt in absolute dollar terms can impact score. I had a relatively low limit BBY store card and could report rather high utilization levels with no change in score. Later, after credit limit was increased on this and other cards, I realized a score drop even though card utilization was lower and aggregare utilization was essentially the same. See example below.

A) I reported a balance of $3202 on BBY when the card CL was $4500 (71% utilization) - no drop in any Fico 8 scores. Aggregate balance around $5200. All remained at 850.

b) Later I reported a balance of $7811 on the BBY card when CL was $12,500 (62% utilization). TU Fico 8 dropped 5 points, no change in other Fico 8 scores. Aggregate balance around $9400.

Great data point. Thank you. Certainly does support theory that absolute dollar amount, on an individual account, is an additional scoring factor in FICO 8.

The above (TU Fico 8 dropping to 845 or sometimes 848 while EX and EQ scores holds 850) has happened on multiple occasions. Sometimes highest individual card utilization never goes above 20%. Aggregate utilization always under 9%. My conclusion was I must be crossing over some absolute revolving debt threshold in the $5k to $6k rangewhere the TU Fico 8 penalty exceeded my available buffer.

Personnally, I think the utilization table is a VERY good tool and support its use wholeheartedly along the threshold guidelines as defined. I have used those levels along with #cards reporting balances to provide stepwise improvement plans to forum members with low scores due to high utilization. Subsequently reported score improvements were realized with drops in utilization and cards reporting as anticipated.

Have you ever personally experienced > 9% aggregate utilization without losing points? I haven't.

Here is a link to one such example (mortgage Ficos):

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/mortgage-score-Bump/td-p/5940138/page/2#

That's a good example of how lower aggregate utilization and more zero balances will increase one's mortgage scores. But I don't see how the example establishes any particular breakpoints.

Although I have not personnally experienced a score drop associated with an elevated individual card utilization,

Which brings us back to the subject of this thread. I had in the past detected a FICO 8 score drop with individual utilization at 30% or higher, and again with a second card hitting 30%. The other day I experienced similar additional score drops when those same two cards hit 50+.

many others have - particularly at or around the 49% level. Likewise, many have experienced score shifts when aggregate utilization at/around the 9% level.

I have never experienced, or seen evidence, of a 9% threshold in aggregate utilization, although I know it is "common knowledge" in this forum that such a breakpoint exists. I am as guilty as anyone of passing this meme along, advising folks to keep aggregate utilization at 9% or less... until I finally woke up and realized that if such a threshold had existed, why wouldn't I have experienced it? The reality of my profile for the past 5 1/2 years has been that the higher my utilization, the lower the FICO 8 scores, except perhaps in the 1 to 3 % range.

For the average Joe with under $100k in total CL and "limited" cards (say under 10), the defined thresholds in the utilization table has proven to be very helpful as a guide.

Are you referring to the utilization table which was posted a few months ago? If so, I'm sure there's no evidence that it has proven to be very helpful to the "average Joe"

The best test for individual card utilization as an attribute is to step up utilization on a low limit card on a profile having a high aggregate CL. Then step up the balance reporting on this card only with all others at zero. This approach eliminates influence of changes in # cards reporting balances, potential impact of crossing absolute $ thresholds and increases in aggregate utilization. Some testing along these lines has been done. Here is another link to an old discussion:

As always, it's a breath of fresh air to get the benefit of your careful, well reasoned thoughts.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Anonymous wrote:

@SouthJamaicaWell I definitely appreciate the DPs, that’s something I’ve been wondering about for awhile. What other “common wisdom” about utilization have you found to be incorrect?Too many examples, I could be here all day trying to locate them, but here are some of the more respected ones:

[B] "9-29% utlization: subtract 10 points

29%-49% aggregate utilization: subtract 10 points

49%-69% aggregate utilization: subtract 10 point

69%-89% aggregate utilization: subtract 20 points

89%-99.9% aggregate utilization: subtract 20 points

100% or higher aggregate utilization: subtract 20 points"

[C]

- Individual card with 29-49% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 49%-69% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 69%-89% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 89%-99.9% utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 100%+ overlimit utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

[D]

i. The major recognized Aggregate revolving utilization thresholds occur at 9%, 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

ii. The major recognized Individual revolving utilization thresholds occur at 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

[E]

1) Total utilization breakpoints: 9%, 29%, 49%, 69%, 89%

2) Individual utilization breakpoints: 29%, 49%, 69%, 89%

Also, I question the utility of this chart. I think it could be quite misleading:

In my experience there are just a few "well defined" breakpoints in revolving utilization -- 29% and 49% in individual account utilization.

The rest of the "collective wisdom" (or madness of crowds) is conjecture.

I actually dispelled that, to my own satisfaction, months ago

This year, unfortunately, has been my opportunity to learn about high utilization

Which is why I'm not happy with much of the wrong 'common wisdom' that's been bandied about suggesting 'acceptable' utilization levels which are in fact hurting people's scores

@SouthJamaica, As always .. Great DP's .. Thank You

The revolving utilization "formulas" (B&C) which state crossing certain thresholds yield specific point gains or losses are misguided and highly inaccurate. Not all thresholds have equal impact and individual profiles certainly experience widely diverging results. Very bad info there which is a disservice IMO.

Fico reason statements are pretty clear in stating absolute dollar amount of revolving debt is a scoring factor. Therefore, unless the cards are rather low limit, elevated card utilizations on multiple cards are likely to trigger scoring penalties associated with an absolute dollar amount.

My experience is revolving debt in absolute dollar terms can impact score. I had a relatively low limit BBY store card and could report rather high utilization levels with no change in score. Later, after credit limit was increased on this and other cards, I realized a score drop even though card utilization was lower and aggregare utilization was essentially the same. See example below.

A) I reported a balance of $3202 on BBY when the card CL was $4500 (71% utilization) - no drop in any Fico 8 scores. Aggregate balance around $5200. All remained at 850.

b) Later I reported a balance of $7811 on the BBY card when CL was $12,500 (62% utilization). TU Fico 8 dropped 5 points, no change in other Fico 8 scores. Aggregate balance around $9400.

Great data point. Thank you. Certainly does support theory that absolute dollar amount, on an individual account, is an additional scoring factor in FICO 8.

The above (TU Fico 8 dropping to 845 or sometimes 848 while EX and EQ scores holds 850) has happened on multiple occasions. Sometimes highest individual card utilization never goes above 20%. Aggregate utilization always under 9%. My conclusion was I must be crossing over some absolute revolving debt threshold in the $5k to $6k rangewhere the TU Fico 8 penalty exceeded my available buffer.

Personnally, I think the utilization table is a VERY good tool and support its use wholeheartedly along the threshold guidelines as defined. I have used those levels along with #cards reporting balances to provide stepwise improvement plans to forum members with low scores due to high utilization. Subsequently reported score improvements were realized with drops in utilization and cards reporting as anticipated.

Have you ever personally experienced > 9% aggregate utilization without losing points? I haven't.

Here is a link to one such example (mortgage Ficos):

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/mortgage-score-Bump/td-p/5940138/page/2#

That's a good example of how lower aggregate utilization and more zero balances will increase one's mortgage scores. But I don't see how the example establishes any particular breakpoints.

Although I have not personnally experienced a score drop associated with an elevated individual card utilization,

Which brings us back to the subject of this thread. I had in the past detected a FICO 8 score drop with individual utilization at 30% or higher, and again with a second card hitting 30%. The other day I experienced similar additional score drops when those same two cards hit 50+.

many others have - particularly at or around the 49% level. Likewise, many have experienced score shifts when aggregate utilization at/around the 9% level.

I have never experienced, or seen evidence, of a 9% threshold in aggregate utilization, although I know it is "common knowledge" in this forum that such a breakpoint exists. I am as guilty as anyone of passing this meme along, advising folks to keep aggregate utilization at 9% or less... until I finally woke up and realized that if such a threshold had existed, why wouldn't I have experienced it? The reality of my profile for the past 5 1/2 years has been that the higher my utilization, the lower the FICO 8 scores, except perhaps in the 1 to 3 % range.

For the average Joe with under $100k in total CL and "limited" cards (say under 10), the defined thresholds in the utilization table has proven to be very helpful as a guide.

Are you referring to the utilization table which was posted a few months ago? If so, I'm sure there's no evidence that it has proven to be very helpful to the "average Joe"

The best test for individual card utilization as an attribute is to step up utilization on a low limit card on a profile having a high aggregate CL. Then step up the balance reporting on this card only with all others at zero. This approach eliminates influence of changes in # cards reporting balances, potential impact of crossing absolute $ thresholds and increases in aggregate utilization. Some testing along these lines has been done. Here is another link to an old discussion:

As always, it's a breath of fresh air to get the benefit of your careful, well reasoned thoughts.

@SouthJamaica I must be misunderstanding something. You said you've never experienced > 9% without seeing a score drop, then you said you've seen no evidence of a 9% threshold. Those statements appear to be contradictory unless I'm misunderstanding, could you please elaborate.

and he's speaking of the utilization chart you posted. He made plans for people based on those thresholds and number of accounts reporting, and when they followed them, the point gains came as anticipated, at those thresholds, so that is evidence of those thresholds being there. Of course lower utilization gives more points, but he made plans based on those thresholds in steps, and the points were awarded at those steps at those thresholds, I believe.

TT, were you indicating there are absolute dollar thresholds on individual revolvers as well as in the aggregate? I suppose they probably do considering how many characteristics they measure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

Tiny data point, but way back in the past when going over 9% wasn't too hard, I've experienced 11 points loss from when utilization went from 8% to 10%.

I cannot test that any longer, because I'd be in a world of pain if I spent 10% of my limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Anonymous wrote:

@SouthJamaicaWell I definitely appreciate the DPs, that’s something I’ve been wondering about for awhile. What other “common wisdom” about utilization have you found to be incorrect?Too many examples, I could be here all day trying to locate them, but here are some of the more respected ones:

[B] "9-29% utlization: subtract 10 points

29%-49% aggregate utilization: subtract 10 points

49%-69% aggregate utilization: subtract 10 point

69%-89% aggregate utilization: subtract 20 points

89%-99.9% aggregate utilization: subtract 20 points

100% or higher aggregate utilization: subtract 20 points"

[C]

- Individual card with 29-49% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 49%-69% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 69%-89% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 89%-99.9% utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 100%+ overlimit utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

[D]

i. The major recognized Aggregate revolving utilization thresholds occur at 9%, 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

ii. The major recognized Individual revolving utilization thresholds occur at 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

[E]

1) Total utilization breakpoints: 9%, 29%, 49%, 69%, 89%

2) Individual utilization breakpoints: 29%, 49%, 69%, 89%

Also, I question the utility of this chart. I think it could be quite misleading:

In my experience there are just a few "well defined" breakpoints in revolving utilization -- 29% and 49% in individual account utilization.

The rest of the "collective wisdom" (or madness of crowds) is conjecture.

I actually dispelled that, to my own satisfaction, months ago

This year, unfortunately, has been my opportunity to learn about high utilization

Which is why I'm not happy with much of the wrong 'common wisdom' that's been bandied about suggesting 'acceptable' utilization levels which are in fact hurting people's scores

@SouthJamaica, As always .. Great DP's .. Thank You

The revolving utilization "formulas" (B&C) which state crossing certain thresholds yield specific point gains or losses are misguided and highly inaccurate. Not all thresholds have equal impact and individual profiles certainly experience widely diverging results. Very bad info there which is a disservice IMO.

Fico reason statements are pretty clear in stating absolute dollar amount of revolving debt is a scoring factor. Therefore, unless the cards are rather low limit, elevated card utilizations on multiple cards are likely to trigger scoring penalties associated with an absolute dollar amount.

My experience is revolving debt in absolute dollar terms can impact score. I had a relatively low limit BBY store card and could report rather high utilization levels with no change in score. Later, after credit limit was increased on this and other cards, I realized a score drop even though card utilization was lower and aggregare utilization was essentially the same. See example below.

A) I reported a balance of $3202 on BBY when the card CL was $4500 (71% utilization) - no drop in any Fico 8 scores. Aggregate balance around $5200. All remained at 850.

b) Later I reported a balance of $7811 on the BBY card when CL was $12,500 (62% utilization). TU Fico 8 dropped 5 points, no change in other Fico 8 scores. Aggregate balance around $9400.

Great data point. Thank you. Certainly does support theory that absolute dollar amount, on an individual account, is an additional scoring factor in FICO 8.

The above (TU Fico 8 dropping to 845 or sometimes 848 while EX and EQ scores holds 850) has happened on multiple occasions. Sometimes highest individual card utilization never goes above 20%. Aggregate utilization always under 9%. My conclusion was I must be crossing over some absolute revolving debt threshold in the $5k to $6k rangewhere the TU Fico 8 penalty exceeded my available buffer.

Personnally, I think the utilization table is a VERY good tool and support its use wholeheartedly along the threshold guidelines as defined. I have used those levels along with #cards reporting balances to provide stepwise improvement plans to forum members with low scores due to high utilization. Subsequently reported score improvements were realized with drops in utilization and cards reporting as anticipated.

Have you ever personally experienced > 9% aggregate utilization without losing points? I haven't.

Here is a link to one such example (mortgage Ficos):

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/mortgage-score-Bump/td-p/5940138/page/2#

That's a good example of how lower aggregate utilization and more zero balances will increase one's mortgage scores. But I don't see how the example establishes any particular breakpoints.

Although I have not personnally experienced a score drop associated with an elevated individual card utilization,

Which brings us back to the subject of this thread. I had in the past detected a FICO 8 score drop with individual utilization at 30% or higher, and again with a second card hitting 30%. The other day I experienced similar additional score drops when those same two cards hit 50+.

many others have - particularly at or around the 49% level. Likewise, many have experienced score shifts when aggregate utilization at/around the 9% level.

I have never experienced, or seen evidence, of a 9% threshold in aggregate utilization, although I know it is "common knowledge" in this forum that such a breakpoint exists. I am as guilty as anyone of passing this meme along, advising folks to keep aggregate utilization at 9% or less... until I finally woke up and realized that if such a threshold had existed, why wouldn't I have experienced it? The reality of my profile for the past 5 1/2 years has been that the higher my utilization, the lower the FICO 8 scores, except perhaps in the 1 to 3 % range.

For the average Joe with under $100k in total CL and "limited" cards (say under 10), the defined thresholds in the utilization table has proven to be very helpful as a guide.

Are you referring to the utilization table which was posted a few months ago? If so, I'm sure there's no evidence that it has proven to be very helpful to the "average Joe"

The best test for individual card utilization as an attribute is to step up utilization on a low limit card on a profile having a high aggregate CL. Then step up the balance reporting on this card only with all others at zero. This approach eliminates influence of changes in # cards reporting balances, potential impact of crossing absolute $ thresholds and increases in aggregate utilization. Some testing along these lines has been done. Here is another link to an old discussion:

As always, it's a breath of fresh air to get the benefit of your careful, well reasoned thoughts.

@SouthJamaica I must be misunderstanding something. You said you've never experienced > 9% without seeing a score drop, then you said you've seen no evidence of a 9% threshold. Those statements appear to be contradictory unless I'm misunderstanding, could you please elaborate.

and he's speaking of the utilization chart you posted. He made plans for people based on those thresholds and number of accounts reporting, and when they followed them, the point gains came as anticipated, at those thresholds, so that is evidence of those thresholds being there. Of course lower utilization gives more points, but he made plans based on those thresholds in steps, and the points were awarded at those steps at those thresholds, I believe.

TT, were you indicating there are absolute dollar thresholds on individual revolvers as well as in the aggregate? I suppose they probably do considering how many characteristics they measure.

Yes you're misunderstanding me. The chart implies that under 10% is hunky dory. I'm here to say it is not hunky dory, and that I am penalized plenty when I'm at 9%. I have found no more noticeable threshold at 10% than I found at 9% or at 8% or at 7%. When my aggregate revolving utilization goes up, my FICO 8 scores go down. And I have discerned no discernible 'breakpoint' or 'threshold' other than that from 1-3% might be a safe harbor from point loss in FICO 8. Thomas_Thumb was endorsing the validity of the chart's breakpoints. I question it.

The chart is new. Are you suggesting that Thomas_Thumb has "made plans" based on the chart, which was posted a few months ago, and that his experience was borne out by the thresholds it contains? I doubt that is the case.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Remedios wrote:Tiny data point, but way back in the past when going over 9% wasn't too hard, I've experienced 11 points loss from when utilization went from 8% to 10%.

I cannot test that any longer, because I'd be in a world of pain if I spent 10% of my limits.

And are you sure you didn't experience 5 or 6 points going from 8% to 9%, and another 5 or 6 going from 9% to 10%?

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous

In the above I was referring to absolute revolving debt in aggregate. Note the comment regarding points drop without individual card UT above 20%. That was due to aggregate above $6k (or thereabouts) - IMO.

I have provided stepchange improvement advise many times on the forums. I think that is often more helpful than just suggesting AZEO with a small balance on a card that is neither a charge card or an AU card. Some members have a certain score goal in mind with limited means for debt paydown. A stepwise plan is both educational and manageable.

Most of the time paydowns are not executed with exact precision. For example, aggregate utilization may have been 55% and payments take aggregate down to 45% with subsequent payments taking aggregate utilization down to 8%. Of course individual card utilizations and # cards with balances are changing as well. I ALWAYS see progressive improvements in reported scores that are in general alignment with the table. Most individuals seeking help are not testers and their objective is how to get a better score in a limited timeframe with limited funds. Does the table help with that, absolutely! If a threshold were 10% and they go below 9% per the table is the score benefit not realized?

I actually have seen a variety of members write posts mentioning improvements in score when aggregate revolving utilization dropped below 9%. Were the testers going from 9.1% to 8.9% - typically no. More likely going from a 12%-14% range to 6%-8% range. That being said, there have been multiple posts documenting score improvements going from 10% to 8% aggregate utilization. Also posts mentioning no change in score going from 8% to 6% and a subsequent bump up going from 6% to 4% - example (Inverse 2016).

Score changes associated with aggregate utilization in % may be easier to identify for profiles having lower aggregate credit limits. Those with high aggregate credit limits may be seeing score changes associated with shifts in absolute dollar debt that don't come into play with an average joe that has $20k in total CL.

Also, score shifts on Fico 8 relating to individual card utilization changes show greater inconsistency. That utilization attribute is more strongly influenced by scorecard/profile. The same situation exists for influence of #/% of cards reporting balances on score.

Note: Impact of changes in attribute values on score may differ by cra (EQ/TU/EX) due to Fico tailoring the algorithm per cra request.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous

A couple comments with regard to the table:

1) Severe penalties are in play when aggregare utilization is in the 70% range. Multiple posters have realized 100 point gains taking their Ag UT from 70% to less than 9%. I would classify the 70% to 89% and 90% & above brackets both as severe penalty. The chart as is doesnot adequately highlight the damage associated with 70% to 89%. Move bracket up into the severe category

2) Although an individual card utilization in the 70% to 89% range may not cause a substantial point drop (meaning 15 points or more), it can significantly increase risk of adverse action. The AA risk (typically a CLD) increases most when the card is kept at high utilization for prolonged periods of time particularly when only minimum payments are made.

Side note: Per Experian card max out threshold is defined as 90% utilization and above. Not sure that going over 100% makes much of a difference. It's more a lender thing. Some lenders allow a charge that takes balance owed above 100% while most do not except for interest penalties associated with unpaid balances.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Thomas_Thumb that's exactly what I thought you meant. I just wanted to clarify because of SJ's comment:

"Great data point. Thank you. Certainly does support theory that absolute dollar amount, on an individual account, is an additional scoring factor in FICO 8."

Thank you, I totally agree with everything you said and, as always, I greatly appreciate you sharing your knowledge.

@SouthJamaica yes, I am absolutely referring to plans made by TT with the thresholds identified in the recently created table, as the thresholds identified in the table were not recently discovered although the chart was recently made to assist members.

And if you will notice there is a disclaimer about being under 4% being better by a few points, depending on scorecard of course.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica wrote:

@Remedios wrote:Tiny data point, but way back in the past when going over 9% wasn't too hard, I've experienced 11 points loss from when utilization went from 8% to 10%.

I cannot test that any longer, because I'd be in a world of pain if I spent 10% of my limits.

And are you sure you didn't experience 5 or 6 points going from 8% to 9%, and another 5 or 6 going from 9% to 10%?

I'm sure. I did lose a single point between 3% and 4%.

4% to 8%, no change.

For me at that time, 9% was definitely a threshold.

I've experienced multiple thresholds between 9% and 29%.

It started to get serious around 19%. I'm fairly certain the difference between 8% and 19% was around 23 points.

Rest, I cannot remember on top of my head.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica wrote:

Also, I question the utility of this chart. I think it could be quite misleading:

In my experience there are just a few "well defined" breakpoints in revolving utilization -- 29% and 49% in individual account utilization.

The rest of the "collective wisdom" (or madness of crowds) is conjecture.

"Quite misleading" is quite a stretch, considering the following key data:

- The average total credit limit is $31,015. Source: Experian Q2 2019 (Halfway down, under Credit Card Snapshot)

- I started with $8500 total credit limit, and now 1yr 9mo later I am at $32,000 total credit limit.

I have been monitoring my own credit profile through a myFICO Premier subscription for my entire revolving credit history, and I have never experienced more than a 3 point shift of FICO 8 scores in the entire (0,9]% interval, due to utilization and/or total balance reported.

I never let individual or aggregate report above 9%, with $1688 being the highest aggregate balance ever reported.

EQ5/TU4/EX2 will lose a small number of points - median 5pts - above $1000, causing reasons similar to 'High Revolving Balances' to appear higher in the list.

"Optimal" is just fine for the average consumer credit profile.