- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Account Aging Metrics / Utilization spreadsheet

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Account Aging Metrics / Utilization spreadsheet

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

Nah I mixed up files when I was editing and combined the not 2019 front half of equation with 2019 back half, download again now and it should be clear -.-

Actually looking again I messed up with another switch in there. Give me a couple minutes.

And updated...again. LMK if I caught them all now.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

Take your time do the changes Cassie suggested, this is gonna be awesome for everybody!!!!!

@ccquest that did the trick now you just got to incorporate the updates!!!! Awesome!!!

this is so awesome because people can plug in their data and give us accurate information this will make troubleshooting score changes so much better if someone uses this!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

@Anonymous wrote:

Take your time do the changes Cassie suggested, this is gonna be awesome for everybody!!!!!

This may have been the spark needed to create the 'One True Excel File to Satisfy Them All'. lol

I can add VBA code if needed, but I think it's better to stick with worksheet formulas rather than switch to an xlsm file format.

SWITCH is included in Excel 2016 versions that were on subscription - it wouldn't work with standalone 2016. (Not even sure how a 2016 on subscription would stay that way, since everyone on MS 365 gets the latest version anyway.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

I'm actually going to delete the age unit dropdown and just go with Cassie's recommendation as it's a little more human that way, young accounts will just need to ignore the 0yr at the start of each one.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

@Anonymous wrote:

So this is set up to go all the way through 103 rows?

That should be fine. There is a way using the OFFSET function to take the whole column range, but that's ridiculous - anyone with 1,048,570 accounts needs a lot more help than an Excel file can give! haha

Could make it J8:J200 just to have even some nice numbers to look at, but even J8:J103 works for practically everyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

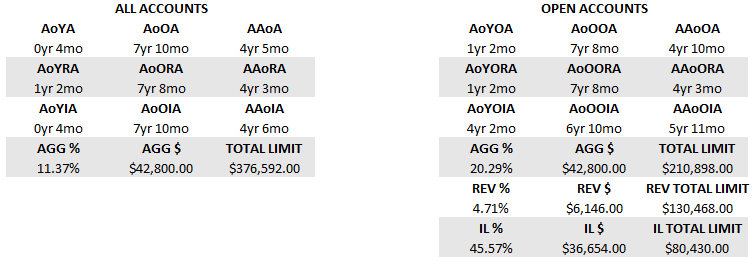

Alright, here's the latest version everybody!

This should work for all versions and shows the age in a bit better format thanks to recommendation of Cassie.

Hope it works better for everyone and thanks for the feedback!

as of 1/1/23

as of 1/1/23Current Cards: