- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- AZEO VS AZE2 DATA PULL

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AZEO VS AZE2 DATA PULL

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZEO VS AZE2 DATA PULL

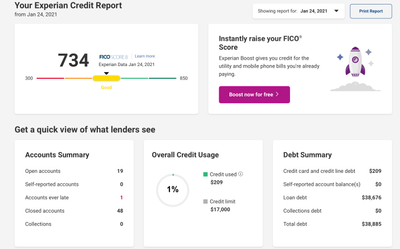

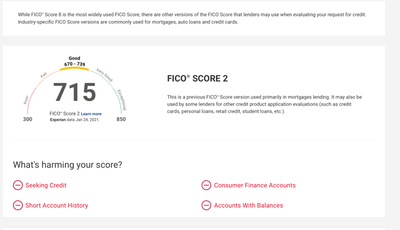

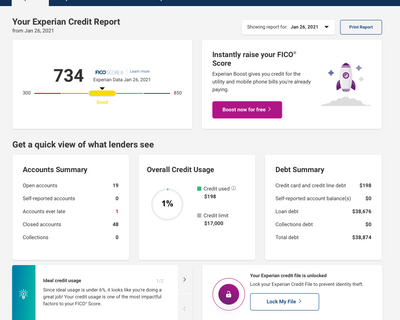

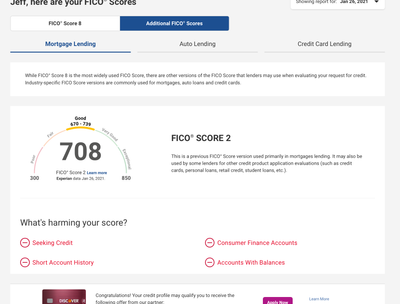

This is interesting to me so I wanted to share with you to get your thoughts. I have to Experian pulls dated 01/24 and 01/26. I have been AZEO for a while but accidently had a pending charge I couldnt pay and ended up with AZE2. So I called Discover and paid it and request them do an off cycle report and they updated it mid month to $0. My EX2 went down with FICO 8 stayed the same. (TU4 stayed the same as well) Pics below...And what is to revolver ratio? Is that Installment loans to Revolvers. I have 7 Installments to 12 revovlers on this report. I got rid of 5 installments, so once they update in Feb..I will have 3 installments to 12 revolvers.

Before: 10 Revolvers at $0. Discover at $11/$1000. NFCU at $198/3000

After: 10 Revolvers at $0. Discover at $0/$1000. NFCU at $198/3000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@UpAndComing74 wrote:

This is interesting to me so I wanted to share with you to get your thoughts. I have to Experian pulls dated 01/24 and 01/26. I have been AZEO for a while but accidently had a pending charge I couldnt pay and ended up with AZE2. So I called Discover and paid it and request them do an off cycle report and they updated it mid month to $0. My EX2 went down with FICO 8 stayed the same. (TU4 stayed the same as well) Pics below...And what is to revolver ratio? Is that Installment loans to Revolvers. I have 7 Installments to 12 revovlers on this report. I got rid of 5 installments, so once they update in Feb..I will have 3 installments to 12 revolvers.

Before: 10 Revolvers at $0. Discover at $11/$1000. NFCU at $198/3000

After: 10 Revolvers at $0. Discover at $0/$1000. NFCU at $198/3000

Thank you for sharing the data points.

I'm not quite sure on the revolver threshold. I think it's around 20-25% of revolving accounts reporting a balance. I presume you went from 8% to 17% of open revolving accounts reporting a balance? I would think there would be no score loss. It's interesting to see that you received such. Perhaps, the open installment loans reporting a balance in addition to your open revolving accounts reporting a balance is a factor too?

To clarify, the NFCU is your SSL?

ETA 1/24 you were at 2/12. Then 1/26 you were at 1/12 open reolving accounts reporting a balance?

What card is your AZEO? Is it a major bank card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@AllZero wrote:

@UpAndComing74 wrote:

This is interesting to me so I wanted to share with you to get your thoughts. I have to Experian pulls dated 01/24 and 01/26. I have been AZEO for a while but accidently had a pending charge I couldnt pay and ended up with AZE2. So I called Discover and paid it and request them do an off cycle report and they updated it mid month to $0. My EX2 went down with FICO 8 stayed the same. (TU4 stayed the same as well) Pics below...And what is to revolver ratio? Is that Installment loans to Revolvers. I have 7 Installments to 12 revovlers on this report. I got rid of 5 installments, so once they update in Feb..I will have 3 installments to 12 revolvers.

Before: 10 Revolvers at $0. Discover at $11/$1000. NFCU at $198/3000

After: 10 Revolvers at $0. Discover at $0/$1000. NFCU at $198/3000

Thank you for sharing the data points.

I'm not quite sure on the revolver threshold. I think it's around 20-25% of revolving accounts reporting a balance. I presume you went from 8% to 17% of open revolving accounts reporting a balance? I would think there would be no score loss. It's interesting to see that you received such. Perhaps, the open installment loans reporting a balance in addition to your open revolving accounts reporting a balance is a factor too?

To clarify, the NFCU is your SSL?

Well the Open Installments didn't change on the two pills. The only change is 1 less revolver reporting. NFCU Is a revolver. Navy Federal card. I'm not familiar with the acronym SSL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@UpAndComing74 wrote:Well the Open Installments didn't change on the two pills. The only change is 1 less revolver reporting. NFCU Is a revolver. Navy Federal card. I'm not familiar with the acronym SSL.

I thought it was a SSL Shared Secured Loan (installment).

I'm not quite sure why you received the score decrease on EX2. Perhaps go back through your reports and compare it line by line? The NFCU card should be good as your AZEO card. Even though, it is recommended that one should not use a credit union card. It is recommended to use a major bank card. However, I don't see that negative reason code on your posted reports as not using your revolving accounts, e.g. All Zero score penalty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@AllZero wrote:

@UpAndComing74 wrote:Well the Open Installments didn't change on the two pills. The only change is 1 less revolver reporting. NFCU Is a revolver. Navy Federal card. I'm not familiar with the acronym SSL.

I thought it was a SSL Shared Secured Loan (installment).

I'm not quite sure why you received the score decrease on EX2. Perhaps go back through your reports and compare it line by line? The NFCU card should be good as your AZEO card. Even though, it is recommended that one should not use a credit union card. It is recommended to use a major bank card. However, I don't see that negative reason code on your posted reports as not using your revolving accounts, e.g. All Zero score penalty.

Aha!! Also the Navy card is now at 7% individual utilization. I did go line by line and even used a program to compare.. lol.. What I will do is my Discover card reports on the 11th next week. I will leave the $11 on it and see if the score bumps back up.. why not? Lol. I want to get to 720.. I have 4 accounts less than a year that will all age to a year by July. So hopefully that bump is enough!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@UpAndComing74 wrote:

@AllZero wrote:

@UpAndComing74 wrote:Well the Open Installments didn't change on the two pills. The only change is 1 less revolver reporting. NFCU Is a revolver. Navy Federal card. I'm not familiar with the acronym SSL.

I thought it was a SSL Shared Secured Loan (installment).

I'm not quite sure why you received the score decrease on EX2. Perhaps go back through your reports and compare it line by line? The NFCU card should be good as your AZEO card. Even though, it is recommended that one should not use a credit union card. It is recommended to use a major bank card. However, I don't see that negative reason code on your posted reports as not using your revolving accounts, e.g. All Zero score penalty.

Aha!! Also the Navy card is now at 7% individual utilization. I did go line by line and even used a program to compare.. lol.. What I will do is my Discover card reports on the 11th next week. I will leave the $11 on it and see if the score bumps back up.. why not? Lol. I want to get to 720.. I have 4 accounts less than a year that will all age to a year by July. So hopefully that bump is enough!

I went back to look at my reports. The negative reason code to look for is "Not Using Revolving Credit". I used a PenFed card as my AZEO and got that statement on EX2. I would think the NFCU card would be okay.

As you stated, do your testing and see if you get the points back. You can also alternate by zeroing out the NFCU card and using another card as your AZEO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@Anonymous wrote:

You said navy was now 7% what was it before?

Before Navy was and has always been $0. So the credit limit increased by $2000 and the balance went to $198. Overall is still at 1% but that individual card is now reporting at 7%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO VS AZE2 DATA PULL

@Anonymous wrote:

Yeah that would be interesting to post balance on the Discover and zero out the Navy and see what happens.

This.

In my own testing many CU revolving lines didn't count for revolving usage (even though they did count as utilization, don't get me started on that ridiculousness) on EX FICO 2.

I am pretty sure if you swap them as Birdman correctly suggests your score will be identical to your first post.

I never did really nail down installment loans with respect to EX FICO 2 and accounts with balances; I got busy and sloppy tracking scores and sort of gave up on analysis even though I paid off my car note.

I will pretty up to AZEO revolver with 2 open installment loans before I go sort my LA condo which should close that tradeline and balance. It's a little weird because the HELOC will be closed same time but that is from one of thr aforementioned CUs that are flat squirrley on EX FICO 2 with revolvers.

Actually that's interesting I don't have an accounts with balances complaint currently at AZEO and the mortgages, the rest of the usual suspects are there. I'll play with the desktop version some later today and see what I had pre-car note air strike. That said my mortgage plan check may fall apart, I was kinda busy April / May of last year cause, yeah, Houston boondoggle.

I am on the path to squeaky clean though on that file, May would be 1 year and then the only issue is my CFA which should be gone in 2022 finally.

I guess I just need to move my Fitness Challenge date back a year for the goal scores haha, nothing went as expected last year.

Hope you all are doing well.