- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Achieving 850 CS

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

@Anonymous wrote:

@Kree wrote:I'd go one step further. Never using the plate gets you to 850, but then you have to take it out every week and dust/polish it. (azeo or similar maintenance). Lots of work for little practical value. Still nice to have though.

Plus it's weird to me to see folks saying they merely want 850 scores and not aim for the next level beyond 850 (850 + buffer).

If you're going to aim for the top, why not actually aim for the actual top?

It's not like FICO gives people metal credit scores, yet!

Actually, maintaining 850 once you are there is rather easy. No need for AZEO or keeping individual card balances low. I allow all charges to report and have been able to report balances on all cards while maintaining 850. It's also possible to take an HP 0 => 1 without a Fico 8 score drop - it's all in the buffer. Of course an HP + all cards reporting takes away a lot of the available buffer on profiles that may otherwise be optimized.

I peg the Classic Fico 8 buffer at 25 to 30 points based on observing drops in Bankcard Fico 8 with no corresponding drop in Classic Fico 8.

ABCD - If someone wants to aim for the top, I'd suggest triple 900s on Fico 8 Bankcard as a goal. It's a bit more difficult than Classic Fico 8 850s.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

@Thomas_Thumb wrote:ABCD - If someone wants to aim for the top, I'd suggest triple 900s on Fico 8 Bankcard as a goal. It's a bit more difficult than Classic Fico 8 850s.

TT, what does it take relative to an 850 FICO 8 to reach a 900 Bankcard FICO 8? I'm 10-20 points off from 850 FICO 8, but am 50 points off from Bankcard FICO 8, so I'd agree that it's more of a challenge. I'm not sure what the differences are, requirements wise, so if you could chime in that would be awesome.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

@Thomas_Thumb wrote:Actually, maintaining 850 once you are there is rather easy. No need for AZEO or keeping individual card balances low. I allow all chargs to report and have been able to report balances on all cards while maintaining 850. It's also possible to take an HP 0 => 1 without a Fico 8 score drop - it's all in the buffer.

Are you saying that you have opened a new account while maintaining a constant triple 850? The impression I always had of your profile is that you have had the same credit cards and loans for at least the last couple years.

I agree that maintaining a triple 850 (FICO 8) shouldn't be hard if a person is not opening any new accounts. Utilization can be dealt with by having a big credit limit, which is certainly how you and I deal with it. AZEO comes into its own with the mortgage models from what I gather.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

CGID - I don't believe mentioning opening a new account. The hard inquiries came from HP CLI requests - one on EQ associated with my BB store card and one on TU associated with my Fidelity Visa. Neither resulted in a score drop. That being said, I have no doubt that opening a single new account will not preclude maintaining 850 if the profile otherwise has sufficient buffer. As I recall, JDK93 reported personal data on this more than once.

Side note: I am referring to individual card utilization, not aggregate. Reach 9% aggregate and score will drop regardless - IMO. However, on an individual card basis I was able to report card balances of $2102/$4000 in 1/2014 (52.6% UT) and $3011/$4000 (75.3% UT) in 3/2014 without dropping Classic Fico 8 score. At the time I had no inquiries on EQ/TU/EX. The point here is an aged credit file with sound credit management and minimal new account activity is all that is needed to maintain 850. No extraordinary effort or micromanagement required.

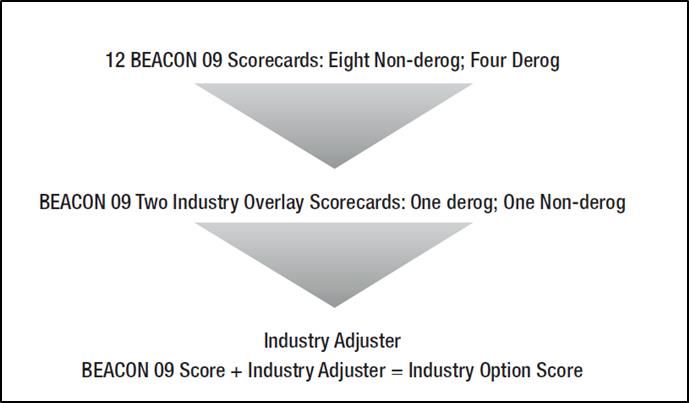

BBS - Best I have had with BC Fico 8 is EQ 892, TU 900, EX 900. As I have observed in the past, EQ is more skitish regarding # (or %) of cards reporting balances. I observed this on Classic Fico 04 but it appears to be true for EQ Bankcard Enhanced Fico 8 as well.

BC Fico 8 has less of a buffer than Classic Fico 8 - IMO. My experience is the Bankcard enhanced version puts more weight on the following relative to its Classic counterpart:

1) Number of cards reporting balances (I can't reach 900 on any CRA with more than 3 cards reporting vs 6 of 6 for Classic)

2) Individual card utilization.

3) Recent inquiries.

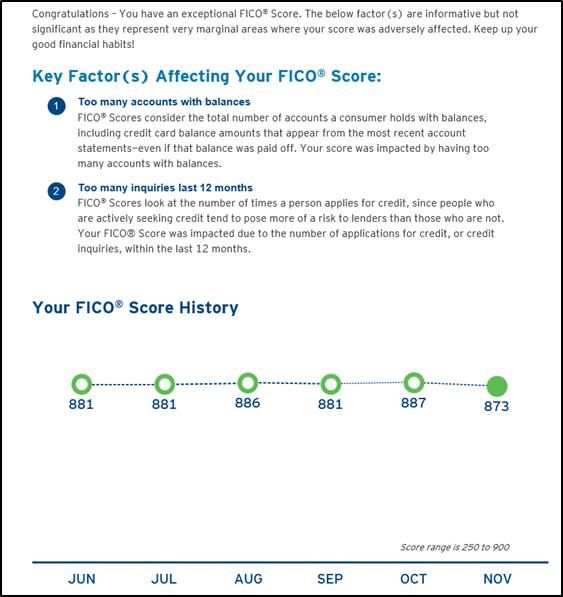

The below summary from Citi in 2017 (INQ added in Nov 2017 for BB card HP CLI)

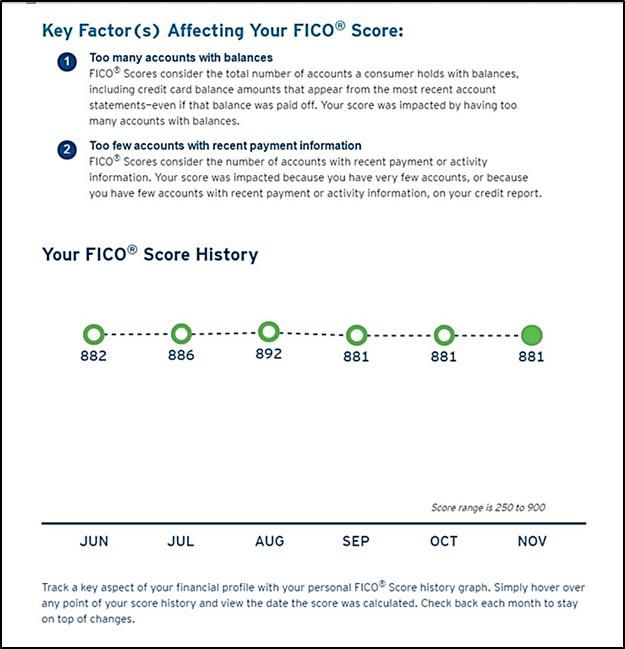

The above summary from Citi for 2016 and the below from EQ for Bankcard Fico 8 (Beacon 9).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

Hi TT. Yeah, you didn't explicitly say that you had opened an account. But you mentioned getting inquiries. I realize of course that it is possible to get an inquiry without opening a new account, but this might not occur to many newcomers (such as our OP). They might think you were suggesting that you opened an account, since that is typically why one gets a hard pull.

Anyway, because you didn't say one way or the other, that's why I asked you -- partly so that other readers would not be misled.

I too can imagine the possibility of an 850 profile that could absorb the impact of a brand new account, but it would need to be one where the person had moved his score well into the buffer above 850, which would mean our OP would have had to spend that many more years working on aging his profile and so forth after he crossed from 849 to 850. Circling back to the advice I gave him, I was encouraging him to rethink whether that was really something he wanted to do. If he were to believe that it was easy to maintain an 850 after that with adding accounts, he'd be mistaken.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

That makes sense, as the factors you referenced are all ones that apply to my profile. I have multiple cards with [reported] balances at times when I'm not focusing on AZEO, I sometimes have individual cards at high reported utilization (47% on my Citi last reporting) and I have a coupe of scoreable inquiries on each bureau. It would make sense with those factors that my Bankcard score would be 30-40 points further away from "perfect" than my FICO 8 scores that are more forgiving in those areas.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

@Anonymous wrote:Hi TT. Yeah, you didn't explicitly say that you had opened an account. But you mentioned getting inquiries. I realize of course that it is possible to get an inquiry without opening a new account, but this might not occur to many newcomers (such as our OP). They might think you were suggesting that you opened an account, since that is typically why one gets a hard pull.

Anyway, because you didn't say one way or the other, that's why I asked you -- partly so that other readers would not be misled.

I too can imagine the possibility of an 850 profile that could absorb the impact of a brand new account, but it would need to be one where the person had moved his score well into the buffer above 850, which would mean our OP would have had to spend that many more years working on aging his profile and so forth after he crossed from 849 to 850. Circling back to the advice I gave him, I was encouraging him to rethink whether that was really something he wanted to do. If he were to believe that it was easy to maintain an 850 after that with adding accounts, he'd be mistaken.

Agreed.

As mentioned in my 1st post, I suggested foregoing a quest for 850 if the OP wants to maintain an active credit lifestyle. However, if the OP wants to set 850 as a personal goal, certain hurdles come into play. It's the OP's choice.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

This has to be one of the most informative threads I've read in a long time. Kudos to everyone for the information!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieving 850 CS

@Anonymous wrote:

@Thomas_Thumb wrote:OP will likely need to get aggregate installment B/L under 70%, AAoA to around 8 years and AoYA to above 12 months for a realistic chance at 850. Maintaining 850 typically translates to a boring credit life. If OP wants to maintain an active credit lifestyle, I'd recommend maintaining membership in the 800 club as a goal and forego 850 as a near term objective.

What's your highest score you've seen with AoYA < 12 months?

First time I saw my Fico 8 score was 1/2014. Score at the time was already 850. However, my AoYA was over 24 months then and is now over 72 months. I've had no reason to open a new account.

I am looking a new car end of this year as my Honda Accord hybrid will be 12 years young with around 180,000 miles. I usually pay cash but, might opt for a 5 year loan. My mortgage will still have 2 years remaining so it will mute the rise in aggregate installment loan B/L.

Highest Fico 8 score I've seen posted (not mine) with AoYA below 12 months is 850. That individual had a AoOA above 20 years, AAoA over 8 years and more than 30 credit cards.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950