- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Aging period and how Fico reacts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Aging period and how Fico reacts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Aging period and how Fico reacts

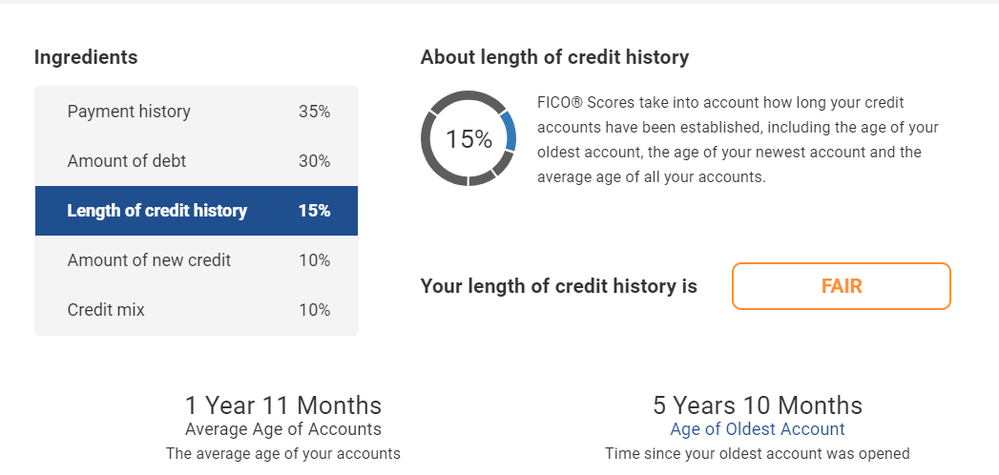

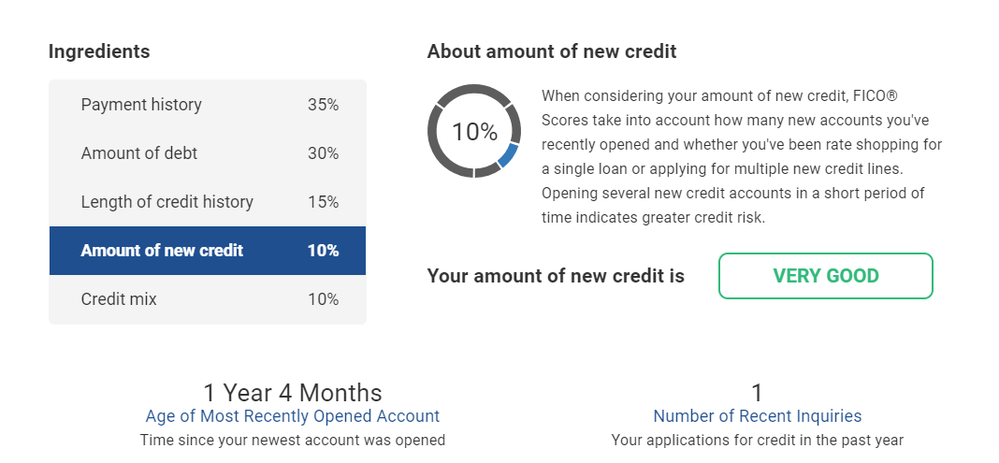

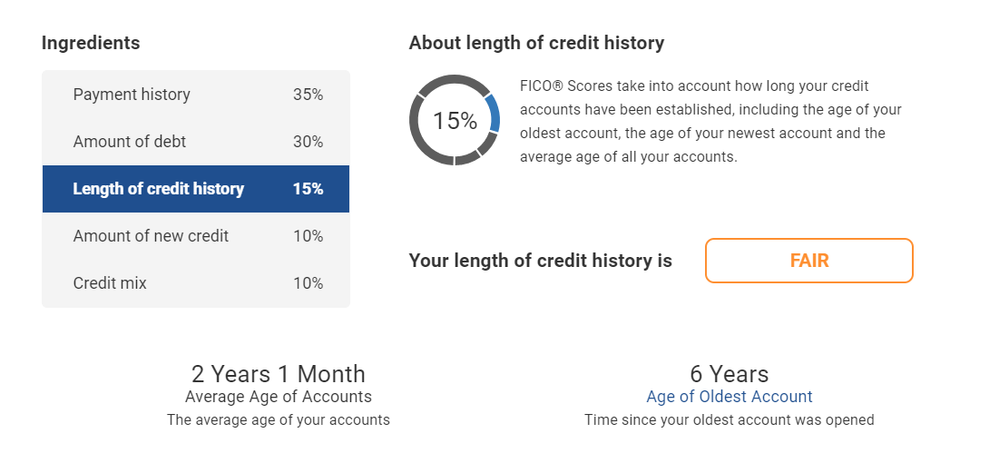

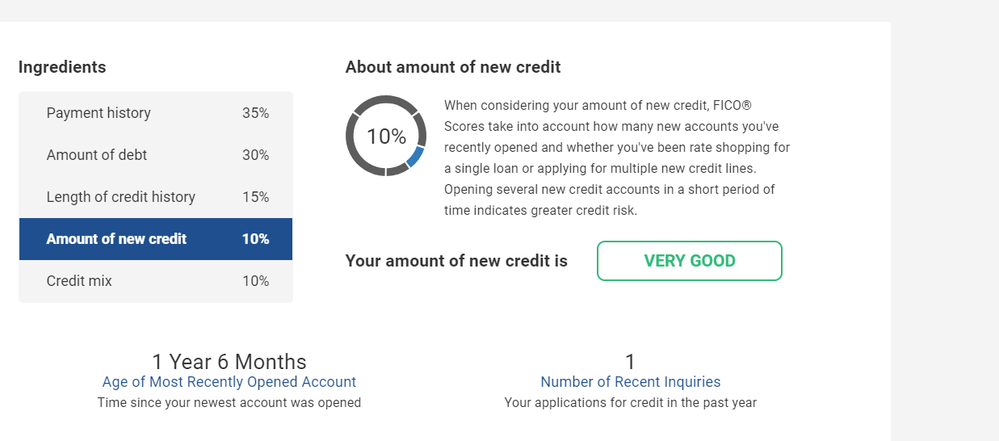

I may need a lesson again, below I assume is a middle ground of new credit being opened with my oldest credit card the other screen shot is the true age of my new credit, how are these making my Fico react as they are 2 different mixes? And which one will rebucket after 3 years?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

My advice on the length credit history I would stay in the garden for quite a while.You need to give those new accounts time to age. My average age of accounts per Equifax is 14 years and 1 month. That number is higher than the other bureaus due to a credit card my first one is still reporting after being closed now for 10 plus years opened in 1982. The second one (amount of new credit) I would not pay that much attention to it. Only apply the credit you need.

JC Penney 10/2008 4,700 US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 14,100, State Dept. FCU 06/2023 25,000 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Commonwealth Credit Union 15000 07/25 Walmart One 5000 12/04/25

Banking: Lafayette FCU Fortera FCU State Department FCU Redstone FCU Hughes FCU Commonwealth FCU

My personal blacklist Axos Bank, Bank of America, Synchrony Bank Capital One TD Bank Comerica Bank BMO US Bank Wells Fargo

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

I went on my credit spree in 2019 and I will not obtain anymore credit, unless its on the business side. I have been in the garden since July 2019. I just paid off a Barclays card and it will never get use and has been cut up lol. I was wondering which age is the one I should be watcing though....Average age seems to be the one?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:I may need a lesson again, below I assume is a middle ground of new credit being opened with my oldest credit card the other screen shot is the true age of my new credit, how are these making my Fico react as they are 2 different mixes? And which one will rebucket after 3 years?

AoOA and/or AoORA (Age of Oldest Revolving Account) are the ones to watch for scorecard reassignment.

So many people start out with a revolving account (credit card) that it's hard to tell which one is repsonsible for some of the scorecard changes. In 11 days I will be at AoOA 3yrs0mo with AoORA 2yrs0mo and I'll be watching it very closely.

AAoA 2yrs 0mo might be worth +20pts according to some posts on this forum. That won't be a scorecard switch, though.

You would see it on December 1st, since you're at 1yr 11mo now.

I'll hit AAoA 2yrs 0mo in March, so I'll be interested to see what happens to your scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@Anonymous wrote:

@AzCreditGuy wrote:I may need a lesson again, below I assume is a middle ground of new credit being opened with my oldest credit card the other screen shot is the true age of my new credit, how are these making my Fico react as they are 2 different mixes? And which one will rebucket after 3 years?

AoOA and/or AoORA (Age of Oldest Revolving Account) are the ones to watch for scorecard reassignment.

So many people start out with a revolving account (credit card) that it's hard to tell which one is repsonsible for some of the scorecard changes. In 11 days I will be at AoOA 3yrs0mo with AoORA 2yrs0mo and I'll be watching it very closely.

AAoA 2yrs 0mo might be worth +20pts according to some posts on this forum. That won't be a scorecard switch, though.

You would see it on December 1st, since you're at 1yr 11mo now.

I'll hit AAoA 2yrs 0mo in March, so I'll be interested to see what happens to your scores.

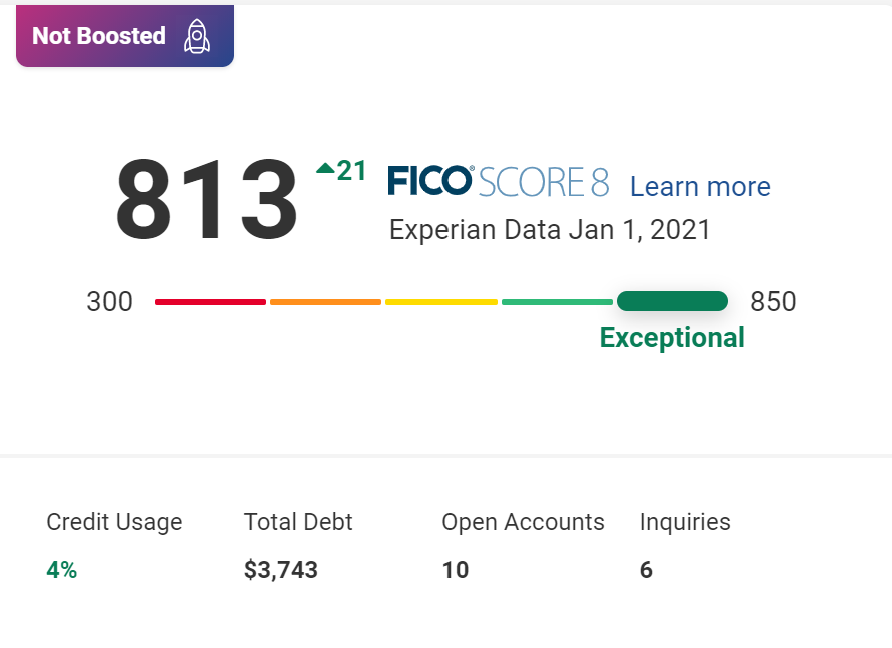

Thanks Cassie I have so no things going on with my scores its annoying they were all at one point close to each other the highest being 782 now as of 11/15/20 Ex 776 Equifax 748 TU 754

I just paid off Barclays and that give me 6 pts with EX so not im back at 782 with them, the others unsure. It seems the more I am getting closer to pay off my debts the more scores are affected by little things. Hmm interesting you say I could get a 20+ pt increase in Dec when I hit 2 years? I expected another bump since I applied $950 to my personal taking it below 8% for UTI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

Here are links to two articles related to Average age of accounts.

They are different in the approach to the question(s) about average of accounts

https://www.creditcards.com/credit-card-news/average-credit-account-age-fico-score-1586/

https://www.nerdwallet.com/article/finance/credit-age-length-of-credit-history

JC Penney 10/2008 4,700 US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 14,100, State Dept. FCU 06/2023 25,000 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Commonwealth Credit Union 15000 07/25 Walmart One 5000 12/04/25

Banking: Lafayette FCU Fortera FCU State Department FCU Redstone FCU Hughes FCU Commonwealth FCU

My personal blacklist Axos Bank, Bank of America, Synchrony Bank Capital One TD Bank Comerica Bank BMO US Bank Wells Fargo

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

Refer to the Scoring Primer linked at the top of my signature for detailed information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

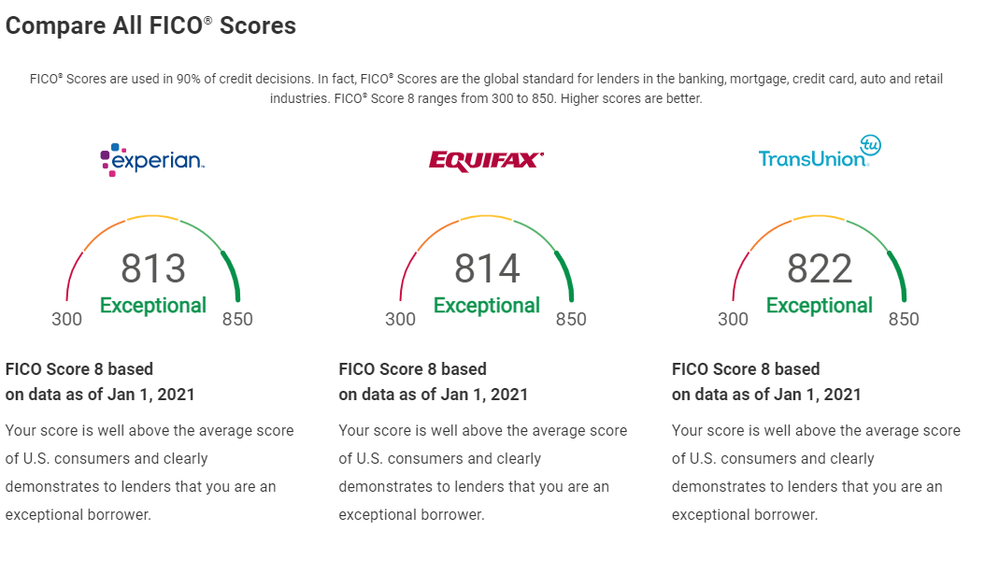

@Anonymous Seems you were right I did get a huge bump from aging, once I hit the 6 year mark on my oldest card I got over 800. Personal loan still hasnt updated to below 8% UTI and some other card info as well...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:@Anonymous Seems you were right I did get a huge bump from aging, once I hit the 6 year mark on my oldest card I got over 800. Personal loan still hasnt updated to below 8% UTI and some other card info as well...

@AzCreditGuy So when your oldest revolver hit six years, you got 21 points?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@Anonymous wrote:

@AzCreditGuy wrote:@Anonymous Seems you were right I did get a huge bump from aging, once I hit the 6 year mark on my oldest card I got over 800. Personal loan still hasnt updated to below 8% UTI and some other card info as well...

@AzCreditGuy So when your oldest revolver hit six years, you got 21 points?

@Anonymous I got a huge bump from all the 3 big EX +21 EQ +37 TU +36, Personal loan has not posted at 8% and 2 credit cards have been paid off(not showing) Changes would be 2 cards showing $0 balances as opposed to all being used and the credit history changing