- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 50% may be utilization threshold for individual ca...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

50% may be utilization threshold for individual card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:

@SouthJamaica wrote:

@SouthJamaica wrote:It has always been clear to me that 30% is a major breakpoint for individual card utilization.

I now believe 50% may be significant too.

Last month I had 2 cards > 30% (one at 30+, one at 40+). One of those 2 accounts just went to 55%, and EX FICO 8 dropped 6 points.

The other one's going to get to > 50% as well, which I predict will be a non-event.

Well my prediction turned out to be wrong. When the second card went from 30-something to 50-something, I lost another 10 points in EX FICO 8.

@SouthJamaica So you confirm one card crossed 50% and you lost points and then a second card crossed the 50% threshold and you lost additional points, while the first card remained above 50%?

Yes.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

Cool thank you for the dp!

Then that would seem to dispel the belief that only the highest individually utilized revolver matters scorewise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:Cool thank you for the dp!

Then that would seem to dispel the belief that only the highest individually utilized revolver matters scorewise.

Yes

I actually dispelled that, to my own satisfaction, months ago

This year, unfortunately, has been my opportunity to learn about high utilization

Which is why I'm not happy with much of the wrong 'common wisdom' that's been bandied about suggesting 'acceptable' utilization levels which are in fact hurting people's scores

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica wrote:

@Anonymous wrote:Cool thank you for the dp!

Then that would seem to dispel the belief that only the highest individually utilized revolver matters scorewise.

Yes

I actually dispelled that, to my own satisfaction, months ago

This year, unfortunately, has been my opportunity to learn about high utilization

Which is why I'm not happy with much of the wrong 'common wisdom' that's been bandied about suggesting 'acceptable' utilization levels which are in fact hurting people's scores

@SouthJamaica, As always .. Great DP's .. Thank You![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:

@SouthJamaicaWell I definitely appreciate the DPs, that’s something I’ve been wondering about for awhile. What other “common wisdom” about utilization have you found to be incorrect?

Too many examples, I could be here all day trying to locate them, but here are some of the more respected ones:

[A] "the well-known scoring breakpoints of 28.9%, 48.9%, 68.9% and 88.9% utilization for individual accounts"

[B] "9-29% utlization: subtract 10 points

29%-49% aggregate utilization: subtract 10 points

49%-69% aggregate utilization: subtract 10 point

69%-89% aggregate utilization: subtract 20 points

89%-99.9% aggregate utilization: subtract 20 points

100% or higher aggregate utilization: subtract 20 points"

[C]

- Individual card with 29-49% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 49%-69% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 69%-89% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 89%-99.9% utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 100%+ overlimit utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

[D]

i. The major recognized Aggregate revolving utilization thresholds occur at 9%, 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

ii. The major recognized Individual revolving utilization thresholds occur at 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

[E]

1) Total utilization breakpoints: 9%, 29%, 49%, 69%, 89%

2) Individual utilization breakpoints: 29%, 49%, 69%, 89%

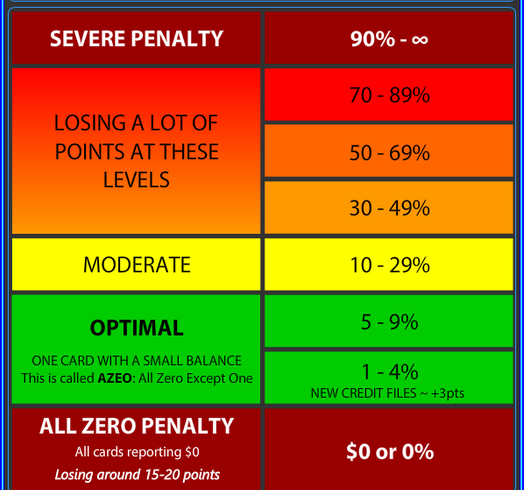

Also, I question the utility of this chart. I think it could be quite misleading:

In my experience there are just a few "well defined" breakpoints in revolving utilization -- 29% and 49% in individual account utilization.

The rest of the "collective wisdom" (or madness of crowds) is conjecture.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica you disagree that there are aggregate revolving thresholds at 9, 29, 49, 69, 89 and 100%?

and you don't believe individual revolving thresholds exist above 49%?

and that chart is for aggregate revolving utilization, might I ask what you find misleading?

and I also disagree with all but D and the chart.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:@SouthJamaica you disagree that there are aggregate revolving thresholds at 9, 29, 49, 69, 89 and 100%?

and you don't believe individual revolving thresholds exist above 49%?

and that chart is for aggregate revolving utilization, might I ask what you find misleading?

and I also disagree with all but D and the chart.

I can't meaningfully agree or disagree with the theory that the various aggregate revolving utilization thresholds you mention exist, because I do not have the ability to prove or disprove their existence. I just know that there has been zero evidence of them in my profile, and I have not seen any convincing evidence of them elsewhere. So I tend to doubt the theory. And when people represent their existence to be a fact, I think they are in error.

I have no reason to doubt that individual account revolving utilization thresholds above 49% exist. In fact, I suspect that they do. I just wouldn't pontificate about them as being "well established" facts. I often advise people who are in over their heads to reduce their debt incrementally -- 68%, 58%, 48% etc -- just in case there are breakpoints in there.

The chart implies that there is something significant about the various ranges in the chart, when in fact there is no evidence to that effect other than a game supplied by front end programmers. I find it misleading because a person reading might think that if their aggregate utilization is under 30% they're fine -- a commonly repeated misconception in this forum -- when in fact they may be getting very severe penalties.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica wrote:

@Anonymous wrote:

@SouthJamaicaWell I definitely appreciate the DPs, that’s something I’ve been wondering about for awhile. What other “common wisdom” about utilization have you found to be incorrect?Too many examples, I could be here all day trying to locate them, but here are some of the more respected ones:

[B] "9-29% utlization: subtract 10 points

29%-49% aggregate utilization: subtract 10 points

49%-69% aggregate utilization: subtract 10 point

69%-89% aggregate utilization: subtract 20 points

89%-99.9% aggregate utilization: subtract 20 points

100% or higher aggregate utilization: subtract 20 points"

[C]

- Individual card with 29-49% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 49%-69% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 69%-89% utilization: subtract 5 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 89%-99.9% utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

- Individual card with 100%+ overlimit utilization: subtract 10 points (multiply by number of cards with utilization/total number of cards)

[D]

i. The major recognized Aggregate revolving utilization thresholds occur at 9%, 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

ii. The major recognized Individual revolving utilization thresholds occur at 29%, 49%, 69%, 89%, 100% (Some scorecards may also have lower thresholds.)

[E]

1) Total utilization breakpoints: 9%, 29%, 49%, 69%, 89%

2) Individual utilization breakpoints: 29%, 49%, 69%, 89%

Also, I question the utility of this chart. I think it could be quite misleading:

In my experience there are just a few "well defined" breakpoints in revolving utilization -- 29% and 49% in individual account utilization.

The rest of the "collective wisdom" (or madness of crowds) is conjecture.

I actually dispelled that, to my own satisfaction, months ago

This year, unfortunately, has been my opportunity to learn about high utilization

Which is why I'm not happy with much of the wrong 'common wisdom' that's been bandied about suggesting 'acceptable' utilization levels which are in fact hurting people's scores

@SouthJamaica, As always .. Great DP's .. Thank You

The revolving utilization "formulas" (B&C) which state crossing certain thresholds yield specific point gains or losses are misguided and highly inaccurate. Not all thresholds have equal impact and individual profiles certainly experience widely diverging results. Very bad info there which is a disservice IMO.

Fico reason statements are pretty clear in stating absolute dollar amount of revolving debt is a scoring factor. Therefore, unless the cards are rather low limit, elevated card utilizations on multiple cards are likely to trigger scoring penalties associated with an absolute dollar amount.

My experience is revolving debt in absolute dollar terms can impact score. I had a relatively low limit BBY store card and could report rather high utilization levels with no change in score. Later, after credit limit was increased on this and other cards, I realized a score drop even though card utilization was lower and aggregare utilization was essentially the same. See example below.

A) I reported a balance of $3202 on BBY when the card CL was $4500 (71% utilization) - no drop in any Fico 8 scores. Aggregate balance around $5200. All remained at 850.

b) Later I reported a balance of $7811 on the BBY card when CL was $12,500 (62% utilization). TU Fico 8 dropped 5 points, no change in other Fico 8 scores. Aggregate balance around $9400.

The above (TU Fico 8 dropping to 845 or sometimes 848 while EX and EQ scores holds 850) has happened on multiple occasions. Sometimes highest individual card utilization never goes above 20%. Aggregate utilization always under 9%. My conclusion was I must be crossing over some absolute revolving debt threshold in the $5k to $6k rangewhere the TU Fico 8 penalty exceeded my available buffer.

Personnally, I think the utilization table is a VERY good tool and support its use wholeheartedly along the threshold guidelines as defined. I have used those levels along with #cards reporting balances to provide stepwise improvement plans to forum members with low scores due to high utilization. Subsequently reported score improvements were realized with drops in utilization and cards reporting as anticipated.

Here is a link to one such example (mortgage Ficos):

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/mortgage-score-Bump/td-p/5940138/page/2#

Although I have not personnally experienced a score drop associated with an elevated individual card utilization, many others have - particularly at or around the 49% level. Likewise, many have experienced score shifts when aggregate utilization at/around the 9% level. For the average Joe with under $100k in total CL and "limited" cards (say under 10), the defined thresholds in the utilization table has proven to be very helpful as a guide.

The best test for individual card utilization as an attribute is to step up utilization on a low limit card on a profile having a high aggregate CL. Then step up the balance reporting on this card only with all others at zero. This approach eliminates influence of changes in # cards reporting balances, potential impact of crossing absolute $ thresholds and increases in aggregate utilization. Some testing along these lines has been done. Here is another link to an old discussion:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content