- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Aggregate Loan Utilization.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Aggregate Loan Utilization.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Aggregate Loan Utilization.

@SouthJamaica @Anonymous @Anonymous @Anonymous Adding @Revelate @Thomas_Thumb

Thank you for all your input! I am now taking action based on your suggestions. I wanted to dicatate what I am doing and gain any last moment insight, advice from you. I want all changes reporting this month. This is definately a science!

I have 11 revolvers, AZEO. I let the Discover card report less than 1%.

Spending $4000 I can decrease Installment loans by (1) and improve Aggregate Utilization. To improve FICO 5,4,2, how do you feel about this strategy. Any other tweaks you suggest? I have to pull Credit in 02/2021 and then again at closing 08/2021.

Is it even worth spend $4000 from reserves?

I am currently FICO 5,4,2: 696/712/734. The goal is to have Midscore of 720 for Prime Rates.

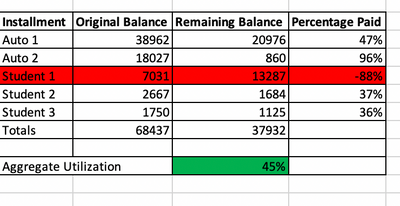

I currently have 5 Installment Loans reporting as below. Student Loan 1 accrued interest has the Oustanding Principle almost double original loan amount so I factored it in as it reports.

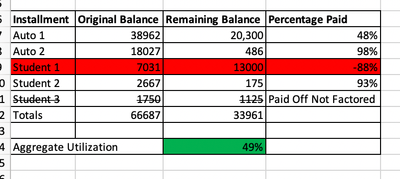

This is the Proposed "improvement" prior to Feb 2021 pull

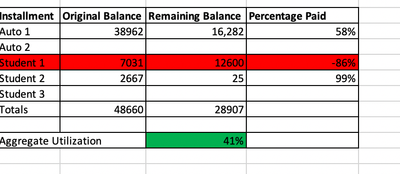

I will not be able to keep my Auto 2 Util all the way thru repull based on small balance. I will be at 3 Installments open but higher aggregate util.

August 2021 Repull

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

@UpAndComing74 wrote:@SouthJamaica @Anonymous @Anonymous @Anonymous

Thank you for all your input! I am now taking action based on your suggestions. I wanted to dicatate what I am doing and gain any last moment insight, advice from you. I want all changes reporting this month. This is definately a science!

I have 11 revolvers, AZEO. I let the Discover card report less than 1%.

Spending $4000 I can decrease Installment loans by (1) and improve Aggregate Utilization. To improve FICO 5,4,2, how do you feel about this strategy. Any other tweaks you suggest? I have to pull Credit in 02/2021 and then again at closing 08/2021.

Is it even worth spend $4000 from reserves?

I am currently FICO 5,4,2: 696/712/734. The goal is to have Midscore of 720 for Prime Rates.

I currently have 5 Installment Loans reporting as below. Student Loan 1 accrued interest has the Oustanding Principle almost double original loan amount so I factored it in as it reports.

This is the Proposed "improvement" prior to Feb 2021 pull

I will not be able to keep my Auto 2 Util all the way thru repull based on small balance. I will be at 3 Installments open but higher aggregate util.

August 2021 Repull

1. The mortgage scores react weakly, if at all, to changes in aggregate installment loan percentage utilization.

2. On the other hand, they can react vigorously to reduction in number of accounts with balance.

So, I would scrap your present plan, and instead pay off Auto 2, Student 2, and Student 3, and apply the leftover $331 to Student 1.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

Understood! I see that you and @Revelate have a lot of DP on the Thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

Yes it applies to loans as well as revolvers, but the effect with loans is less pronounced because the reduction in accounts with a balance is not reduced as much, since the metric appears to measure open accounts with a balance. (there has been a report the closed revolvers may be taken into account on EX2.)

So the percentage is reduced more by a revolver than a loan, since the revolver only affects the numerator, staying open, but the loan affects the numerator and the denominator, by closing.

Yes the big points on low aggregate loan utilization is on versions 8/9. For 5/4/2, reduce accounts with a balance, as stated by SJ.

Edited @UpAndComing74

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

@UpAndComing74 wrote:Understood! I see that you and @Revelate have a lot of DP on the Thread

Mortgage Scores: accounts with Balances: 6/23/19 update. It appears the DP was with revolvers and not installments. Can I confirm that the same behavior will apply with Installments as well. Intererstingly the Reason codes for Too many accounts with balances is not on my Mortgage scores. It is on my FICO 8 analysis however. I know we have no cystal ball.. just want to ensure good data supports score movements

Revolving utilization and installment utilization are 2 wholly unrelated subjects.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

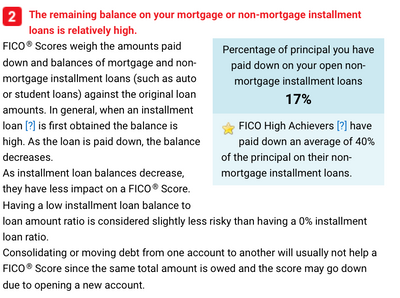

@UpAndComing74 wrote:From an older credit pull: Is this just FICO 8?? @SouthJamaica

I have no idea what it is. If it's from the negative resson codes on your FICO 8 score than it's probably related to FICO 8. But negative reason codes don't tell you what's going on, they are merely possible clues

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

@SouthJamaica wrote:

@UpAndComing74 wrote:@SouthJamaica @Anonymous @Anonymous @Anonymous

Thank you for all your input! I am now taking action based on your suggestions. I wanted to dicatate what I am doing and gain any last moment insight, advice from you. I want all changes reporting this month. This is definately a science!

I have 11 revolvers, AZEO. I let the Discover card report less than 1%.

Spending $4000 I can decrease Installment loans by (1) and improve Aggregate Utilization. To improve FICO 5,4,2, how do you feel about this strategy. Any other tweaks you suggest? I have to pull Credit in 02/2021 and then again at closing 08/2021.

Is it even worth spend $4000 from reserves?

I am currently FICO 5,4,2: 696/712/734. The goal is to have Midscore of 720 for Prime Rates.

I currently have 5 Installment Loans reporting as below. Student Loan 1 accrued interest has the Oustanding Principle almost double original loan amount so I factored it in as it reports.

This is the Proposed "improvement" prior to Feb 2021 pull

I will not be able to keep my Auto 2 Util all the way thru repull based on small balance. I will be at 3 Installments open but higher aggregate util.

August 2021 Repull

1. The mortgage scores react weakly, if at all, to changes in aggregate installment loan percentage utilization.

2. On the other hand, they can react vigorously to reduction in number of accounts with balance.

So, I would scrap your present plan, and instead pay off Auto 2, Student 2, and Student 3, and apply the leftover $331 to Student 1.

@SouthJamaica @Anonymous

Thanks for your help!! I trust your extensive analysis. You are probably akin to me in that you love numbers and data. I have put many months of reports side by side. For example my EQ 5 has been 696 across the board. This is with 9 accounts then 7 accunts and now 6 accounts reporting a balance. My TU4 has had as many as 13 accounts reporting a balance and never the Negative reason code. Not sure if that is in line with your findings. Wish I could send you two reports and dissect. Its a gamble. I will have to document any score changes by paying off the small loans.i just hope and pray I do not dip below 700 mid score with TU4 currently at 712 and/or EQ5 currently at 696 comes above 700. I will have 20 days to toss and turn before 02/01 reporting to determine!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

I believe that negative reason code is from 8.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aggregate Loan Utilization.

@UpAndComing74 wrote:

@SouthJamaica wrote:

@UpAndComing74 wrote:@SouthJamaica @Anonymous @Anonymous @Anonymous

Thank you for all your input! I am now taking action based on your suggestions. I wanted to dicatate what I am doing and gain any last moment insight, advice from you. I want all changes reporting this month. This is definately a science!

I have 11 revolvers, AZEO. I let the Discover card report less than 1%.

Spending $4000 I can decrease Installment loans by (1) and improve Aggregate Utilization. To improve FICO 5,4,2, how do you feel about this strategy. Any other tweaks you suggest? I have to pull Credit in 02/2021 and then again at closing 08/2021.

Is it even worth spend $4000 from reserves?

I am currently FICO 5,4,2: 696/712/734. The goal is to have Midscore of 720 for Prime Rates.

I currently have 5 Installment Loans reporting as below. Student Loan 1 accrued interest has the Oustanding Principle almost double original loan amount so I factored it in as it reports.

This is the Proposed "improvement" prior to Feb 2021 pull

I will not be able to keep my Auto 2 Util all the way thru repull based on small balance. I will be at 3 Installments open but higher aggregate util.

August 2021 Repull

1. The mortgage scores react weakly, if at all, to changes in aggregate installment loan percentage utilization.

2. On the other hand, they can react vigorously to reduction in number of accounts with balance.

So, I would scrap your present plan, and instead pay off Auto 2, Student 2, and Student 3, and apply the leftover $331 to Student 1.

@SouthJamaica @Anonymous

Thanks for your help!! I trust your extensive analysis. You are probably akin to me in that you love numbers and data. I have put many months of reports side by side. For example my EQ 5 has been 696 across the board. This is with 9 accounts then 7 accunts and now 6 accounts reporting a balance. My TU4 has had as many as 13 accounts reporting a balance and never the Negative reason code. Not sure if that is in line with your findings. Wish I could send you two reports and dissect. Its a gamble. I will have to document any score changes by paying off the small loans.i just hope and pray I do not dip below 700 mid score with TU4 currently at 712 and/or EQ5 currently at 696 comes above 700. I will have 20 days to toss and turn before 02/01 reporting to determine!

Nah, @Anonymous loves numbers and data, not I.

I'm just some guy struggling to survive.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682